The major card brands offer advanced anti-fraud tools for businesses willing to use them, and SafeKey is one such tool.

Available from American Express, SafeKey provides an addition layer of protection for online transactions made with an American Express card.

What is American Express SafeKey?

SafeKey is American Express’ version of a 3D Secure authentication tool to help both cardholders and businesses protect against unauthorized online Amex transactions.

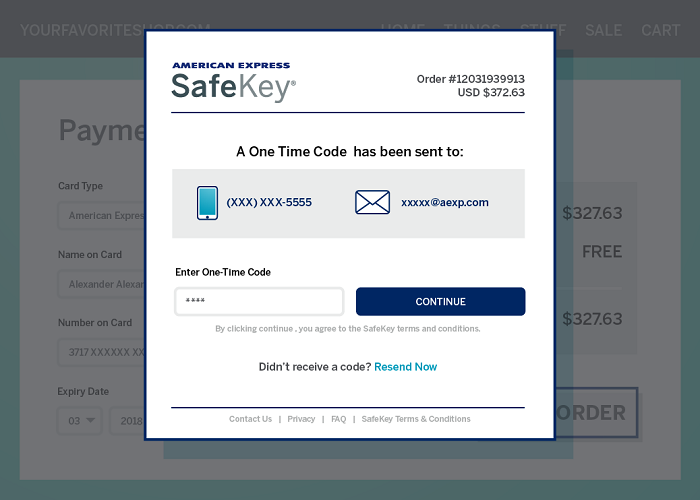

Cardholders are automatically enrolled in the SafeKey program. When making an online purchase with a participating business, the cardholder may be asked to provide a one-time use code that they will receive by email or on their phone.

One-time use codes are only valid for 10 minutes. If the cardholder doesn’t complete the checkout in that time, they’ll need to restart and request another one-time code.

SafeKey 2.0

American Express SafeKey 2.0 offers additional features not available with the first iteration. 2.0 supports non-browser shopping (such as in-app payments through smartphones) and can support biometric payment authentication.

SafeKey 2.0 is available now, though minor revisions are still in process. The 2.0 version provides helpful benefits, such as liability shifts for some disputed transactions. Liability for fraudulent transactions shifts from the business to the issuer if the business properly utilizes SafeKey.

SafeKey 2.3 is slated to be available in 2023 and will offer support for additional payment scenarios, such as payments through gaming consoles.

How it Works

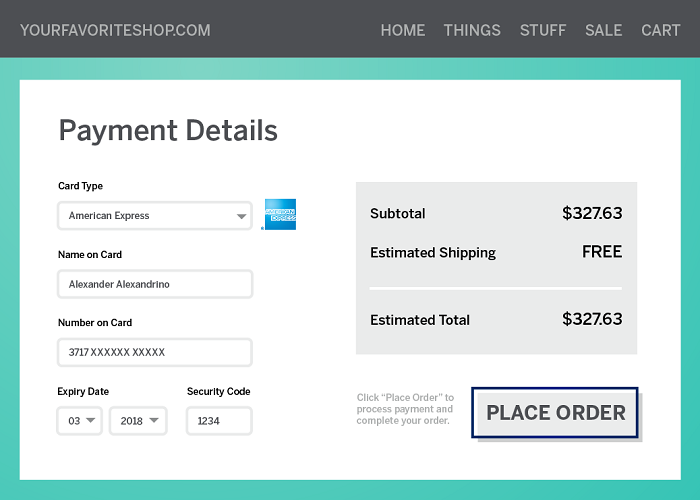

On its website, American Express details the process for a cardholder checkout with SafeKey. The customer shops on your website as usual, adding items to their cart. When ready to complete the purchase, your customer proceeds to your checkout page and enters their card details.

If the transaction requires the customer to enter a one-time code, the SafeKey one-time code window will appear, advising the customer that they have been sent a code and prompting them to enter it to complete the purchase.

Note that not all Amex transactions will require a one-time use code, and that SafeKey doesn’t work with all types of Amex cards. It’s a good idea to utilize SafeKey as one of several anti-fraud tools, not the only one. SafeKey works in conjunction with popular fraud prevention tools such as Address Verification (AVS).

On the business side, SafeKey usage looks like this:

The business utilizing SafeKey provides the transaction details, where it is authenticated to confirm the cardholder’s identity. If it’s determined that the transaction is low risk, no additional verification is needed. If the transaction is determined to be high risk (due to being unable to confirm details of the cardholder’s identity) then the issuer can choose to require additional authorization through a one-time-use passcode.

Benefits of Implementing SafeKey

One of the primary benefits of SafeKey is that liability for chargebacks shifts to the issuer, not your business, if a customer initiates a chargeback on a transaction that was approved with proper use of SafeKey.

Additionally, SafeKey may allow you to serve higher risk markets (such as international customers) while limiting your own risk. Amex also states that SafeKey leads to increased customer confidence in the business, which can result in more sales or decrease cart abandonment.

Does it cost money to use American Express SafeKey?

The service is free for cardholders and businesses, but there may be costs to your business for implementation or set up. In its SafeKey FAQ, American Express states that it does not add a transaction fee to businesses for using SafeKey. However, your processor may have its own charges for setting up 3D secure fraud services, including SafeKey. If you’re considering using SafeKey, contact your credit card processor to ask about any setup fees or ongoing charges.

How to Implement Amex SafeKey

To implement American Express SafeKey on your ecommerce site, you’ll need to enroll with American Express and accept the terms and conditions. Once you’ve completed the necessary enrollment form, you’ll get an email from the SafeKey Certification Team with a SafeKey ID and details on the next steps. Amex will work with the acquirer to complete setup and notify you when ready.

Taking American Express

If you haven’t set up SafeKey for American Express, you can contact your processor for setup assistance. Some businesses think that it’s too expensive to accept Amex, but American Express introduced a pricing model called OptBlue in 2015, which offered the potential for lower costs of acceptance. However, not all processors are passing along the savings to businesses.

If you think you’re paying too much to take Amex, or if you aren’t taking it yet but want to know how much you can expect to pay on Amex transactions, sign up for a free comparison through CardFellow and then give us a call. We’ll be able to explain the numbers for your specific business so you won’t have any surprises when it comes to the cost for accepting credit cards.