There are a lot of options when it comes to credit card payment machines. Here are some of the leading equipment manufacturers.

Some credit card machine companies also provide merchant accounts, while others are solely equipment manufacturers. We’ll take a look at why that matters and give a rundown of the major equipment providers in the United States.

This article is specifically about credit card machine companies, not the machines themselves. Need details on particular machines? Check out CardFellow’s full credit card processing equipment directory for reviews, feature lists, compatibility with processors, and more.

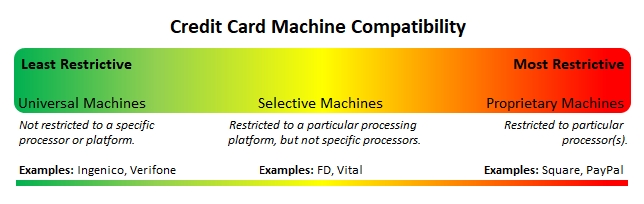

Universal vs. Selective vs. Proprietary

Before we dive into the companies that make credit card terminals, it’s important to know that there are credit card terminal providers that don’t offer credit card processing and ones that do. Machine providers that don’t offer merchant accounts work with processing companies that do in order to enable businesses to use their machines.

Universal

There are only a handful of major players that are considered primarily or solely credit card machine companies or manufacturers, and they’re all “universal” payment machine providers. (Meaning their machines aren’t locked to particular processors or processing platforms.) These machines can typically be “reprogrammed,” meaning that you can continue to use it even if you switch credit card processors in the future.

Proprietary

On the other end of the spectrum is “proprietary” equipment providers. They either offer merchant accounts directly and only allow use of their machines with their merchant accounts, or they manufacture machines that are “locked in” to one particular processor that they partner with. With proprietary machines, you’ll need to purchase new processing equipment if you decide to switch credit card processors in the future.

Selective

Somewhere in the middle are “selective” equipment providers. These companies offer machines that work on a particular platform, but allow the machine to be used by any processor that operates on that platform. (We’ll explain this in more detail later in this article, in the section on selective machines.)

The image above provides a quick visual reminder of the differences between universal, selective, and proprietary credit card processing equipment. When looking for the right credit card machine for small businesses, machine status can play an important role in choosing the a terminal.

Universal Credit Card Machine Companies

Credit card machine companies that allow you a choice of processors are sometimes called “universal” machine companies. That means that they don’t restrict their machines to particular processors or platforms. (Though processors don’t necessarily support all universal machines.) Universal credit card machine companies don’t provide merchant accounts directly. You’ll need an account with a compatible credit card processor in order to use the universal terminal.

The major universal credit card machine companies are:

- Dejavoo

- Ingenico

- PAX

- Poynt

- Verifone*

*You may also see references to Hypercom Equinox machines. Hypercom was purchased by Verifone, so we’re not listing it separately even though some machines are still called Hypercom.

You’ve probably seen these machines at retail stores and supermarkets without even realizing it. Each company offers multiple models, with different models providing different features. All five offer and promote EMV chip-capable credit card machines and options that can accept NFC (contactless) payments.

Verifone and Ingenico are the two largest equipment manufacturers for machines available in the United States. As such, most of the major processing platforms support those two. In the table below, we’ll include processor compatibility by brand, but there are three important things to keep in mind.

- Compatibility can change.

If you’re interested in a particular machine, be sure to confirm you can use it with the processor of your choice before purchasing it. - Processor compatibility refers to the backend processing platform, not necessarily the specific processor.

Most processing companies are not backend processors, but rather function as “resellers” of those backend processors and operate on their platform. That means that a company that operates on the TSYS platform would be able to support equipment listed as TSYS compatible. However… - Just because a processor supports a particular brand doesn’t mean they offer every terminal or machine within that line. See point #1 about confirming with your individual processor before purchasing a machine.

With that in mind, here’s the table of universal machine companies.

Dejavoo

As one of the smaller equipment manufacturers, Dejavoo isn’t as widely used as some of the other brands, but it provides modern terminals with plenty of features. One specific area where you’re likely to see Dejavoo come up is for credit card surcharging. Many processors that set up businesses for surcharging or cash discount programs require use of Dejavoo terminals, often the Z8, Z9, or Z11.

More info: Check our CardFellow’s equipment directory to read reviews of specific Dejavoo credit card terminals.

Ingenico

Along with Verifone, Ingenico sits near the top of the list of largest credit card processing equipment manufacturers. It was founded in Paris, France in the early 1980s but has since expanded all over the world. The company boasts that it has deployed 30 million terminals in 170 countries. Chances are, if you’ve used a credit or debit card, you’ve seen an Ingenico terminal.

More info: CardFellow’s equipment directory offers reviews of many Ingenico credit card machines.

PAX

Founded in Hong Kong, PAX is not as big of a player in the United States as others on this list. However, the company is still a large manufacturer and boasts that it has sold tens of millions of machines since its founding in 2000. While you might not see the machines as often as other brands, they still offer all the modern features and payment acceptance types.

More info: In CardFellow’s equipment directory, you can read reviews of individual PAX credit card machines and get price quotes.

Poynt

As a relative newcomer, Poynt has fewer hardware options and focuses largely on perfecting its “smart terminal” operating system. From the beginning, Poynt’s goal was to “future-proof” payment terminals by providing a machine that accepts all types of payments – even if a business doesn’t yet take those payments or consumers haven’t switched over to the newest payment technology. The idea is that when they do, your business will be ready.

It’s worth noting that Poynt prominently references credit card processor Elavon as an investor. While Poynt currently doesn’t restrict its machines to the Elavon platform, we’ll keep an eye on it to see if compatibility changes in the future.

More info: Poynt terminals in the CardFellow equipment directory.

Verifone

What started as an over-the-phone verification service for check acceptance (verification by phone, hence Verifone) soon shifted to machine manufacturing to address a relatively new payment method at the time: credit cards.

With over 7.5 billion transactions processed per year, it’s not hard to believe Verifone’s claim of being the world’s largest equipment provider. The company’s multi-lane machines are popular for retailers and grocery stores that have multiple checkouts, while one of the first EMV chip-capable terminals – the Vx520 – remains a popular choice for smaller stores.

More info: Check out CardFellow’s reviews of individual Verifone credit card terminals.

Pros and Cons of Universal Machines

The primary benefit of a universal machine is that you’ll have a larger choice of processors. That means you’ll be able to look for the one with the best possible rates and fees. Additionally, universal machines are usually reprogrammable. You’ll have the option to keep your machine if you want to switch to another processor in the future. (Provided that processor supports the brand and model you use.)

There really aren’t any downsides to universal machines. They provide the latest features, and give you the flexibility to choose the right processing company for your needs.

Selective Credit Card Terminal Providers

Some terminal providers sell machines that only work with on certain processing platforms. Those are considered “selective” credit card terminal providers. Choosing a machine from a selective provider gives you less flexibility in obtaining a merchant account than with a universal company, but more flexibility than with a proprietary machine.

In most cases, companies offering limited choice terminals are primarily credit card processors that also have a line of equipment. They may manufacture the equipment themselves or private label a credit card machine company’s products.

It’s important to note that when we say the terminal only works with certain providers, we mean it only works on that provider’s platform. Many different processing companies work on one processor’s platform. For example, if you were to purchase a Clover station, it only works on Fiserv’s (formerly First Data’s) platform. However, that doesn’t mean you need a merchant account directly with Fiserv. It just means you need a merchant account with a Fiserv reseller. (Don’t worry, there are hundreds!)

Selective credit card terminal providers include:

- First Data (now Fiserv)

- TSYS

That’s not a big list, but keep in mind that there aren’t many direct, backend processors. Those companies are the most likely to offer a machine that runs only on their platform.

First Data (now Fiserv)

Any business owner that has accepted credit cards has probably come across First Data, which has since been acquired by Fiserv. It’s one of the largest processors in the world, and has been around for over 50 years.

Of the two companies, Fiserv is somewhat more restrictive in your machine choices. While the platform supports universal machines such as Ingenico and Verifone, the corporate office will not reprogram universal terminals. (However, some Fiserv / First Data resellers will.)

Instead, the company heavily pushes its two selective lines: the FD line of equipment and Clovers.

First Data’s Options

The FD line, which includes popular machines like the FD130, is reprogrammable. (Including by First Data / Fiserv corporate.) Clovers, which include the Mini, Flex, and Station, cannot be reprogrammed. In that sense, they are closer to proprietary than universal. However, because many resellers on the platform can sell you a Clover to use on that platform, we’re still considering them selective and not proprietary.

Just keep in mind that when you purchase a Clover, you can only use it with the processing company from whom you purchase it. If you want to switch processors down the road, you’ll need to purchase new equipment, even if you switch to a processor that runs on First Data’s platform and supports Clovers.

More info: Check out reviews of FD credit card machines or Clover stations.

TSYS

Total System Services (TSYS) is also one of the largest processors and has been around for many years, but doesn’t have quite the same name recognition as First Data / Fiserv. However, of the two, it’s a little more flexible when it comes to processing equipment.

Unlike First Data / Fiserv, TSYS corporate will reprogram universal terminals. For example, if you already own an Ingenico model that TSYS supports, you can switch over to TSYS and keep using that machine. TSYS resellers will also reprogram universal equipment.

TSYS Equipment

However, TSYS does have its own selective line that it prefers: Vital. The Vital line is roughly equivalent to First Data’s Clover line. Both have countertop machines, mobile readers, and full POS systems. Also, like Clover, Vital systems cannot be reprogrammed. When you purchase one, its use is limited to the processing company from whom you purchase it. That means that you’ll want to be sure you plan to stick with the processor you choose for awhile if you plan to buy a Vital system as your credit card equipment.

More info: Read reviews of the Vital credit card equipment.

Pros and Cons of Selective Machines

Selective machines offer modern features and reliable equipment.

The minor drawback is that when opening a merchant account, you don’t have the full range of processing companies to choose from if you want to use selective equipment. However, because selective equipment is limited by processing platform and not by processor, you do still have many choices to secure a merchant account. You’ll have fewer choices than with a universal machine, but more choices than with a proprietary system.

Proprietary Card Payment Systems

Proprietary credit card machines are the most restrictive in terms of processors. These machines aren’t just restricted by platform, they’re restricted by processor. They often work with only one or two processing companies. With proprietary systems, it doesn’t matter if another company runs on the machine’s approved processing platform. It will still only work with the specific processor that the machine provider chooses.

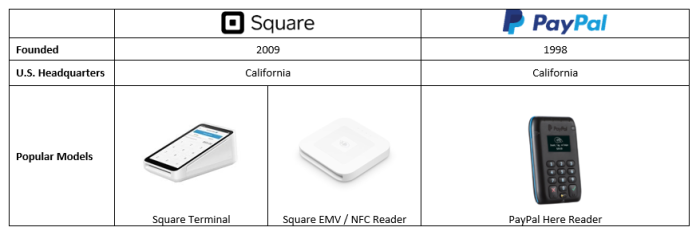

It’s more common to see proprietary POS systems than proprietary credit card machines / readers. However, there are two primary companies that are known for proprietary card machines:

- PayPal

- Square

PayPal

While PayPal has about 10 years and thousands of customers on Square, it also has garnered more of a negative reputation. The bulk of the complaints about PayPal from business owners center on held funds and closed accounts. However, it’s worth noting that a number of Square’s Better Business Bureau complaints (as well as complaints elsewhere around the internet) mention the same problem with Square.

It’s equally important to stress that some of PayPal and Square’s closed accounts are for violations of their Terms of Service. Following your agreement doesn’t guarantee you’ll never have funds held, but it goes a long way to ensuring a smooth relationship with PayPal or Square.

Regardless of the complaints, PayPal remains an 800-lb gorilla in the proprietary processing world. From a consumer standpoint, PayPal is still a trusted name.

The company’s PayPal Here reader competes directly with Square’s reader. PayPal Here only works with PayPal, so if you want to use it, you need to set up a PayPal account.

More info: Read PayPal Here reviews.

Square

Where PayPal was the established name, Square was the trendy up-and-comer. Founded by the same guy who created Twitter, Square sought to make processing simpler and cooler. The company continues to try to do just that, releasing the sleek Square Terminal credit card machine to try to unseat traditional models like those offered by Verifone and Ingenico.

Square readers and terminals only work with Square, so you’ll need an account directly with them to use the machines.

More info: Read about the Square credit card terminals.

Pros and Cons of Proprietary Credit Card Machines

A company that offers proprietary machines should have extensive knowledge of its system for troubleshooting. While that can come in handy, it’s up to you to determine if it’s worth the drawbacks.

The primary con to proprietary terminals is that you have no choice at all in processors. For example, if you want to use the Square Terminal, you have to sign up with Square. Because of that, you have less competitive leverage. Proprietary machines tend to come with higher processing fees due to that lack of competition. If you want to switch processors down the road, you’ll need to purchase new equipment.

While both PayPal and Square offer simple pricing, simplicity does not necessarily equal low cost; a fact to keep in mind when considering either company.

Other Proprietary Systems

Most other proprietary credit card machines and POS systems aren’t sold by independent companies, but rather processing companies with their own equipment lines. Even when some equipment manufacturers start off not offering their own credit card processing, many end up offering it. (Such as Toast.)

However, there are a few systems that are made by companies who don’t handle their own processing. These include POS systems such as Harbortouch.

Choose a Processor Before a Machine

Unless you need a very specific feature or have your heart set on a particular machine, it’s a good idea to choose your processor first. That way, you can compare among many processors, finding the right fit for your business. You’ll be able to look for the lowest cost companies with the services you need and leverage the competition to get the best pricing. From there, you’ll select a machine from the multiple options they support.

Need help finding a credit card processor or a terminal? CardFellow can help.

Fill out a business profile to see pricing and supported credit card terminals from multiple processors. It’s free, fast, and private. Try it now!