Accepting credit cards at a business comes with costs. The largest portion of the costs is known as interchange.

Often shortened from “interchange reimbursement fees,” interchange refers to a set of categories that are used to determine the rates for individual card transactions. Every category has requirements for eligibility and a rate associated. Those rates change at the card brands’ discretion, typically twice a year.

Interchange can be a complex topic. For the purposes of this article, we’ll include a simplified overview, and a detailed explanation. It can help to have a basic understanding of credit card processing before diving into this interchange explanation. If you haven’t already read it, be sure to check out our credit card processing guide.

Interchange – Simplified

Every time you accept a credit card at your business, you pay a fee to a credit card processor. That fee has three parts: interchange, assessments, and processor markup.

Interchange is the largest part, and it goes to the banks that issue cards to customers. It’s also non-negotiable; Visa and Mastercard set the interchange rates for accepting their cards. Additionally, they publish those fee tables, which include dozens of interchange categories. Interchange rates are not secret.

What are interchange fees?

Interchange fees are the costs associated with interchange categories. Every interchange category has specific requirements. If a transaction meets those requirements, it will be charged that category’s interchange fee.

Interchange rates are all over the map. They can range from less than a percent for some debit cards all the way up to 2.95% for downgrade categories.

You can view the published interchange fees here:

Note that Discover and American Express don’t publish their interchange schedules. In fact, American Express doesn’t even call their fees “interchange,” though it’s a similar concept.

The published interchange tables can be a bit confusing. At CardFellow, we have articles that more clearly explain the various interchange categories, the requirements, and the fees associated.

Who pays interchange?

You do, but indirectly. Your processor will physically pay the card brands, but you pay your processor a fee for accepting credit cards. They will include the costs of interchange in that fee, meaning it’s simply a way to recover their costs.

For the purposes of the simplified explanation, it’s fine to think of interchange as a fee you pay, since it’s part of your cost to accept cards.

Do I need to worry about interchange?

Not really, because you can’t change it anyway. The card brands charge the same interchange rates to everyone. However, there’s a caveat, and it’s a big one. Some credit card processors “pad” interchange, meaning they add additional costs on to Visa’s and Mastercard’s published interchange rates without telling you.

If your processor does that, you’re paying more than you have to and may not even realize it. What’s even worse is that padded interchange is difficult to spot unless you’re familiar with interchange costs.

CardFellow members receive statement audits as part of your membership. Among other things, our processing experts check for padded interchange during audits. If you haven’t had an audit recently and would like one, sign in to your CardFellow dashboard or give us a call.

Not a member yet? Membership is free, and signing up only takes a minute. Go here: Become a member.

Interchange – In Detail

If you’re a business owner that really wants to understand the ins and outs of processing costs, this section is for you. It’s also where things get a little complicated. First, let’s look at the purpose of interchange, and the in-depth explanation of how interchange fees work.

Why does interchange exist?

Historically, interchange has been imposed on businesses to reimburse issuing banks for lost interest resulting from a cardholder’s grace period for repaying their debt. This is why Visa still refers to interchange fees as “interchange reimbursement fees.”

These days, Visa is a lot more vague. The company simply states that, “Visa uses interchange reimbursement fees as transfer fees between acquiring banks and issuing banks for each Visa card transaction. Visa uses these fees to balance and grow the payment system for the benefit of all participants.” (Source)

Interchange fees for the two largest card brands may change twice annually, in April and October.

How Interchange Fees Really Work

While it’s fine to think of interchange as a fee you pay for accepting cards, it’s important to remember that you as a business owner don’t pay interchange directly. Instead, the acquiring bank pays it, and you repay the acquiring bank.

When you accept a card as payment, the money doesn’t come from the customer’s account right away. However, you get a deposit of the funds quickly; usually within 1-2 days. The acquiring bank (processor) deposits the funds in your account. The issuing bank (the cardholder’s bank) removes the money from the cardholder’s account. The issuing bank deducts interchange fees (which it keeps as its fee for its role in the transaction) and gives the rest to the acquiring bank.

However, the exchange between the issuing bank and acquiring bank isn’t equal to the original transaction amount. That means the acquiring bank hasn’t made any money yet, and in fact is in the red. So, they charge you the difference between the original transaction amount and the amount they deposited in your account (so they break even) plus a markup (which puts them in the black.)

Essentially, the acquiring bank pays interchange costs to the issuing bank first, and later collects a fee from you that is greater than what it paid in interchange. Your business ultimately receives the gross amount of the sale minus a series of base costs and markups that include interchange, dues, assessments, and the processor’s markup. These fees are described in more detail in our article about credit card processing fees.

Padded Interchange

Processors “padding” interchange is a sneaky tactic that we’ve seen firsthand. Essentially, the processor adds fees to the interchange fee that the card brands charge without telling you it did so. It then leaves the cost listed simply as “interchange,” making you think it’s a non-negotiable component of cost.

Since you’re not paying interchange directly, there’s actually no guarantee that you pay it at cost. You would need to be familiar with interchange fees (or willing to look them up individually) to spot padded interchange.

Is padding interchange legal?

Unfortunately, there are very few regulations in credit card processing. Padding interchange is not necessarily forbidden. That said, if it’s against your contract, you may be able to fight it.

However, it’s far easier to avoid processors that play games like padding interchange. Start by becoming a CardFellow member. It’s free, and your membership includes valuable protections when you choose a processor through our service. One of those protections is the requirement that you receive interchange costs at cost, with no padding. Even better, CardFellow processing experts regularly audit your statements to ensure you’re not overcharged.

Note that padded interchange refers to the processor adding on to the published interchange costs set by Visa or Mastercard. It does not mean that your transactions fell to a more expensive interchange category. If your transaction qualifies for a particular category, it should receive the rate for that interchange category. If the rate is higher, that’s padded interchange.

Interchange Qualification

That brings us to the question of how interchange fees are determined. The portion of a transaction that’s taken by an issuing bank for interchange depends on the interchange category that the transaction falls under, as dictated by the card brand (Visa, Mastercard.) The process of categorizing a transaction (and thus determining its interchange fee) is called interchange qualification, and it happens on a per-transaction basis.

Anyone who has looked at a credit card processing statement has seen the dozens of lines with various names and numbers. That’s because different transactions will route to different interchange categories. The statement lists the categories that applied to the transactions in that month.

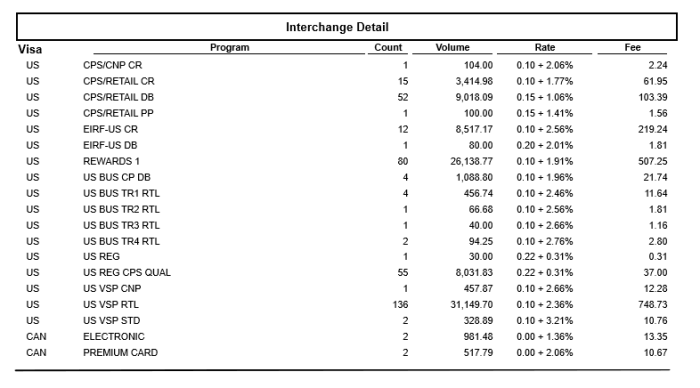

Different processors present the information differently. However, in many cases, processors will list interchange categories in their own section, such as in this example:

In this statement excerpt, you can see that the processor lists categories in their own section (called interchange detail) and separates it by card brand. Notice how many Visa interchange categories applied in this one month.

Note: If you’re on flat rate pricing (such as the pricing companies like Square and Stripe offer) you won’t see interchange detail. That doesn’t mean that your transactions are exempt from interchange; it just means the processor isn’t showing you the interchange categories that applied to your transactions.

Understanding Interchange on Statements

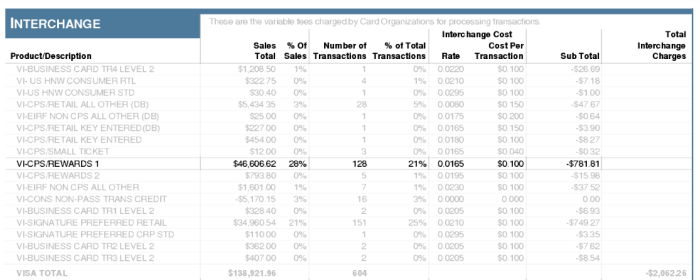

So, what do the interchange lines actually tell us? Let’s just take a look at one category. In the statement below, I’ve left the Visa category CPS Rewards 1 visible.

This line tells us that 128 of the business’s transactions met requirements for the CPS Rewards 1 interchange category, and were thus charged an interchange fee of 1.65% + 10 cents per transaction. (The percentage is listed as a decimal in this statement, but multiplying the decimal by 100 gets the percentage.) If you do the math, calculating 1.65% of the sales volume ($46,602.62) plus 10 cents per transaction for 128 transactions, you end up with the total fees for all of the transactions in the CPS Rewards 1 category: $781.81.

Those transactions qualified for CPS Rewards 1 because they met the criteria for that category. (You can view the criteria for that category in the link above.)

Factors that Affect Interchange Qualification

A number of factors affect where a transaction will qualify. You can control or influence some of these factors, but not all of them.

Factors that you can influence include:

Processing Method

The terms card-present and card-not-present refer to the different ways of processing a credit card transaction. Card-present interchange categories typically carry smaller fees than card-not-present categories. If it’s possible to swipe cards, that will help you keep fees down.

Card-Present

Card-present transactions are those where a merchant is able to read a customer’s credit card data electronically. This process is referred to as electronic data capture. This includes swiping a magnetic stripe card, “dipping” an EMV chip card, or “tapping” a contactless payment method, such as an Apple Pay-enabled smartphone.

Card-Not-Present

On the other hand, card not present transactions are those where the cardholder enters their card details online (such as through an ecommerce checkout page or an invoice page) or where you enter the card details manually into a credit card machine or online portal.

Transaction Data

The information supplied with a credit card transaction impacts how it qualifies at interchange. Proper and complete transaction data is especially important for businesses that process card-not-present transactions and for those that deal with corporate and government cards.

Interchange qualification factors that you can’t control include:

Merchant Category Code

Specific interchange categories exist for businesses that fall under certain merchant category code (MCC) designations. However, you’re not able to control or change your MCC just to change your interchange qualification. MCCs are assigned based on the type of business that you run.

Card Type and Brand

Separate interchange categories exist for credit and debit card charges, and for specific types of cards within those classes. For example, rewards credit cards will have different rates than non-rewards credit card.

Additionally, the brand of a card will impact interchange qualification. Visa has different rates than Mastercard. However, you’re not in control of what type of card your customer uses.

Card Owner

Whether a credit or debit card is issued to an individual, business, corporation or municipal agency impacts interchange qualification. Corporate and government credit cards have their own interchange categories separate from consumer credit cards.

Interchange Optimization

Now for the really complex part. While it’s true that interchange fees can’t be negotiated, there are sometimes ways to lower your interchange costs. That’s because transactions are eligible for different interchange categories, depending on various factors.

You’re not actually negotiating lower rates on a particular interchange category. Rather, you’re adjusting something about how you take cards or settle transactions in order to qualify for a lower cost category. This can apply to both fixing “downgrades” (or penalty categories) so that you no longer have expensive penalties or to meeting criteria for a better interchange category even though you weren’t initially penalized.

Interchange fees account for the bulk of your business’s credit card processing expense, making it very important to ensure that the majority of transactions qualify to the lowest possible categories as often as possible. The process of adapting your business’s processing behavior to achieve the lowest possible interchange costs is called interchange optimization.

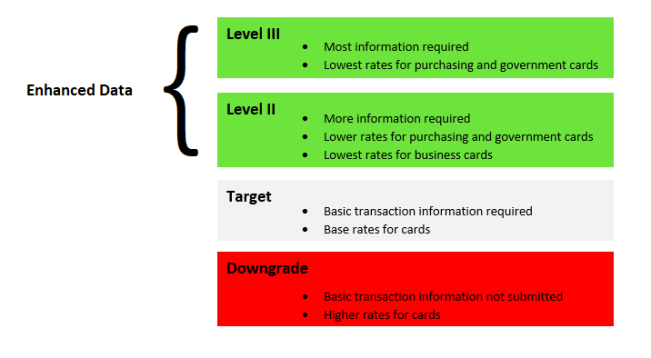

It’s easiest to think of it in terms of base or “target” interchange, “downgrade” interchange, and “enhanced” interchange.

Target Interchange, Enhanced Data, Downgrades

Target interchange is where your transaction should fall if you meet basic requirements. You haven’t provided anything extra to receive enhanced data interchange, but you also haven’t done anything that gets you “penalized” with a downgrade.

In some cases, target interchange is the best possible rate you can receive for a transaction. However, certain transactions can receive lower cost “enhanced” interchange if you provide additional information with the transaction, known as enhanced data. This primarily applies to corporate credit cards, purchasing cards, and government cards.

If commercial cards make up the bulk of your transaction volume, it’s crucial to ensure that you’re properly optimized for enhanced data. Not doing so means you’ll pay more than you have to, due to un-optimized interchange. Providing enhanced data (also called level 2 or level 3 data) means better rates than target for those cards that are eligible.

If commercial cards make up the bulk of your transaction volume, it’s crucial to ensure that you’re properly optimized for enhanced data. Not doing so means you’ll pay more than you have to, due to un-optimized interchange. Providing enhanced data (also called level 2 or level 3 data) means better rates than target for those cards that are eligible.

On the flips side is “downgrade” interchange categories. These categories will cost you more than target, as they serve as a penalty category for not meeting a requirement of the target interchange categories. Most interchange categories have multiple requirements. You only need to miss one for a downgrade.

Correcting downgrades ensures more of your transactions will qualify for their target interchange categories. The extent to which interchange can be optimized for your business depends on several variables and is a question that you should address with your merchant service provider or your CardFellow representative.

Interchange Category Requirements

Unfortunately, there’s no simple list of interchange qualification requirements. That’s because the criteria varies by category. Some factors that affect qualification include:

- How much time passes between authorization and settlement

- Whether you used Address Verification Service (AVS)

- Information submitted with the transaction

- Merchant category code

- And more…

CardFellow has explanations of the criteria for common interchange categories. The links below will take you to a list of posts that cover the interchange fees for that card brand. You can also use the search function in the blog to look up a particular category by name or statement abbreviation.

- Visa Interchange Rates, Fees, and Requirements

- Mastercard Interchange Rates, Fees, and Requirements

- American Express Transaction Fees

Note that American Express technically doesn’t call its base rates “interchange rates” but they function similarly to interchange.

As you’ll see when you start looking into interchange categories, it’s a constantly moving target. Categories are created or removed and rates are updated regularly. Additionally, different processors use different abbreviations for the same interchange categories, making it difficult to compare across companies without expert assistance. If you need help, you can sign up for a free Cardfellow.com account to see real pricing from processors and ask our experts your interchange questions.