The term “downgrade” gets thrown around a lot in credit card processing, but what does it actually mean?

Interchange downgrades aren’t exactly a fun topic, and they can be a little complicated to explain. However, there are very real costs associated with them, and too many downgrades means throwing money down the drain.

Fortunately, downgrades are an avoidable expense. The issue is that a processor’s expertise is required to recognize and address downgrades. However, processors have no financial incentive to do so. This leaves the burden of spotting and correcting downgrades on business owners.

In this article I’m going to explain what downgrades are, how to spot them, and how to correct them. Doing so can ensure your business isn’t paying more than necessary for credit card processing.

Keep in mind that CardFellow members receive free interchange optimization services, including finding and correcting downgrades. If you’re a CardFellow member and you suspect that downgrades exist on your statement, simply contact us for a free comprehensive statement review. We’ll diagnose and help you correct any downgrades. Not a member yet? It’s free to join.

- What is a downgrade?

- What are common causes of downgrades?

- How do downgrades impact cost?

- How do you recognize downgrades?

- Correcting Downgrades

What is a downgrade?

Each time you process a credit (or signature debit) card, it is assigned to an interchange category. That category has a corresponding rate and fee that processors use to calculate the cost of the transaction. Every transaction has a target interchange category, which is the category that has the lowest rate and fee for the given transaction type.

A downgrade occurs when a transaction is routed to an interchange category that is priced higher than the target category. When this happens, the rate used to calculate the cost of a transaction is increased and the transaction is said to have “downgraded.”

For example, if a Visa transaction’s target interchange category is CPS Rewards 2, but the transaction is not settled within 24 hours, it will downgrade to a more expensive interchange category. The rate associated with CPS Rewards 2 is 1.95%, but the rate associated with the downgrade category is 2.30%. In this case, the downgrade increases the cost of the transaction by 0.35%.

Downgrades Are a Construct of Interchange

Like most things on the topic of credit card processing, you’ll need to understand credit card processing fundamentals. Downgrades influence interchange qualification, so it’s not possible to understand downgrades without first understanding what interchange is and how it works.

We have a lot of information about interchange here at CardFellow, so I won’t reiterate it in this article. If you’re not familiar with interchange, please take a moment to read our article about interchange fees before reading further about downgrades.

Why do downgrades happen?

While some downgrades are associated with processing equipment or software, the vast majority of downgrades are a result of a business’s processing behavior – meaning how it authorizes and settles transactions.

The bad news is that businesses are often the cause of their own downgrades. The good news is that this provides an opportunity to adjust processing behavior to eliminate, or at least significantly reduce, the occurrence of downgrades.

Business Types Most Susceptible to Downgrades

Visa, Mastercard, and Discover all have interchange qualification guides. These guidelines outline the requirements a transaction must meet for various interchange categories. Transactions that don’t meet these requirements will downgrade to an interchange category with a higher rate.

Retail businesses that swipe cards (or dip cards, in the case of EMV) through a card reader are less susceptible to downgrades than businesses that do not swipe cards, such mail-order or e-commerce companies.

Reason being, when a transaction is swiped, the business’s processing equipment electronically reads and transmits all required data with a transaction. The technical industry term for this process is “electronic data capture.”

This isn’t the case with card-not-present transactions such as keyed or e-commerce. In this case, a person must ensure they provide all required data. That is less reliable than having a piece of equipment perform the task automatically.

What are common causes of downgrades?

The most common reasons for downgrades differ for card-present and card-not-present businesses. The reasons for each are listed below.

Card-present businesses (swiped transactions)

- Stale authorizations

A stale authorization is one that has surpasses the allowable time between authorization and settlement.Authorizations must be settled in order for a business to receive money from a transaction. Interchange category qualifications dictate how much time is allowed to pass between authorization and settlement. If too much time passes, the transaction is said to be stale, and it will downgrade.Many interchange categories require an authorization to be settled within 24 hours, so ensure your batch of authorizations is being settled at least once every day to avoid downgrades due to stale authorizations.Most credit card machines and POS software have the ability to automatically close batches (settle authorizations) at a set time every day. This is a very helpful feature in avoiding downgrades due to stale authorizations.

Card-not-present businesses (keyed / e-commerce transactions)

- Stale authorizations

The same explanation as noted above applies equally to card-not-present businesses. - Failing to use AVS

AVS stands for address verification system, which is a fraud deterrent tool that tells businesses whether the address provided by a cardholder matches the address on file at the cardholder’s issuing bank.Address information (the customer’s five-digit zip code) is required for card-not-present transactions to qualify to target interchange categories. If a customer’s zip code is not provided, the transaction will downgrade.To avoid downgrades related to AVS, be sure to provide a customer’s billing zip code with each transaction. - Not providing a customer code

This reason applies to credit cards issued to a business or commercial entity rather than to an individual. Commercial cards have unique interchange requirements, and one such requirement is that a customer code be provided with the transaction. A customer code is any numeric value. To avoid these downgrades, supply a customer code when processing all transactions involving a commercial credit card. If you don’t have or know the customer code, provide any numeric value to satisfy the interchange requirement.

How do downgrades impact cost?

Downgrades cause a transaction to be processed at a higher rate, which results in a higher cost to the business. Exactly how much higher the cost will be depends on a few variables, the most important of which is the pricing model that a processor uses to assess charges to a business. As we cover in our credit card processing guide, the two general forms of pricing are bundled and interchange-plus.

I’ll cover how the cost associated with downgrades can differ for each pricing model below.

Interchange-Plus & Downgrades

As noted in our article about interchange plus, this pricing model functions by passing the cost of interchange to a business. Therefore, the processor also passes increased costs from downgrades to your business.

The important distinction with downgrades and interchange-plus is that a processor doesn’t get any monetary benefit when a business’s transactions downgrade. This is not necessarily the case with bundled pricing.

Bundled Pricing & Downgrades

As we outline in our article about bundled pricing, a processor assess charges to a business by funneling interchange costs through its own contrived rates. In addition to its numerous other negative aspects, bundled pricing can actually allow a processor to profit from a business’s downgrades.

Processors typically make a larger profit on the non-qualified rate used in bundled pricing, and interchange categories associated with downgrades are routed to the non-qualified pricing tier.

Not only can this increase a business’s processing costs substantially, it completely disincentives a processor from bringing downgrades to a business’s attention, let alone helping to resolve them.

For this and other reasons, I highly recommend that any business being billed via bundled pricing use CardFellow’s service. You’ll secure a competitive interchange-plus solution, and we’ll address any downgrades.

Mastercard’s Interchange Downgrade Fee

In addition to the actual interchange downgrades, Mastercard imposes an assessment fee (called the interchange downgrade fee) of $0.15 per downgraded transaction.

How do you recognize downgrades?

Spotting downgrades on a bundled pricing credit card processing statement can be virtually impossible. It’s true that downgrades will result in a large volume of transactions being billed at the non-qualified rate, but there are processors (such as Intuit credit card processing) that surcharge many non-downgrade categories. Aggressive pricing (to put it nicely) is not necessarily an indicator of excessive downgrades.

The best course of action is to switch to a processor that does not use bundled pricing, such as those that offer certified quotes through CardFellow.

Recognizing downgrades on an interchange-plus credit card processing statement is much easier.

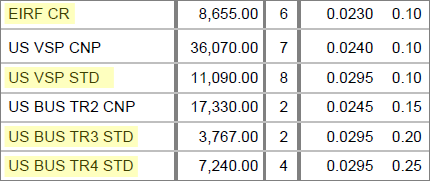

There are a few interchange categories that are generally associated with downgrades. These categories are Visa’s “non-qualified” (which is different than a processor’s non-qualified rate, confusingly) and standard, which is associated with several different possible downgrade categories. In the past, a category called EIRF (for electronic interchange reimbursement fee) was common and you may even still see it on statements.

Take a look through your credit card processing statement. You have excessive downgrades if you see “EIRF” or “standard” associated with a large number of transaction or volume. In the image below, both EIRF and standard downgrades are highlighted.

Read more about Visa standard interchange.

Correcting Downgrades

It’s not uncommon to see a few downgrade interchange categories on every processing statement. It’s almost impossible to completely eliminate downgrades all together, but downgrade categories should not account for a large number of transactions or sales volume.

The first step in correcting downgrades is to determine why they’re happening. The best way to do this is to request a downgrade report from your processor. This is a report that lists transactions that missed target interchange and provides the reason(s) for missing.

Once the reasons for downgrades are known, a representative with your processing company should be able to make recommendations on how processing behavior can be adjusted to curb the downgrades.

Again, CardFellow members receive our free monitoring and support. Part of this support is assistance with interchange optimization, which includes eliminating downgrades. If you chose your processor through CardFellow, please contact us and we will work with you and your processor to curb downgrades.