There are several common misconceptions in credit card processing and sales reps can use those to trick you into overpaying.

In this article, we’ll clear up these credit card processing misconceptions to help you avoid common pitfalls and misleading sales spin.

Misconception 1: Flat Rate Pricing is the Cheapest

Flat rate pricing, where a processor offers you a fixed rate for transactions, looks simple. Instead of various interchange rates, you’ll just see one rate. Companies like Square, Stripe, and PayPal offer flat rate pricing. You may see it as 2.75% (in the case of Square’s swiped transactions) or 2.9% + 30 cents (in the case of Stripe’s online transactions.)

The truth is, flat rate pricing can be the cheapest, but only for businesses that fit very specific criteria. In the case of Square, for example, it will be your lowest cost option if your average transaction is under $10 OR if you only accept a few thousand dollars per month in credit cards. Otherwise, competitive interchange plus pricing will be lower cost.

The reason is that flat rate pricing is typically much higher than the “wholesale” cost to process your transactions. No matter which processor you choose, that company pays interchange fees to process cards. In turn, the company charges you to cover their costs of interchange plus a markup for their profit.

On flat rate pricing, the processor charges you one rate no matter how much the transaction costs at wholesale. On interchange plus, the processor passes along the wholesale interchange costs to you and then charges a separate markup.

The difference between the interchange costs and the rate you pay is the amount the processor makes. On interchange plus pricing, you’d see lower costs when the transaction costs are lower, because the processor passes along the lower interchange costs. On flat rate, the processor continues to charge their one flat rate. So, when a transaction costs them less to process, they make more money instead of passing the savings to you. The flat rate processor needs to charge enough to cover your most expensive transactions, but when you have lower cost transactions, you won’t see the savings. Instead, the flat rate processor gets more profit.

Where does this misconception come from?

There are two sources for this misconception. The first is businesses that would legitimately pay less if they sign up with a flat rate company. A coffee shop with $5 average transactions, for example, could be quoted well over Square’s 2.75% no matter how many interchange plus processors they check with. So they find flat rate, see that it’s cheaper for their situation, and tout it as the lowest cost option. While that’s true for their business, it’s not true for companies that don’t have a similar processing profile.

Pricing for credit card processing is highly business-specific. What’s lowest cost for one business, won’t necessarily be lowest cost for yours.

The second source is businesses that go from “tiered” pricing to flat rate. Tiered pricing is opaque, expensive, and complex. A business moving from tiered pricing to flat rate will often see a reduction in cost, but they could reduce costs even further if they chose to go with a competitive interchange plus solution instead. However, they may not know about the differences between interchange plus and tiered (which both show more detail than a flat rate statement and look more complex) and thus determine that flat rate is cheapest.

The lowest cost pricing for your business will depend on your specific needs and processing volume. Just because another business secured low costs with one solution doesn’t mean it will be the lowest cost for you.

Misconception 2: Interchange Plus Pricing Protects You from Being Ripped Off

While it’s true that interchange plus pricing is more transparent and has potential to help you secure the lowest costs, be aware that it’s not a silver bullet. The truth is, interchange plus pricing can still be manipulated. At CardFellow, we’re increasingly seeing processors “pad” interchange.

Here’s how it works. You go out and learn all about processing. You’ve read CardFellow’s credit card processing guide, you’ve determined interchange plus is the best fit for your business, and you know to compare markups to get the lowest cost.

The processor offers you a nice, low markup and you sign up. The processor then proceeds to make up for the low markup by inflating the interchange rates. Rather than passing interchange fees to you at cost, the processor adds markup to interchange, but leaves it labeled as interchange. Even worse, they often only apply it to some interchange categories, making it more difficult to spot.

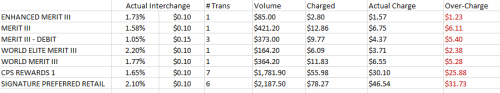

In the example below, we analyzed a business’ processing statement and found padded interchange in certain categories. We listed what the true interchange cost should be, along with the cost if they business had been charged according to actual interchange. We then also include what the business was actually charged and calculated the overage.

As you can see, overcharging can add up quickly. This business paid about $78 over the real interchange cost. That doesn’t account for other fees that will be paid to the processor. This is strictly the hidden costs of manipulated interchange plus pricing.

How to Avoid Padded Interchange

Make sure that you’re getting interchange plus with true pass-through pricing, where interchange and assessments are passed to you at cost.

The easiest way to ensure true pass-through is to use CardFellow. All of the certified quotes you receive from processors in our marketplace are true pass-through pricing as part of our contractual agreement with the processors. Additionally, CardFellow audits your processing statements to ensure that processors don’t overcharge you.

CardFellow is free to use, making it a no-brainer for businesses that don’t want to lose money on processing fees. Take 2 minutes to sign up now.

Misconception 3: You’ll Get the Best Pricing by Cutting Out “Middlemen.”

In merchant services, some processors try to make it sound like you’ll be “going direct” to the card companies or say that they can help you “cut out the middleman.” In reality, no one goes “direct” to the card companies. There is always a processor to facilitate the transactions.

The exception is American Express. If you process more than $1 million per year in Amex cards, you’ll go direct to Amex.

Additionally, while Visa and Mastercard do set interchange rates, your processor is ultimately responsible for your total processing costs. Pricing model, markup, and interchange padding all play a role in how much you’ll pay. It’s not possible to get a merchant account with Visa or Mastercard and “go direct” to ‘cut out the middleman’ for securing lower costs.

Misconception 4: You Can’t Get Lower Pricing Unless You’re a Big Business

Small businesses often think that they’re not large enough or important enough to get lower pricing, but that’s just not true. Here at CardFellow, we regularly help small businesses get the same great pricing that larger companies enjoy.

The key to securing good pricing is education and confidence. If you go into it thinking that your business is too small and resigning yourself to whatever rates a processor offers, you’re dooming yourself.

How to Get Better Pricing as a Small Business

To get the best pricing as a small business, go into it thinking that it’s possible. Don’t resign yourself to higher pricing just because you’re not a publicly traded company. Be realistic about what pricing you can get (see our article what are the average credit card processing fees? for a starting point) but don’t assume that you need to hit $1 million/year before you can get lower prices.

Be sure to check with multiple companies. Not all processors use the same risk determinations, so just because one company quotes high doesn’t mean another will. Use a credit card processor comparison service to get real quotes from processors for quick and easy cost comparisons.