Processor Directory > Capital Merchant Solutions

Capital Merchant Solutions Review

As of November 2017, the ones we know of are:

As of November 2017, the ones we know of are:

- FreeAuthNet

- Take Cards Today

- Holy Processing

- Rate Checkup

- ProcessAway

- Firearm Payments

(Did we miss one? Let us know!)

Take Cards Today seems to be Capital Merchant Solutions’ main website, focused the least on a particular niche and instead offering general details about the company’s processing services. We’ll dig into that one, and each of the others, in separate sections in this Capital Merchant Solutions review.

But first, let’s take a look at reviews from current or former clients. Because each of the ‘companies’ listed above are all Capital Merchant Solutions, there aren’t many independent reviews for those companies. We’ll start off with a Capital Merchant Solutions review section for the company as a whole.

Capital Merchant Solutions Reviews from Customers

On its website, Take Cards Today/Capital Merchant Solutions includes a section of testimonials. Each review includes the customer’s full name and business name. Reviewers praise the company for top-notch customer service, smooth processing, reasonable rates, PCI compliance, and quick answers to questions.

Capital Merchant Solutions Reviews with the Better Business Bureau

CMS has an A+ rating with the BBB, where it has been accredited since 2004. The company has only received one complaint, which isn’t enough to identify a pattern of problems. The complaint alleged that CMS fraudulently receives kickbacks from illegal termination fees.

Ripoff Report and Capital Merchant Solutions

To contrast the A+ Better Business Bureau rating, there are 9 reports for CMS in the Ripoff Report directory. Reviews complain that Capital Merchant Solutions is a fraud, engages in deceptive tactics or outright lies, has hidden fees, freezes accounts without warning, and takes money from accounts without authorization.

Okay, now let’s dig in to each of the CMS websites. Remember, while each of these “companies” has its own website, they’re all Capital Merchant Solutions.

- FreeAuthNet Review

- Take Cards Today Review (CMS Review)

- Holy Processing Review

- Rate Checkup Review

- ProcessAway Review

- Firearm Payments Review

- Conclusion

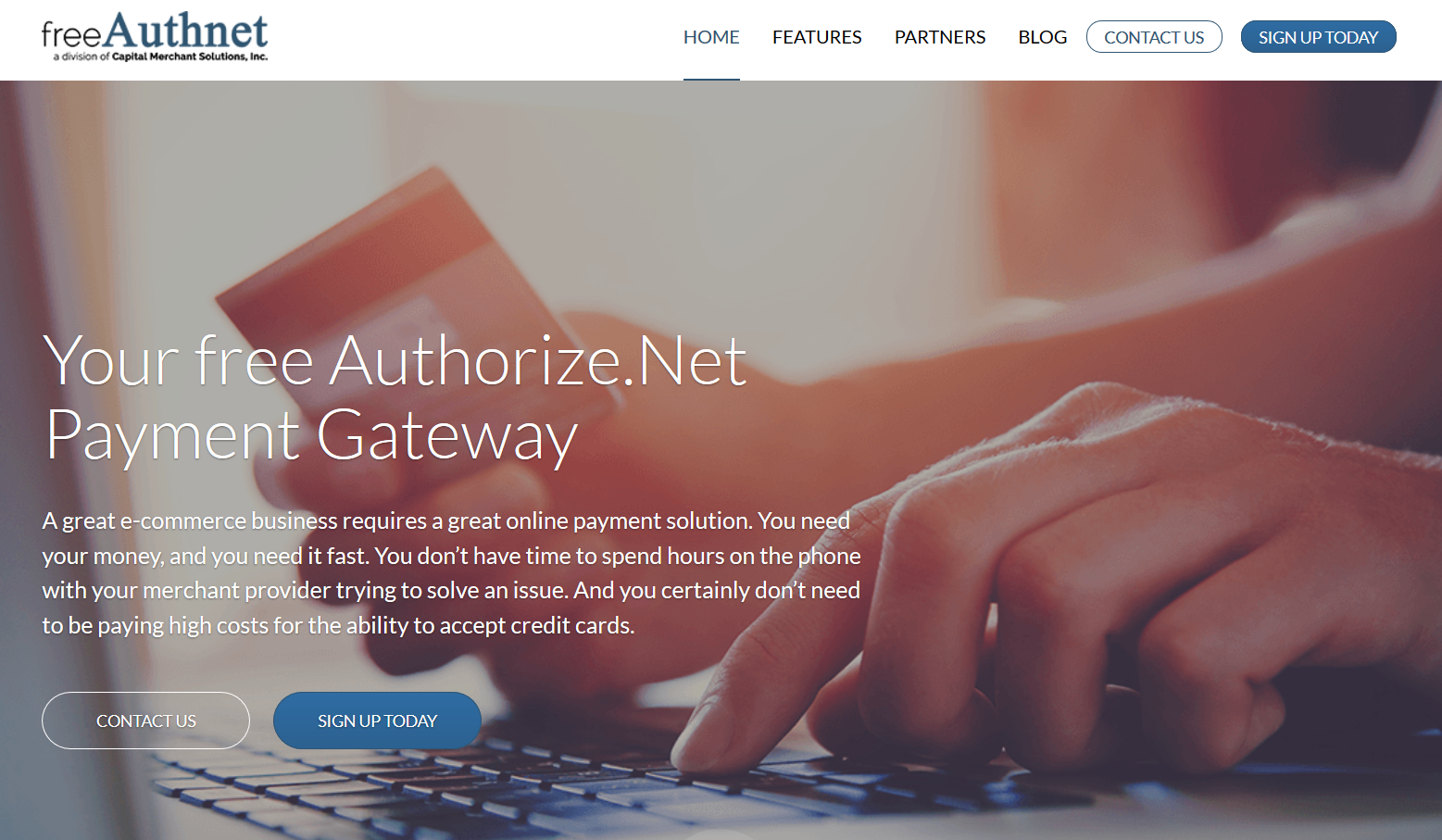

FreeAuthNet Review

From the name, you’d assume that you’re signing up for a free Authorize.Net account, right? Well, not exactly. Freeauthnet.com is a site owned and operated by Capital Merchant Solutions, which is not Authorize.Net. In my opinion, it’s a bit misleading to title the site “FreeAuthNet.” However, multiple companies “resell” Authorize.Net services (like the popular gateway) including Capital Merchant Solutions, so that part isn’t a problem.

As mentioned in the introduction, Capital Merchant Solutions is known for creating multiple websites targeting specific industries or aspects of processing. For this one, what they’ve done is make the Authorize.Net gateway the centerpiece of their credit card processing solution, and included the cost of the gateway in their published pricing. So, the gateway isn’t “free” but the cost is bundled into the rest of your costs to accept credit cards. Make sense?

Related Article: What to Look for When Choosing a Payment Gateway.

If you’re looking for the Authnet gateway, let’s take a look at what those costs actually are, as well as what FreeAuthNet offers, via Capital Merchant Solutions.

Is FreeAuthNet really free?

No. Nothing in the world of credit card processing is free, and that includes taking credit cards through FreeAuthNet/Capital Merchant Solutions. The Authnet gateway costs are bundled into the overall costs to accept credit cards.

FreeAuthNet Costs

The company publishes interchange+ pricing of $35/month with a $0.25 fee per transaction. You’ll also be charged interchange and a markup of what we hope is supposed to be .20%. (It’s listed on FreeAuth’s site at 20%, as shown in the screenshot below. We’re hoping that was a simple missed decimal point.)

Beyond that pricing, FreeAuthNet claims no annual fees, no monthly gateway fees, no PCI fees, no application fees, and no monthly minimums.

Related Article: What is Interchange Plus Pricing?

Authorize.Net Gateway Features

The Authorize.Net gateway option available through FreeAuthNet/Capital Merchant Solutions includes the regular Authorize.Net gateway features, including recurring billing, a virtual terminal, reporting, and integrations.

Recurring Billing

Businesses that take payments on a recurring basis (like gyms and membership businesses, monthly “clubs”, etc.) can use the recurring billing option to automate payment acceptance. You can set up multiple pricing plans and add or change customers as needed.

Virtual Terminal

Ideal for businesses that take credit cards over the phone or just don’t need fancy equipment, a virtual terminal gives you access to a secure web portal to enter credit card details directly through your computer. Since it’s internet-based, you don’t have to install or update any software, and for safety reasons, payment information isn’t stored on your computer.

Reporting

Detailed reports help you make smart business decisions, reconcile payments, and more. With the Authorize.Net gateway, you can create reports, search transactions, and download details for further review. You can sort by a number of variables, like date, card number, customer name, and more.

Integrations

Authorize.Net is one of the most popular gateways available, and as such supports a lot of integrations. An API is available, as are pre-made third-party shopping carts, mobile apps, and point of sale options. Additionally, you can integrate your sales and processing data with QuickBooks.

FreeAuthNet Reviews from Clients

On its website, FreeAuthNet includes 3 testimonials. Reviewers primarily focus on the company’s customer service, which they say is excellent. Reviews include the client’s full name, title, and company. Other reviews are not readily available online. We’ll discuss Capital Merchant Solutions reviews and reputation overall in the Take Cards Today section, as that is the company’s primary website.

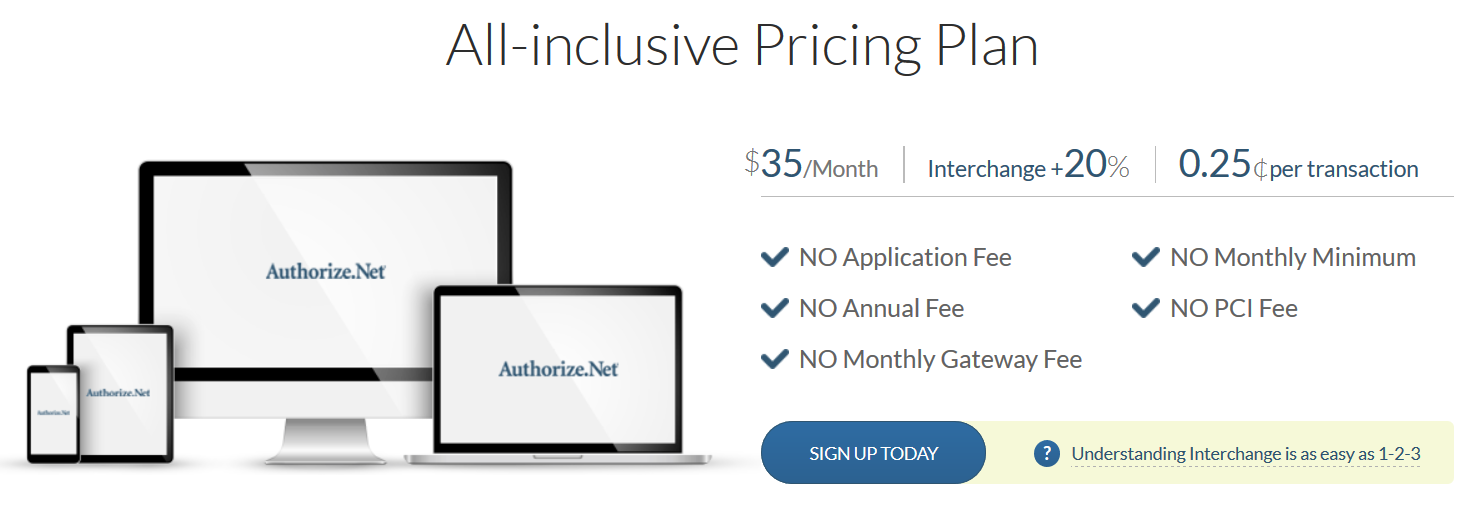

Take Cards Today Review

As the main site for Capital Merchant Solutions, Take Cards Today doesn’t provide as much information as you might expect. The company mentions that processing services are available using traditional credit card processing equipment, mobile devices, or through the internet.

CMS also says that you can take electronic checks, collect invoice payments, and process ACH transfers.

Pricing

Capital Merchant Solutions publishes a somewhat misleading table, comparing their pricing to what it calls “industry average.” However, pricing for credit card processing is set individually for each business, so this table serves no real purpose other than to make CMS look better. For this reason, we’re going to ignore the “industry average” since it’s not accurate, and just focus on what CMS claims for pricing.

TakeCardsToday.com claims no setup, application, programming, or customer service fees. It lists the following pricing:

- Discount Rate for ecommerce transactions: 2.04%

- Discount Rate for swiped transactions: 1.69%

- Authorization fee: 24 cents

- Statement Fee: $8.95

- Internet Gateway Fee: $13.99

- Those last two fees are monthly, while the authorization fee is applied to every transaction.

There is also an important disclaimer on the site, under the pricing table. It says that the rates and fees published aren’t meant to be inclusive of all fees, and that additional costs may apply to “certain transaction types.”

I’d strongly recommend getting a complete cost breakdown. You can request one from Capital Merchant Solutions right here through CardFellow if you’d like to just see the costs without high-pressure sales tactics and marketing spin. It’s free and there’s no obligation.

Just complete this simple form to get started.

Take Cards Today’s website also states that contracts are month-to-month with no early termination fees.

Equipment

CMS offers free equipment (either a terminal or a card reader) from a limited selection, or you can choose other terminals. The Take Cards Today website lists the following choices for free machines:

- Verifone Vx 510LE

- Hypercom T7Plus

- Nurit 2085

- WaySystems MTT 1581

The company also lists the following compatible terminal options, which are not included free:

- Verifone Vx 570

- Hypercom T4220

Related Article: Are free credit card machines really free?

Holy Processing Review

In case the name didn’t give it away, Holy Processing is targeted toward religious institutions, but also to members of churches that own businesses, as an affiliate partnership. (CMS as Holy Processing sends monthly checks to the church that refers members to them for processing.)

If you’re a church or other religious organization, Holy Processing suggests that you can automate the tithing process by setting up recurring billing to collect tithes. You can also choose to refer members who have their own businesses to Holy Processing, and collect a commission for the referral.

Holy Processing (through Capital Merchant Solutions) allows for credit card processing through traditional terminals or a virtual terminal (computer with secure internet form to enter card information) for either one-time or recurring/subscription payments. While the company can work with popular payment gateways like Authorize.Net, it heavily pushes its own partner gateway, DowCommerce.

Despite the focus on helping churches, the website lists some potentially problematic things you should be aware of, like expensive equipment leases, and no apparent discount for non-profit organizations, which is a cost-saving method available through many other processors.

Rates and Fees

Holy Processing publishes rates and fees that are almost exactly the same as Take Cards Today. The company claims:

- Discount rate for swiped transactions: 1.65%

- Discount rate for internet transactions: 2.04%

- Authorization fee: 23 cents

- Statement fee: $8.95

These are not necessarily all the rates and fees that you can expect to pay. It’s also worth noting that this does not seem to reflect a discount for 501(c)3 non-profit organizations. If your church is a registered non-profit, it’s likely that you can receive lower costs by working with a credit card processor who can help set up non-profits.

Related article: Credit Card Processing for Non-Profit Organizations.

Holy Processing Equipment

As with the other Capital Merchant Solutions ‘companies’, Holy Processing offers “free” equipment. However, the free terminal available is a Nurit 2085, a model that has been discontinued by the manufacturer as it doesn’t comply with all current regulations.

Other terminals are available for sale or for lease, including the Nurit 8000S. The company lists pricing of $899, which appears well over the costs listed for the same machine from other sources. It is available for lease at $39.95/month, with no indication of the length of the lease term. Since many leases are for 4 years, that terminal would end up costing just over $1,900.

The Nurit 8000S is also a wireless terminal, and Holy Processing mentions a wireless fee of $19.95/month that is not disclosed on the pricing page.

Related article: Is leasing a credit card machine the worst decision you can make?

Rate Checkup Review

Keeping with its theme of names that match the industry it’s targeting, Rate Checkup is primarily geared toward doctors, dentists, and other medical professionals. On this site, Capital Merchant Solutions employs an old-favorite: offering money if they can’t beat your rates. It’s such a common practice that we actually have an article about it, here.

On this site, CMS pushes its rate analysis (your ‘checkup’) service to see how much you could be saving. As with most CMS services, almost every processor offers a rate analysis. But CMS has chosen to make it the centerpiece of Rate Checkup.

The company details its service in a 4-step plan named for phases of medical diagnosing.

- Step 1 is the “rate checkup,” where your processing will be analyzed.

- Step 2 is the “follow up visit,” where sales reps will call you to discuss your “diagnosis” (results of the rate checkup) and advise you on the “treatment plan” that will best fit your “condition.”

- Step 3 is the “treatment plan,” which is when you switch to Capital Merchant Solutions.

- Step 4 is the “complete recovery,” which is when CMS says your processing costs will return to full health.

The Frequently Asked Questions section also continues the doctor theme, with questions like, “Will getting my rate checkup cause any side effects or discomfort?” that are more cutesy answers than detailed information about savings.

RateCheckup offers no pricing information at all, no details about contracts or termination fees, and no information about equipment.

Statement analyses can be a great idea, but in some cases they’re easy to manipulate. If possible, try for a rate analysis from an independent company – that is, one that isn’t a processor trying to sell you on their services.

ProcessAway Review

ProcessAway is the Capital Merchant Solutions website for taking credit cards on the go. (Processing away from a storefront.) It’s geared towards businesses that may prefer to take credit cards in different locations, such as clients’ homes or offices, tradeshows, fairs, and more.

This site offers more information about the services than RateCheckup, at least giving details on the equipment available and some details about pricing.

ProcessAway Equipment

Since the point of ProcessAway is to set you up with a merchant account for taking credit cards on the road, the available equipment is wireless. The company lists an iPhone card swiper, a Way Systems 1581 machine, and a Nurit 8020 terminal. CMS states that the terminals are available for no or low cost.

The iPhone option is subject to special iPhone Merchant Account pricing, included in the rates and fees section below. At the time of publication, it does not appear that ProcessAway has options for Android smartphone processing.

Rates and Fees

ProcessAway discloses rates and fees on its website, including a “Qualified Discount Rate” of 1.69%. This indicates a tiered pricing model, which is prohibited here at CardFellow. In addition to the qualified rate, CMS states there will be a $20 wireless network fee, an $8.95 monthly statement fee, and a per-transaction fee of 24 cents.

Additionally, the iPhone special pricing includes a $24.95/month fee.

Since ProcessAway utilizes a tiered pricing model, you may see more expensive “non-qualified” rates for some transactions. CMS specifies on the pricing page that the rates and fees published are not all inclusive.

Firearm Payments Review

And finally, we have Firearm Payments. Of all the Capital Merchant Solutions “companies” this website provides the least information. That’s a little odd, considering firearm sales do have some differences from other types of payment processing.

Perhaps most notably, CMS doesn’t publish any rate or fee information on the Firearm Payments website. Gun sales are considered “high risk” in the credit card processing industry, and as such you can expect to pay higher fees than other types of businesses. The company offers no further details except to say that it offers “competitive” rates.

You’ll have the option to take payments in all the usual ways – in person, online, or using your smartphone, which can be helpful for taking payments away from the store, such as at a gun show.

We’d love to tell you more, but there isn’t a whole lot to say from the website. Firearm Payments offers reporting, QuickBooks integration, and multiple user capabilities. The company does not list any endorsements from gun rights groups like the NRA, which some other processors do.

Related Article: Credit Card Processing for Firearms Businesses.

Conclusion

While Capital Merchant Solutions tries hard to make it seem like they’re offering services unique to different businesses, there really isn’t anything that other processors can’t offer. The automatic tithing program for Holy Processing is simply a recurring billing option, which can be set up with almost any processor. FreeAuthNet isn’t free, and Authorize.Net accounts can be secured through a bunch of other channels. ProcessAway’s entire point is to offer payments on the go – that’s a feature now available from almost every company, in part due to the popularity of smartphone readers like Square and PayPal Here.

The only “company” that is different is Firearm Payments. Since firearms are considered a “high-risk” industry, not all processors support firearm dealers. However, there are still options for gun sale credit card processors, including well-known companies like TSYS.

When it comes down to it, all of these features and services are available with other processors, showing that Capital Merchant Solutions’ multiple websites and names are primarily a marketing ploy. That’s not to fault CMS – they’re trying to get business, like any processor. However, it’s always worth your time to compare pricing, as there may be lower cost options that suit your needs.

But you don’t have to take my word for it – you can easily compare the total costs for as many processors as you’d like using a simple quote comparison tool. It’s free, private, and no-obligation, so it doesn’t hurt to look. See quotes instantly by filling out this simple form: Credit card processing quote check.