Visa began charging an acquirer processing fee (APF) on July 1, 2009 on all authorizations acquired in the United States. The acquirer processing fee is a flat transaction fee.

The Acquirer Processing Fee is sometimes called the Visa Authorziation Processing Fee.

Note that Visa charges a separate acquirer processing fee for debit and credit card transactions. The APF for credit card transactions is $0.0195, and the APF for debit card transactions is $0.0155. For debit, the APF only applies to signature-based debit authorizations, not PIN debit transactions.

- Visa Assessment Fees

- Acquirer Processing Fee

- Locating the Fee on Your Statements

- How to Reduce Costs to Accept Visa

Visa Assessment Fees

Visa sets assessment fees. They’re separate from interchange (which goes to the banks that issue credit cards to consumers) and markup (which goes to the credit card processor that facilitates the transaction.)

Visa imposes several assessment fees that you’ll pay (through your processor) when you accept Visa cards. Multiple assessment fees can apply to one transaction. However, assessment fees are typically among the smallest fees you’ll incur.

Acquirer Processing Fee

The Visa Acquirer Processing Fee applies to US-based credit card authorizations that are acquired in the United States. (Regardless of where the cardholder or card issuer is located.) Basically, if your business is in the United States, the fee will apply to your Visa credit card authorizations. The acquirer processing fee is kept by Visa and generates roughly $500 million in annual revenue.

Visa added its acquirer processing fees shortly after going public, and many industry experts feel confident that the fee was imposed in response to shareholder demand for increased revenue.

Unlike MasterCard’s network access and brand usage (NABU) fee, Visa’s acquirer fee is charged on all authorized transaction regardless of whether the transaction is actually settled.

As of 2018, Visa sets the fee at $0.0195 for credit authorizations and $0.0155 for debit authorizations. Fees are subject to change at Visa’s discretion.

Locating the Fee on Your Statements

If you’re on interchange plus or tiered pricing, you’ll usually be able to locate the APF under your Visa assessment charges. (In some cases, a processor may lump the fee in with other charges. If that’s the case, you will not see the fee listed separately by name.) Keep in mind that different processors may refer to the fee by different names.

Businesses on a tiered pricing model may or may not benefit from the lower APF for debit card transactions. While the difference isn’t huge, if you take a lot of debit it can add up over time. Whether you pay true cost or an inflated assessment rate depends on how your processor passes costs to you.

For the most transparency and possibility of lowest costs, consider an interchange plus pricing model.

Read more about credit card processing pricing models.

Statement References

The acquirer processing fee is referred to by processors in several different ways on processing statements. Some of the common references are:

- ACQR Processor Fee

- Network Access Fee

Examples

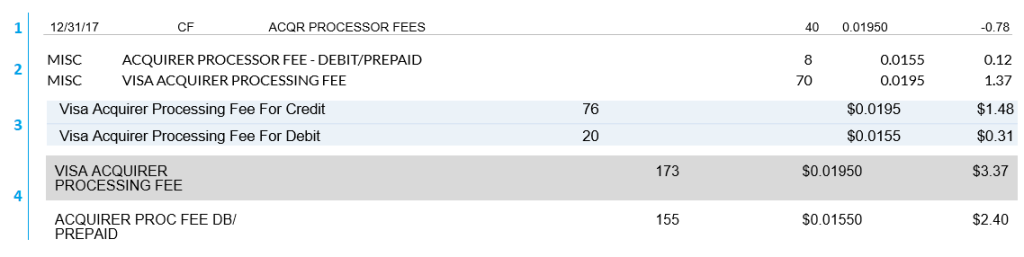

Below are some examples of how the fee appears on credit card processing statements.

In the first example, the processor abbreviate the fee as “ACQR Processor Fees” and only shows one rate – 0.0195. Either the processor has lumped together credit and debit, or the business only had Visa credit transactions.

The second, third, and fourth examples all show two distinct acquirer fees – one for debit (or prepaid) cards and one for credit cards. In those cases, you can see that the processors list the $0.0195 fee for credit and the $0.0155 fee for debit, indicating they’re passing the fees at cost.

If you wanted to further check the costs, you could do the math. In these examples, the processor includs the number of transactions to which the fee applies. The processor also includes the total charge.

For example, if we do the math for example 2 for credit, we see that there were 70 transactions. 70 * 0.0195 = 1.365, which rounds to 1.37. Indeed, the processor charged $1.37. You can do the math on your own statements to determine if you’re paying assessments at cost.

CardFellow clients won’t need to check assessments – we’ll do it for you. As part of our statement audit service, we check to ensure you’re not paying more than you should be. Furthermore, our legal agreement with processors requires that they pass assessments (including the Acquirer Processing Fee) to you at cost.

How to Reduce Costs to Accept Visa

If you’re looking to pay less to accept Visa cards at your business, the first thing to do is ensure you’re paying a competitive markup.

As we detail in our complete guide to credit card processing, there are three components of processing cost: interchange, assessments, and processor markup. Interchange and assessments are the same for every processor. For that reason, you can think of them as the “wholesale” cost of processing. Processor’s markup is what you pay over wholesale, or over cost. The closer you pay to wholesale, the better.

The trick is to find (and keep) a low processor markup. How do you do that? The easiest way is to use a price comparison tool, like the one CardFellow offers. It’s free, takes two minutes, and lets you see all costs from multiple processors in an apples to apples format.