It isn’t necessary to have intimate knowledge of the inner-workings of the bankcard system in order to find the best credit card processor. But, it’s a good idea to have a general understanding of how credit card processing works because fees are incurred at various stages of the system.

Knowing the lay of the land will help you better identify how to get the best processing solution. Once you’re done reading this article, check out our more detailed breakdown of where credit card processing fees come from.

For now, let’s dive in to how credit card processing works.

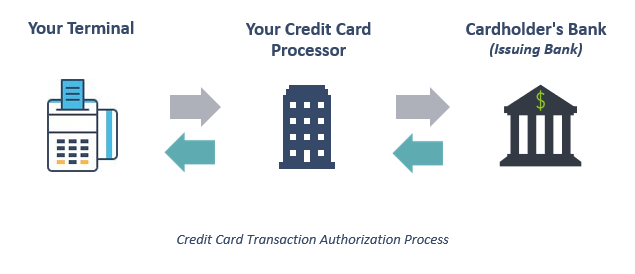

The bankcard networks that ferry billions of transactions between merchants (businesses), processors and banks are truly modern marvels. In just a matter of seconds, your terminal passes transaction information to a processor, and then through the card network to the issuing bank for approval. The issuing bank then sends an authorization back through the card network to your processor before it finally ends up back at your terminal or software.

As involved as the system sounds, obtaining an authorization for a transaction is just the first step. Authorizations must be settled before sales can be deposited into you business’s bank account. Credit card transactions happen in a two-stage process consisting of authorization and settlement. This is important because different fees are incurred at each stage, and a failure (or partial failure) in either step can result in increased costs and/or credit card sales not being deposited.

As involved as the system sounds, obtaining an authorization for a transaction is just the first step. Authorizations must be settled before sales can be deposited into you business’s bank account. Credit card transactions happen in a two-stage process consisting of authorization and settlement. This is important because different fees are incurred at each stage, and a failure (or partial failure) in either step can result in increased costs and/or credit card sales not being deposited.

How Credit Card Processing Works: Key Players

The key players involved in authorization and settlement are the cardholder, the merchant (that is, the business accepting the card), the acquiring bank (the business’s bank), the issuing bank (the cardholder’s bank), and the card associations (Visa and Mastercard.)

Cardholder

If you have a credit or debit card (as most of us do), you’re already familiar with the role of the cardholder. But just to be thorough — a cardholder is someone who obtains a bankcard (credit or debit) from a card issuing bank. They then present that card at a business to pay for goods or services.

Merchant

Technically, a merchant is any business that sells goods or services. But, only merchants that accept cards as a form of payment are pertinent to our explanation. So with that said, a merchant is any business that maintains a merchant account that enables them to accept credit or debit cards as payment from customers (cardholders) for goods or services provided. You as a business owner are a merchant. A common misconception is that the merchant is the processor. It comes from confusion around the term merchant services. But what that really means is services provided to you, a merchant.

Acquiring Bank (Merchant’s Bank)

An acquiring bank is a registered member of the card associations (Visa and Mastercard). An acquiring bank is often referred to as a merchant bank because they contract with merchants (businesses) to create and maintain accounts (called merchant accounts) that allow that business to accept credit and debit cards. Acquiring banks provide merchants with equipment and software to accept cards and handle customer service and other necessary aspects involved in card acceptance. The acquiring bank also deposits funds from credit card sales into a merchant’s account.

Interestingly enough, many merchants don’t recognize their acquiring bank as the primary provider of their merchant account. Acquiring banks are playing an increasingly hands-off role as the bankcard system evolves. Acquiring banks often enlist the help of third-party independent sales organizations (ISO) and membership service providers (MSP) to conduct and monitor the day-to-day activities of their merchant accounts.

Issuing Bank (Cardholder Bank)

As you’ve probably guessed, an issuing bank issues credit cards to consumers. The issuing bank is also a member of the card associations (Visa and Mastercard).

Issuing banks pay acquiring banks for purchases that their cardholders make. It is then the cardholder’s responsibility to repay their issuing bank under the terms of their credit card agreement.

Card Associations (Visa and Mastercard)

Visa and Mastercard aren’t banks and they don’t issue credit cards or merchant accounts. Instead, they act as a custodian and clearing house for their respective card brand. They also function as the governing body of a community of financial institutions, ISOs and MSPs that work together in association to support credit card processing and electronic payments. Hence the name, “card associations.”

The primary responsibilities of the Card Association are to govern the members of their associations, including interchange fees and qualification guidelines, act as the arbiter between issuing and acquiring banks, maintain and improve the card network and their brand, and, of course, make a profit. That last one has become even more important now that Visa and Mastercard are public companies.

Visa uses their VisaNet network to transmit data between association members, and Mastercard uses their Banknet network.

Credit Card Authorization

In the authorization process, all of the parties noted above play a role.

Cardholder

A cardholder begins a credit card transaction by presenting his or her card to a merchant as payment for goods or services.

Merchant

The merchant uses their credit card machine, software, or gateway to transmit the cardholder’s information and the details of the transaction to their acquiring bank, or the bank’s processor.

Acquirer / Processor

The acquiring bank (or its processor) captures the transaction information and routes it through the appropriate card network to the cardholder’s issuing bank for approval.

Visa / Mastercard Network

Mastercard transaction information is routed between issuing and acquiring banks through Mastercard’s Banknet network. Visa transactions are routed through Visa’s VisaNet network.

Issuer

The credit card issuer receives the transaction information from the acquiring bank (or its processor) through Banknet or VisaNet and responds by approving or declining the transaction after checking to ensure, among other things, that the transaction information is valid, the cardholder has sufficient balance to make the purchase and that the account is in good standing.

Visa / Mastercard Network

The card issuer sends a response code back through the appropriate network to the acquiring bank (or its processor).

Merchant

The response code reaches the merchant’s terminal, software or gateway and is stored in a batch file awaiting settlement.

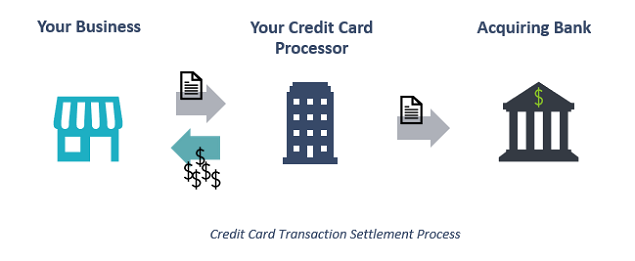

Credit Card Clearing and Settlement

The second part of how credit card transactions work is clearing and settlement. This occurs after the authorization process takes place. For settlement, the merchant (that’s you) sends a “batch” of authorizations to your processor, typically once per day. The processor reconciles the authorizations and submits the batch over the card association networks. The processor also deposits the funds from those sales into the business’s bank account and deducts processing fees. At that point, the business’s role is complete.

The issuing and acquiring banks continue to communicate and move money (with the issuing bank paying the acquiring bank for the cardholders’ purchases) and the cardholder eventually pays the issuing bank. Neither of those steps involves your business.

The issuing and acquiring banks continue to communicate and move money (with the issuing bank paying the acquiring bank for the cardholders’ purchases) and the cardholder eventually pays the issuing bank. Neither of those steps involves your business.

Merchant

A merchant(business) begins the settlement process by sending a batch of approved authorizations to their acquiring bank (or the bank’s processor). Authorization batches are typically sent at the close of each business day. Multiple individual credit card transactions make up a batch.

Acquirer

The acquiring bank (or its processor) reconciles and transmits the batch of authorizations through interchange via the appropriate card association’s network (VisaNet or Banknet).

The acquiring bank also deposits funds from sales into the merchant’s bank account via the automated clearinghouse (ACH) and debits the merchant’s account for processing fees either monthly, daily, or both depending on the merchant’s processing agreement.

Card Network

The card association debits the issuing bank’s account and credits the acquiring bank’s account for the net amount of the authorizations which is gross receipts less interchange and network fees.

Issuer

The card issuing bank essentially pays the acquiring bank for its cardholder’s purchases.

Cardholder

The cardholder is responsible for repaying his or her issuing bank for the purchase and any accrued interest and fees associate with the card agreement.

Funding and Fees

In the explanation of settlement and clearing above, I noted that the processor will deposits the funds from your credit card sales into your business bank account and deduct processing fees. However, there are some variations on exactly how fees are deducted, and when funds are deposited.

Credit Card Deposits

These days, most processors offer next day funding, meaning that you’ll receive money for today’s credit card transactions tomorrow. The caveat is that you must “batch” your transactions by a specific cutoff time in order to receive the funds the next day. If you miss the cutoff, you won’t receive funds until the second business day.

In some cases, processors may hold your funds if they suspect fraud or otherwise determine that a transaction is too risky. In those cases, you will not immediately see the funds.

Credit Card Fee Deductions – Discounting

There are two primary methods that processors use to deduct credit card fees from your transactions. The methods are called daily or monthly discounting.

Daily discounting involves the processor deducting processing fees each day, before depositing your funds. This means that you receive the net sale amount, or the amount after fees. With monthly discounting, the processor deducts processing fees for an entire month’s transactions once per month but deposits funds daily. This means that you receive the gross sale amount, or amount before fees, each day.

There are pros and cons to both methods, and many processors let you choose which discounting timeframe you’d like. You can read more in our post on daily vs. monthly discounting to help determine which method is right for your business.

The amount of processing fees you’ll owe varies depending on a number of factors, including the processor you use, the pricing model you’re on, and your processor’s markup. If you need help securing low cost processing with great service, join CardFellow’s wholesale credit card processing club. You shop the same processors but with better terms and better member rates. Best of all, membership is free! Join here.