Hidden surcharges, fine print and tiered pricing combine to make Intuit Merchant Services one of the most expensive, opaque credit card processing solutions on the market today.

Intuit markets its credit card processing services under a few different brands such as Intuit Payment Solutions, Innovative Merchant Solutions, QuickBooks Payments, and GoPayment. Whatever it’s called, Intuit Payment Solutions is an expensive way to process credit cards.

In this article, we’ll look at Intuit’s current fee structure and how to determine if you’re overpaying.

Note: This article contains information about pricing practices Intuit has used in the past. In some cases, businesses may still see that type of pricing. We’re leaving that information in this article both for businesses that are on that pricing and to keep a record of Intuit’s processing history. However, Intuit also has newer, more transparent processing solutions.

- Intuit Payment Solutions

- Current Intuit Payment Solutions Costs

- Intuit Statements

- Other Possible Intuit Rates & Fees

- QuickBooks Credit Card Processing

Intuit Payment Solutions

Sometimes called QuickBooks Payments, Intuit Payment Solutions offers credit card processing services to businesses. Processing is available with QuickBooks or independent from it. It’s not necessary to use QuickBooks to use Intuit Payment Solutions / QuickBooks payments. However, if you want to use Intuit Payment Solutions without using QuickBooks, you’ll be limited to accepting payments through the GoPayment smartphone readers. While in the past, Intuit offered merchant accounts compatible with universal credit card machines (such as the Verifone Vx520) the company confirmed via livechat that such machines are not compatible and that the only non-QuickBooks option is GoPayment.

In any case, many businesses that use Intuit for processing also have QuickBooks. The reason is that the two systems integrate seamlessly.

However, it’s worth noting that in the past several years, more processors have begun offering services to integrate with QuickBooks. Some processing companies offer “plugins” to easily integrate data. Others provide a simple export/import solution.

Intuit Payment Solutions includes options for taking cards in person, on the go, and online. (You can accept payments online through invoicing or with compatible ecommerce store systems.)

Current Intuit Payment Solutions Costs

While it’s possible to use Intuit Payment Solutions independent of QuickBooks, it’s limited to GoPayment and it’s not something the company pushes. If you contact Intuit about it, you can expect to hear a sales pitch about the ease and low cost of using QuickBooks.

As such, they don’t publish the rates for non-QuickBooks merchant accounts on their website. Instead, the company lists pricing according to the type of QuickBooks software you use (Online or Desktop versions, including Premier and Pro.)

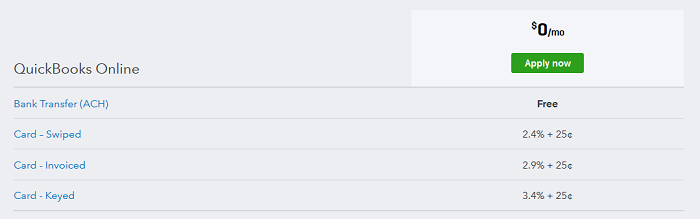

QuickBooks Online Credit Card Processing Costs

If you use QuickBooks Online and want to accept credit cards through Intuit, you’ll only have one pricing option: pay-as-you-go.

As you can see from the screenshot above, pay-as-you-go pricing using QuickBooks Online has no monthly fee, and -per-transaction fees that vary depending on how you accept the card. Swiped cards will cost you 2.4% + 25 cents per transaction while invoicing will cost you 2.9% + 25 cents per transaction. Keyed cards are the most expensive. Expect to pay 3.4% + 25 cents per transaction.

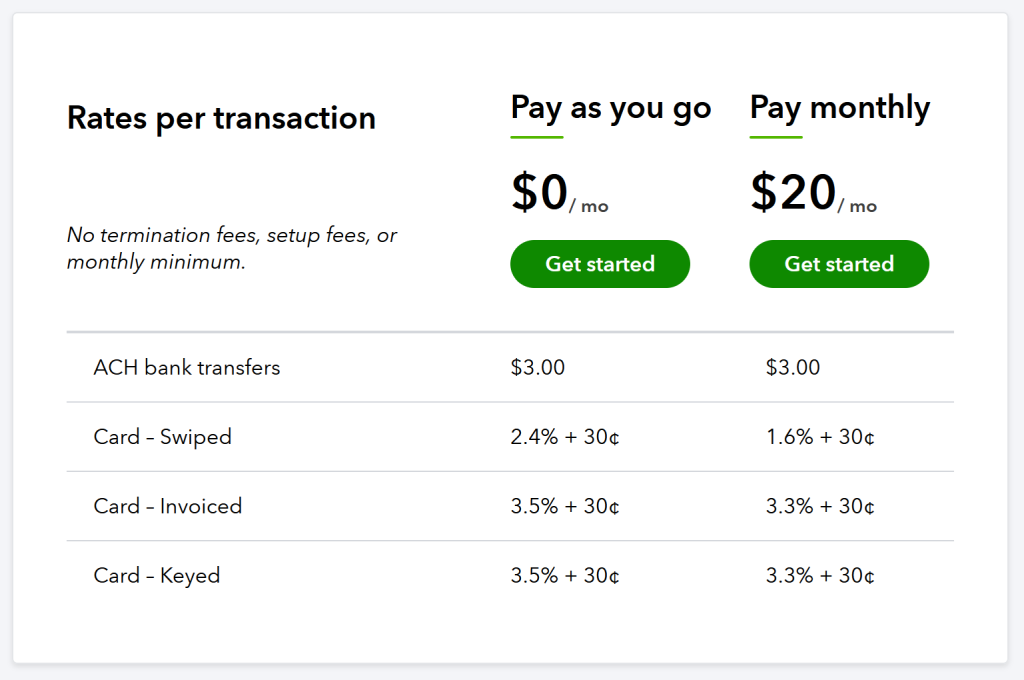

QuickBooks Desktop Credit Card Processing Costs

You have two options with QuickBooks desktop credit card processing. The first is a pay-as-you-go option with no monthly fee, and the second is a monthly plan. The monthly plan includes a $20/month cost in addition to per-transaction fees.

The screenshot above shows the published pricing. For pay-as-you-go, expect to pay 2.4% + 30 cents per transaction for swiped cards, and 3.5% + 30 cents for invoiced or keyed cards.

For the monthly plan, expect to pay 1.6% + 30 cents for swiped cards, and 3.3% + 30 cents for invoiced or keyed cards.

Interestingly, QuickBooks’ merchant services website still lists references to “qualified” and “non-qualified” transactions, referring to tiered pricing. That’s the ‘old’ Intuit model, and what we’ll discuss in the next few sections of this article.

Intuit Statements

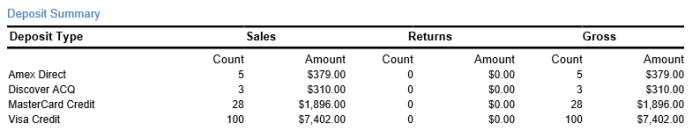

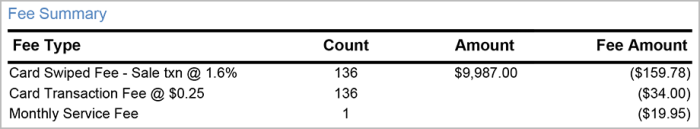

Along with the new Intuit pricing come new Intuit statements. Unfortunately, while they look simpler, they offer almost no helpful information.

As you can see from this snippet, Intuit doesn’t include any details about the interchange categories / types of cards accepted beyond breaking them down by card brand. That makes it difficult to determine if you’re getting a good deal or an expensive deal, as you can’t tell what portion is wholesale cost and what is Intuit’s markup.

Intuit does list the rate and transaction fee it charges, along with how many transactions were processed, but taht’s about it.

When looking for competitive pricing, it’s important to be able to determine the processor’s markup. Without that, you don’t know if you’re paying close to wholesale cost or a lot more than wholesale.

————————————————-

The remainder of this article provides information on other forms of pricing that Intuit has used in the past. This information may no longer apply to new Intuit Payment Solutions merchant accounts. However, we’re leaving it here both for historical record of Intuit’s pricing practices and for any businesses that are still on this pricing.

Other Possible Intuit Rates & Fees

Historically, Intuit has employed tiered pricing, hidden fees, and excessive surcharging to significantly increase its customers’ credit card processing fees.

Concealing True Cost

Intuit uses something called tiered pricing to bill its customers for credit card processing services. Tiered pricing makes it possible for Intuit to completely conceal the rate that Visa and MasterCard charge for a credit card processing transaction behind its own set of rates.

The result is that Intuit’s customers are never shown the actual cost of a transaction, and therefore, they can’t calculate Intuit’s markup. That makes it very difficult to determine if the business is being charged fairly or overpaying.

The Shell Game

To make matters worse, tiered pricing allows Intuit to play a shell game with customers’ rates through something called inconsistent buckets. Banks charge all credit card processors the same interchange fees to process various credit card transactions. Some processors pass these fees directly to businesses using interchange plus pricing, while other processors, like Intuit, funnel the banks’ fees through their own rates.

This allows processors like Intuit to entice customers with bait-and-switch tactics by offering a low rate that only applies to a very limited number of transactions. All transactions that Intuit does not consider “qualified” for the low rate are routed to a much higher “mid-qualified” or “non-qualified” rate.

Intuit abbreviates these surcharge rate categories on merchant statements as MQUAL for mid-qualified surcharge transactions, and NQUAL as non-qualified transactions.

The screenshot below is taken from the statement of an actual Intuit customer and shows the shell game at work. You will notice that the lowest rate on the statement is 2.48% (shown as .0248), but most of this customer’s volume was charged at a rate of 3.62% (shown as .0362).

Intuit considered only about 21% of this customer’s total volume as qualified, and 80% of its volume was surcharged.

This type of pricing is misleading at best, and enables hidden credit card fees in the form of non-qualified surcharges. Take a look at CardFellow’s credit card processing guide to learn more about how credit card processors like Intuit use tiered pricing to manipulate pricing.

The Fine Print

It takes reading the fine print carefully to get an accurate picture of the costs associated with Intuit Merchant Services.

The screen shot below was taken directly from Intuit’s Web site. The pricing table looks simple enough, but the asterisk following the sentence in the upper right-hand corner that that says, “All transaction fees included” suggests exactly the opposite is true.

A scroll to the bottom of the page reveals a link that says, “*Important Disclosures,” and when clicked, drops down a series of five bullet points. The second, third and fifth bullet points change pricing substantially, and they are outlined below for clarity.

Point #2: Bait-And-Switch in Action

The second bullet point in Intuit’s fine print says:

Card-swiped rate applies to qualified swiped Visa/MC/Discover network transactions and requires the GoPayment card reader. Most rewards, corporate and special card types are considered non-qualified transactions and merchants will be charged the key entered rate.

In other words, the 1.64% rate shown in the table above only applies to a very small number of swiped transactions. All other transactions will be charged at the 2.47% rate.

Point #3: Adding Hidden Fees

The third bullet point in the fine print actually adds a completely new rate that is not disclosed in the pricing table.

“Key-Entered Rate” will be charged on all qualified manually keyed Visa/MC/Discover Network transactions that have verified addresses. All Visa/MC/Discover network transactions that do not meet the requirements for card-swiped and/or key entered rates will be charged a non-qualified rate of 3.91%.

In other words, Intuit Merchant Services will charge a rate of 3.91% for all transactions that don’t meet its criteria for the 1.64% or 2.47% rate categories. However, the qualification criteria for each rate category are not specifically defined.

Point #5: Adding Even More Hidden Fees

The fifth bullet point in the fine print adds an annual PCI fee that is also not disclosed in the pricing table.

Credit card companies require merchants to be PCI compliant in order to meet the minimum data security standards designed to protect customer card information. The PCI Compliance fee … is based on the estimated number of transactions per year, and will be charged annually beginning in the 4th month of service: $35 for 1-24 transactions, $50 for 25-99 transactions, or $100 for 100+ transactions. Different fees may apply to merchants who process in excess of 20,000 transactions per year.

Along with a hidden 3.91% rate, Intuit Merchant Services also charges a hidden annual PCI.

QuickBooks Credit Card Processing

Intuit’s popular QuickBooks accounting software is what causes many businesses to begin utilizing Intuit merchant services. It doesn’t take long before these businesses realize that the convenience of QuickBooks often comes with a hefty price tag.

Software applications, called Quickbooks plugins, exist that allow credit card processors other than Intuit to integrate with various versions of Quickbooks. These plugins allows businesses to enjoy the convenience that QuickBooks provides without having to utilize Intuit’s costly merchant services.

We’ve compiled a list of some of the most popular universal plugins, along with details about how they work and their costs. You can check that out in the section of our guide to QuickBooks credit card processing about QuickBooks plugins.

CardFellow has helped hundreds of businesses switch from Intuit credit card processing to a processor with far more competitive pricing, and in almost all cases, businesses are able to continue using QuickBooks to process credit cards. Sign up for free today at CardFellow to get instant competitive quotes from multiple credit card processors.

I want to use cc processing with my qb pro accounting software. I also want to use it with my quickbooks p.o.s. Intuit rates are too high. other cc processing doesn’t integrate with my pos.

Hi Chris,

Processors here in CardFellow’s marketplace are capable of integrating with most Quickbooks applications, including Quickbooks POS for Windows. You can sign up for free to receive free quotes.