Restaurants notoriously operate on thin margins, so ensuring that you’re not overpaying for credit card processing can help your bottom line.

Restaurant owners are in a great position to secure low cost credit card processing. Lower “risk” swiped transactions, low chargebacks, and the popularity of going out to eat make processors eager to sign restaurants as clients.

At CardFellow, we help restaurant owners and managers find the right fit. Whether you need particular POS features, lower cost than you currently pay, or someone to keep an eye on your rates and fees, we can help. If you’d prefer to do it yourself, this article will teach you what you need to know to find a great processing solution.

Or you can save yourself time by signing up for a free CardFellow membership to get exclusive low cost pricing with our rate guard protection. Get a free membership!

How can restaurants take credit cards?

We’ll cover credit card processing for restaurants in-depth in this article, but if you’re new to taking cards, here are some basics on how it works.

You’ll choose a credit card processing company, who will handle your card payments. It is not possible to accept credit cards without a credit card processor.

The processor will require you to fill out an application and may perform a credit check (if you’re a new business) or request previous processing statements (if you’re an established business.)*

You’ll purchase compatible processing equipment (which you can get from the credit card processing company) or ask the processor to reprogram your current equipment. Note that not all equipment can be reprogrammed.

You’ll also need to provide your business bank account information. The bank account is needed so that your processor can deposit the funds from your card transactions and so they can deduct processing fees.

Your processor will send your equipment ready to use (or work with you to reprogram your current equipment) and you can begin accepting cards. It typically takes 1-3 business days to receive funds from card transactions. These days, many processors offer next day funding, but some companies charge an extra fee for it.

* Note that you should not give out processing statements until you have a price quote in writing. Otherwise the processor can easily manipulate pricing to make any deal look better than your current pricing, even if it isn’t. Keep your current rates to yourself when shopping for better deals.

So, how much will it cost to take credit cards?

Restaurant Credit Card Processing Rates

Unfortunately, there isn’t one simple answer to the question, “How much do restaurants pay in credit card fees?” Your average transaction size and average monthly volume pay a big role in the answer, and the type of restaurant you run in turn plays a big role in those numbers. After all, a fine dining establishment will have higher average checks than a fast casual sandwich shop.

Your average transaction size and monthly volume will also guide you to the most competitive pricing model. The merchant account type you choose – whether tiered, flat rate, or interchange plus – will set the stage for your pricing. Let’s take a look at how these variables factor in to your costs. You can also jump to the end of the article to see a rough guideline for costs to accept credit cards at a restaurant.

Merchant Account Types for Restaurants

Restaurants have no shortage of choices when it comes to merchant accounts. You’ll find processors that offer every type of pricing model, including tiered (or “bundled”) pricing, flat rate, and interchange plus or pass-through pricing.

In many cases, you’ll have a choice of pricing model because you can find a processor that uses the pricing type you want. However, if you choose a particular POS system that locks you in to specific processors, you won’t have as much of a choice when it comes to pricing. We’ll discuss this in the section on POS systems later in this article.

For now, let’s go over the pricing options.

Tiered Pricing

Identifiable by the presence of “qualified” and “non-qualified” transactions, tiered pricing is an opaque and expensive option. What happens is the processor creates “tiers” with rates associated. It’s common to see three tiers (called qualified, mid-qualified, and non-qualified) but a processor can use more or fewer if they like.

The processor then decides which of your transaction it will charge according to which tier. While it’s common for sales reps to tell you that they’ll consider most transactions “qualified,” in reality, they will end up classing a lot of your transactions as mid-qualified or non-qualified. Additionally, the processor can change the criteria for qualified and non-qualified transactions at any time. The result is unpredictable, expensive pricing for you.

Bottom line: There are multiple processors that offer tiered pricing and you’ll have a choice of equipment. But when looking for the best processing solution, tiered pricing is not in your best interest. CardFellow does not permit tiered pricing for certified quotes in our marketplace due to its opacity and the likelihood of overcharging.

Flat Rate

Technically a form of tiered pricing, flat rate is not as onerous as tiered pricing that uses “qualified” distinctions. Instead, flat rate simply offers what its name implies – a flat rate for transactions, regardless of the card type.

You’ve probably heard of companies like Square. That’s an example of flat rate pricing. The company’s original 2.75% for all swiped cards remains the same no matter what type of card you accept. There are no “qualified” and “non-qualified” transactions.

Instead, Square and other flat rate companies set their rates high enough to make money. Unfortunately, in most cases, this type of pricing is more expensive for you as the restaurant owner. Since the costs of credit card processing fluctuate, and Square has to pay those fluctuations, they need to set their own rates high enough to cover your most expensive transactions. Not every card you take will be the most expensive card to process, but Square will always charge you as if it is.

Instead, Square and other flat rate companies set their rates high enough to make money. Unfortunately, in most cases, this type of pricing is more expensive for you as the restaurant owner. Since the costs of credit card processing fluctuate, and Square has to pay those fluctuations, they need to set their own rates high enough to cover your most expensive transactions. Not every card you take will be the most expensive card to process, but Square will always charge you as if it is.

However, there are two primary times when flat rate is a good idea:

1. You sign up for a 2.75% flat rate that has no cents-based fee AND your average transaction is under $10 OR you only accept a few thousand dollars per month in credit cards.

Up until recently, Square only offered a 2.75% rate without cents fees. However, it has since rolled out pricing plans of 2.65% + 10 cents per transaction for restaurants using the Square for Restaurants application. This pricing is not as beneficial as the former percentage-only rate.

2. You want simplicity, even if it costs more.

Some businesses prefer the simple look of flat rate pricing. They want to see just the rate that they paid, and what the fees were. For some businesses, it makes sense to pay more for simplicity. Just remember that “simple” is not automatically equal to “low cost.”

Bottom line: Flat rate isn’t automatically a bad idea, but unless you fit a specific business profile, it’s not the lowest cost option. Additionally, you’re limited in equipment choices with flat rate processors. CardFellow does not currently permit flat rate pricing for certified quotes in our marketplace, but we will advise restaurant owners if flat rate is lower cost or a better fit.

Interchange Plus

Interchange plus looks the most complicated, which puts off some business owners. However, if low cost is your goal and you don’t have small average tickets, interchange plus is the way to go.

With interchange plus (also sometimes called “pass-through”), the processor charges you the cost of processing your transactions, plus a small markup. The result is that when you process cards that cost less, you pay less. The processor’s markup rate is fixed, but the “wholesale” cost of the transactions fluctuates by card type. There are two keys to getting a competitive interchange plus solution:

1. Work with a processor that charges you the true cost of processing your transactions, without “padding” the numbers.

Interchange plus by itself doesn’t guarantee that a processor will pass along the true cost, so you need to ensure that you’re not overcharged at that level. Note that CardFellow requires processors in our marketplace to pass the true cost to you, without padding. We also monitor your statements to ensure that you aren’t overcharged.

2. Secure a low markup over the wholesale cost.

The lower the markup, the less you’ll pay overall. Markups include both the fixed rate (usually a percentage and a cents-based fee, such as 0.20% + 10 cents) and any monthly fees or other processor-imposed fees.

Bottom line: Interchange plus has the potential to be the lowest cost solution while still providing a wide choice of equipment and features. The downside is that it looks more complex, which can be daunting. However, at CardFellow, we’ll keep an eye on your statements for you, so you don’t have to worry about your processing costs. CardFellow requires interchange plus pricing for certified quotes in our marketplace due to its transparency and the potential for low costs.

Restaurant Types

As noted above, the type of restaurant you run will play a role in which merchant account will be the best fit. Let’s take a look at several common types of restaurants to get an idea of the rates and fees you can expect and which pricing model to look for.

Fine Dining and Sit-Down Restaurants

Full service sit down restaurants typically have higher average checks than fast casual and other types of food service businesses. Aside from entrees themselves costing more, these restaurants often sell alcohol, which increases the check size. Appetizers and desserts round out the order, further increasing the total.

Fine dining restaurants are in a great position to secure competitive pricing without scrimping on features or customer service.

Look for: Interchange plus pricing. Full service restaurants almost never have checks under $10, which is the rough cutoff for when flat rate makes more sense. Interchange plus gives you the greatest negotiating power and the widest choice of POS systems / processing equipment, which makes it easier to get the right solution.

Bars and Pubs

Like full serve restaurants, bars and pubs typically have larger average checks. (Alcohol adds up fast!) For establishments that have a heavy alcohol sales component, the right equipment often matters as much or more than cost. Bars look for the ability to manage customer tabs, set happy hour pricing to kick in automatically, and provide drink recipes right on the POS system. Fortunately, there are plenty of POS systems with those capabilities.

Look for: Interchange plus pricing. Patrons of bars and clubs typically run up bills more than $10, so flat rate is not likely to be a low cost option. You’ll also have more choice when it comes to POS systems, so you can find the solution with the features you want.

Quick Serve

The tricky thing for quick serve restaurants (QSRs) is that most straddle the line where flat rate becomes more expensive than interchange plus. That means that for some QSRs, flat rate will be the lowest cost, while for others it will be interchange plus.

There’s no hard and fast rule, but for a rough guideline, if you have an average transaction under $10, flat rate will be lower cost. However, that does somewhat limit your equipment options, so be sure the systems you’re considering have all the features you want.

Look for: Interchange plus pricing if your average transaction is larger than $10 and you process more than $5,000/month in cards. Otherwise, if your average transaction is on the lower side (under $10) or you process under $5,000/month, flat rate.

Bakeries and Cafes

Similar to QSRs, bakeries and cafes could find interchange plus or flat rate to be the lowest cost, depending on the specifics of the business. In many cases, flat rate will be the lowest cost, as a lot of bakeries and cafes have average transactions under $10.

An exception is commercial bakeries or specialty bakeries that sell higher cost items, like wedding cakes. If your orders regularly exceed $10, interchange plus pricing will be a better fit. That will also be true if you take a lot of business credit cards.

Look for: Flat rate if your average transaction is under $10 or you accept $5,000 or less in cards per month. Otherwise, look for interchange plus pricing.

Franchises

In many cases, franchisees are not given a choice for payment processing. If the franchisor requires a particular processing company or POS system, you’ll have to use that. However, if you have the flexibility to choose your own, the same criteria apply for the restaurant types noted above. Meaning, if your average transaction is on the smaller side or if you only accept a few thousand dollars per month in cards, flat rate will be lower cost. If those criteria don’t apply, interchange plus will be cheaper.

If you’re the franchisor, you can negotiate low pricing on behalf of your franchisees. CardFellow can help you negotiate competitive franchise pricing. Give us a call at (800) 509-4220 for assistance.

POS Systems for Restaurants

Many restaurant owners approach POS systems backwards. Unless you need a very specific feature, you should secure your credit card processor first and then choose from their supported POS systems. When you choose a processor first, you have competitive advantage. You can compare pricing from multiple different companies.

When you choose a POS system first, you’re limited to the company (or companies) that support that system. In some cases, it may not be a big deal. There are universal POS systems, like NCR Silver, that still allow you a choice of processors. However, many systems are locked in to one or a few credit card processing companies. That severely restricts your competitive leverage. These proprietary POS systems allow processors to charge you more, because there is no competition. Proprietary systems include flat rate solutions like Square as well as companies like Harbortouch.

When you choose a POS system first, you’re limited to the company (or companies) that support that system. In some cases, it may not be a big deal. There are universal POS systems, like NCR Silver, that still allow you a choice of processors. However, many systems are locked in to one or a few credit card processing companies. That severely restricts your competitive leverage. These proprietary POS systems allow processors to charge you more, because there is no competition. Proprietary systems include flat rate solutions like Square as well as companies like Harbortouch.

These days, most POS systems offer the functions that restaurants need and want, and most processors support multiple POS systems. You’ll be able to choose the one that suits your needs.

Restaurant POS Costs

POS systems can be expensive, but the arrival of tablet-based systems means that businesses with smaller budgets can still find a good system with plenty of features. The cost of a POS system spans a wide range. Some basic tablet systems are only a few hundred dollars, while more complex installations or multi-system setups can run into the tens of thousands.

Many restaurants settle somewhere in the middle, opting for systems that start around $1,000, such as Clover Stations and Vital Pro. You can purchase POS systems from the processor you choose or you can confirm compatibility with the processor and then purchase elsewhere.

At CardFellow, processors sell systems at or near cost, helping eliminate the need to shop externally for the best deal.

POS Features

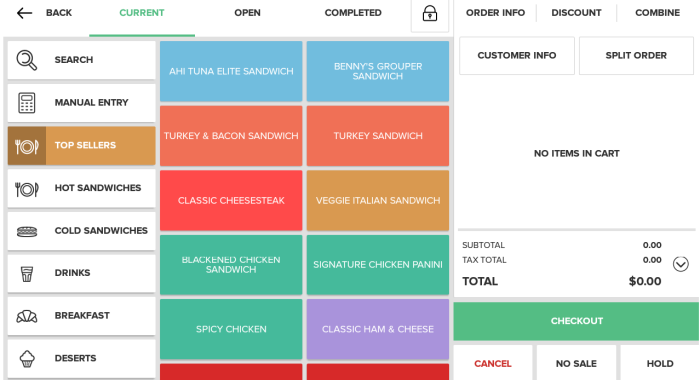

Fortunately, many POS systems offer features that restaurants need. Systems that market to restaurants typically offer functions such as customized table layouts, check splitting, bar tabs, item menu modifiers, and more. Some systems also include delivery modules. Most systems these days offer touchscreen order entry with either color coded items or pictures of dishes for fast entry. For example, in the image below, the Vital POS entry screen has been color coded by a primary ingredient. Chicken dishes are in green, turkey in dark orange, and fish in blue.

The items are also available by categories. As you can see, the left side menu offers categories that include hot and cold sandwiches, drinks, breakfast, and desserts.

If you’d like more visual options, there are systems that allow you to upload pictures of each dish so staff can scan the menu entry screen by name and image for accuracy. The Rezku POS system, pictured below, offers that type of visual order entry.

No matter what system you go with, you’ll have the ability to add accessories. You can connect kitchen printers or kitchen displays, cash drawers, weight scales, and more. You’ll just need to ensure that you’re purchasing compatible accessories.

Equipment is an important enough decision that we’ve dedicated an article to the topic. Check out our POS Systems for Restaurants article for more details.

Restaurant POS Systems and EMV Chip Cards

An important thing to know is that even with “universal” POS systems that allow you to use any processor, you may need to use a particular processor if you want to take EMV chip cards through the POS system.

For example, Revel works with Freedompay for EMV, while Lavu uses Econduit. Be sure to confirm with the POS company or your credit card processor what you’ll need to do if you want to securely accept chip cards using a chip reader.

Alternatives to Integrated EMV

If you don’t use the required processor for integrated EMV chip card acceptance, it doesn’t mean you can’t take chip cards. It just means that you’ll either need to swipe them as magstripe (which is less secure and may not be recommended) or connect a countertop credit card reader to use for chip card transactions.

GrubHub and Delivery Apps for Restaurants

As delivery apps like Grubhub catch on, more owners wonder if it makes sense for their business. Is Grubhub really worth it for restaurants?

On the one hand, partnering with a company like Grubhub removes the hassles of hiring a dedicated delivery driver and managing delivery in-house. However, it does come at a price. Some restaurants feel that Grubhub and similar apps’ costs are too steep to be worthwhile.

We’ve taken a closer look at the pros and cons of restaurant delivery apps in these articles:

- Uber Eats for Restaurants

- Should you use DoorDash for your restaurant?

- The Complete Guide to Grubhub for Restaurants

Gratuities and Credit Cards

There are a few ways that gratuities impact restaurants when it comes to credit card processing. There are legal questions (such as whether you can deduct processing fees from tipped employees) and procedure questions (such as how gratuities paid by credit card can affect your restaurant.)

Can restaurants take credit card fees from servers?

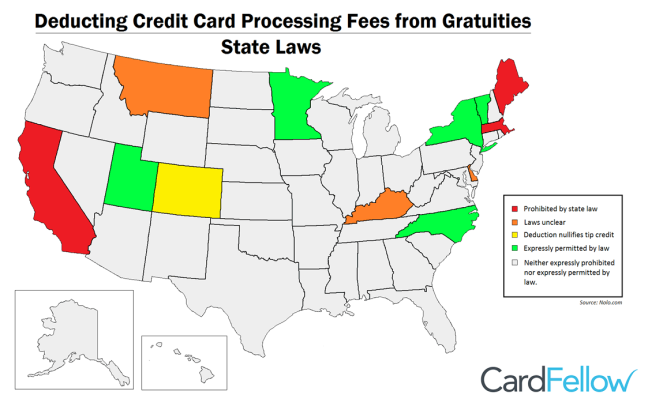

Most states allow you to deduct processing fees from servers’ tips, but there are some that prohibit it, and others where the laws are unclear. Even where allowed, you’ll need to ensure that you’re properly deducting fees by following the Department of Labor rules.

Restaurants are prohibited from deducting processing fees from servers in the following states:

- California

- Maine

- Massachusetts

The laws are unclear in the following states:

- Kentucky

- Montana

Processing fee deductions are expressly permitted in the following states:

- Colorado*

- Minnesota

- New York

- North Carolina

- Utah

- Vermont

*Allows fee deductions, but it nullifies the tip credit.

All other states neither expressly permit nor expressly forbid taking processing fees out of servers’ tips prior to paying out the tip. State laws are subject to change.

If you choose to deduct fees, you can only deduct the percentage of the fee that applied to the tip. You cannot deduct the entire processing fee from the server’s tip. For example, say the bill is $100 and the customer tips $20, bringing the total to $120. Let’s say your restaurant pays 3% for credit card processing. Your total cost to process the transaction is $3.60. (120 x 0.03.) The $20 tip accounts for $0.60 cents of that processing fee. (20 x 0.03.) You can only deduct 60 cents from your employee’s tip.

Full details are available in our article Can Employers Legally Deduct Processing Fees from Employees’ Tips? or you can consult your attorney.

Gratuities Paid by Credit Card

A lesser known issue is that large gratuities can trigger fraud flags, even in cases where the tip is legitimate. That can result in an issuer-initiated chargeback (less likely) or a processing fee downgrade (more likely.)

Issuer-initiated chargebacks are what they sound like – the bank that issued the card will initiate a chargeback for the transaction. In these cases, the customer does not initiate the chargeback. However, you’ll have the option to fight the chargeback the same as you would with a customer-initiated dispute. Fortunately, issuer-initiated chargebacks aren’t very common.

The more common problem with large credit card tips comes in the form of “downgrades” that affect your processing fees. Tips over 20% can cause your transactions to fall into a more expensive “catch all” processing category. Sometimes it’s unavoidable, as many restaurants don’t want to discourage customers from tipping. But if you start seeing a lot of downgrades, it’s worth revisiting.

Read more about How Tips Paid by Credit Card Could Affect Your Restaurant, including how to spot downgrades.

Merchant Account Rates for Restaurants

Now that you’ve got the background on credit card processing for restaurants, what can you expect to pay? If you read this whole article (I know, it was a long one!) you know that the numbers will vary. For a very rough guideline:

Expect to pay around 2.75% if you use a flat rate processor such as Square. (This is the best bet for QSRs, cafes, and food service businesses with low average tickets or low monthly volume.)

Expect to pay rates starting around 1.9% if you secure competitive interchange plus pricing with higher average transactions and monthly volume. The key word there is “competitive.” Not all interchange plus processors will be low cost. If you need assistance finding and evaluating low cost quotes, CardFellow can help.

Ready to see rates tailored to your restaurant? Use CardFellow’s free quote comparison tool. You’ll get instant quotes from multiple processors to review in private. It’s fast, free, and no obligation. Additionally, CardFellow processing experts are on hand to help walk you through the numbers and determine what will make the most sense for your restaurant.