Both new and seasoned business owners may come across confusing terms when it comes to credit card processing. One such term is “merchant services.”

It seems to include a lot of different things, so what is “merchant services” or “merchant processing?”

If you’re starting a business or looking to get better rates on credit card processing at your existing business, it’s a good idea to understand what’s involved in merchant services and how to choose the right provider.

Let’s take a look at merchant services, providers, costs, and making the right choice for your business.

- What is merchant services?

- Merchant Service Providers

- Merchant Accounts

- Processing Equipment

- How much do merchant services cost?

- How to Choose a Merchant Service Provider

What is merchant services?

Merchant services refers to the ability to take credit cards at a business. You, the business, are the “merchant.” The company you work with to accept credit cards may be called the merchant service provider, the credit card processor, or variations of those terms. (Such as simply “processor” or “provider.”)

There are three basic components of “merchant services”:

- The merchant service provider (credit card processing company)

- A merchant account or payment account

- Processing equipment

However, the second two are directly related to the first in that they’re provided by the merchant services company.

The merchant service provider issues you a merchant account (or a payment account) to allow you to accept cards. They will sell, lease, or reprogram credit card processing equipment to enable you to accept cards. If you take payments online, the merchant service provider will work with you on setting up a gateway, hosted payment page, invoicing solution, or other method to take cards when your customers are the ones entering the card details.

We’ll look into each of these three components in greater depth in this article.

Related Services

In addition to the “core” merchant services of payment processing, some processors offer additional related services. This includes things like merchant cash advances (an alternative to small business loans where you “sell” a portion of your future card payment revenue for immediate cash), gift card programs, and marketing tools.

However, you don’t have to use those services to get a merchant account or accept credit cards.

Merchant Service Providers

As noted above, the merchant service provider (credit card processor) is a major component of merchant services. Within the broad category of “merchant services providers” are different types of providers. There are direct processors, also sometimes called backend processors or acquirers. There are independent sales organizations (ISOs), who act as “resellers” of the direct processors. Lastly, there are payment facilitators (payfacs), also sometimes called aggregators.

Related Article: Credit Card Processing Who’s Who.

However, any or all of those companies may be simply referred to as “credit card processors.”

Direct Processors

The direct processors are the ones that actually handle the transaction. There are only a handful of direct backend processors. Everyone else “resells” those companies’ services. Even if you don’t know which one it is, a direct processor is involved in your transaction processing.

The direct backend processors in the United States are:

- TSYS / TransFirst

- FiServ (formerly First Data)

- Elavon

- Chase Paymentech

- Global Payments / Heartland Payment Systems

- Worldpay / Vantiv / NPC

Companies with slashes indicate an acquisition or merged company. The company name listed first acquired the company listed after the slash. You may see either name, or a new name (such as Vantiv Integrated Payments) used.

Direct processors provide dedicated merchant accounts to businesses.

ISOs

Independent sales organizations (ISOs) are resellers for the direct processors. They process your transactions ‘through’ a direct processor. They’re not just a middleman, but it’s often easy to think of them in those terms. ISOs set your pricing, act as your first line of customer service, provide your monthly processing statements, and assist with issues such as PCI compliance and chargebacks.

There are hundreds of ISOs – too many to list here. CardFellow maintains a credit card processor directory where you can read about different ISOs and the services they offer.

ISOs provide dedicated merchant accounts to businesses.

PayFacs

A payment facilitator, or payfac, is different than direct processors and ISOs because they don’t issue you your own merchant account. Instead, they essentially “sublet” their own merchant account to you. Payfacs often boast the shortest setup time, usually letting you process immediately after signup with no wait.

Square and Stripe are two well-known payment facilitators.

Payfacs do not provide dedicated merchant accounts to each individual business.

Is a direct processor, ISO, or PayFac better?

Believe it or not, the status of the merchant services company isn’t a big factor in determining which company is the best credit card processor for small businesses.

Some businesses assume that they’ll get the lowest pricing by going directly to the backend processor, cutting out the ISO. In actuality, ISOs often quote just as competitively as direct processors. At CardFellow, we work with both direct processors and ISOs, and have seen competitive pricing from both.

There is one word of warning with payfacs. Because they don’t issue you a merchant account and instead process through theirs, they are sometimes more risk-averse, which can make it more likely that your account will be frozen or closed if you have any unusual activity.

Payfacs are a good choice for businesses with low monthly volume, small average tickets, or seasonal work. If those apply to you, a payfac is worth looking into. Otherwise, you’ll be better off (cost-wise and in terms of account stability) by working with an ISO or direct processor and receiving your own dedicated merchant account.

Merchant Accounts

Your merchant account is essentially a business line of credit that allows you to process payments. Unlike bank accounts, it’s not an account that you directly access. Instead, the payment processor will deposit the funds from your credit card transactions into a business bank account that you designate.

Like other lines of credit, a merchant account can have limits, rates, and rules about its use.

Processing Equipment

The last piece of merchant services is the processing equipment that enables actual card acceptance. For in-person (“card-present”) transactions, that will be a countertop terminal, POS system, or mobile card reader. When it comes to online (“card-not-present”) transactions, it will include a payment gateway plus either a shopping cart, buy button, hosted payment page, or invoicing option. For transactions where card details are given over the phone, it will require a virtual terminal.

We’ve covered these options in detail in our article on how to accept credit cards, so we won’t repeat it here. Just know that any method of taking cards will require equipment of some kind.

How much do merchant services cost?

Asking how much it will cost to take credit cards is a little bit like asking how much it costs to buy a car. There’s no single fixed cost for merchant services. It depends on a number of factors. In the case of merchant services, the variables that will impact cost the most include:

- Your industry

- Average transaction size (aka average ticket)

- Average monthly volume

- How you accept cards (swiped or online / keyed)

- The pricing model your merchant services provider uses

- The markup over wholesale cost

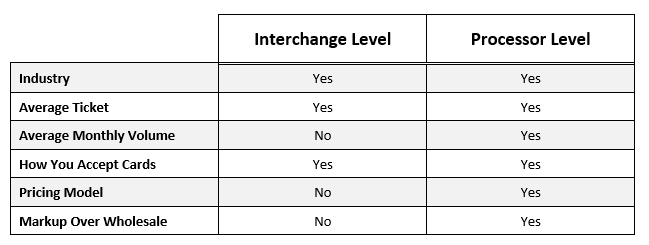

These variables can affect pricing at the interchange level, the processor level, or both. By the “interchange level” we mean that the variable affects your interchange (wholesale) costs. Interchange rates and fees are set by the banks that issue credit cards, and your processor has no control over them.

By the “processor level” we mean that the variable affects your processor’s markup, or what they quote in addition to wholesale interchange costs.

Here’s why these factors matter.

Industry

Your industry is a variable that may matter at the interchange level, the processor level, or neither – it depends on the actual industry.

At the interchange level, some industries have their own interchange rates. These include hotels / lodging, grocery stores, non-profits, educational institutions, and car rentals. If you don’t fall into one of those industries, these interchange categories won’t apply to you.

At the processor level, the provider takes into account the level of risk associated with an industry. Some industries are considered “higher risk” than other industries. It’s not because the business is doing something wrong or that the merchant services provider doesn’t like them. It just means that businesses in that industry typically pose more risk to the processor. That may be risk of losing money or risk of incurring fines or government scrutiny.

Businesses that are generally considered “high risk” include those with higher than average chargebacks, businesses that sell age-restricted items or items with varying state laws, certain industries with lots of international transactions, and businesses that operate in legal grey areas.

It often includes adult entertainment, travel, SaaS, subscription services that bill annually, tech support, smoke and vape shops, firearms, telemarketing, debt collection, nutraceuticals/herbal remedies, etc.

High risk merchant services come with higher processing costs and fewer options for processors. It’s still possible to get a good processing solution, you’ll just need to understand the specifics of high risk credit card processing.

If you don’t fall into a high risk category, your industry will not matter as much to the processor.

Average Ticket

Your average ticket (the size of the average sale at your business) matters at both the interchange level and processor level. Some transactions qualify for small ticket interchange, receiving different interchange rates than other transactions. That can lower your wholesale costs.

As far as processor’s markup, most of the time, you’ll see a percentage charge and a per-transaction fee, which is a flat, cents-based charge.

Businesses with smaller average tickets will want a merchant services provider that offers a lower per-transaction fee and a higher percentage charge. The reason is that flat, cents-based fees take a proportionally larger bite out of small transactions.

Average Ticket in Action

For example, let’s say that your average transaction is $5.00. Processor A offers you a rate of 0.45% and 6 cents per transaction. Processor B offers you a rate of 0.15% and 25 cents per transaction.

Despite the higher percentage fee, Processor A’s rate would only come to $0.0825 while Processor B’s would come to $0.2575. The 25 cent charge takes a bigger bite than the 6 cents per transaction, while the difference in percentages on the small dollar transaction doesn’t amount to much.

Businesses with average tickets of $10 or less will usually receive the lowest pricing by working with a flat rate payfac as long as that company doesn’t charge a cents-based transaction fee. For example, one of Square’s rates is 2.75% with no cents fee. If you’re on that pricing, you’ll often save money over a solution that charges a cents fee.

Average Monthly Volume

There’s no complicated industry secret behind why average monthly volume matters. A business that processes more credit cards makes more money for a processor. So when you’re processing higher volumes, a processor is more willing to negotiate with you on pricing to try to win your business.

Monthly volume matters at the processor level. It only involves interchange for the very largest corporations – that is, once a business processes millions of transactions.

How You Accept Cards

The methods that you use to take cards affect your merchant services pricing at both the interchange and processor levels.

Interchange is divided into multiple different categories, including debit, credit, and prepaid cards. It’s further divided by “card-present” and “card-not-present.” So a credit card swiped in-store will have different interchange (wholesale) costs than a credit card a customer enters online into your ecommerce website to make a purchase.

At the processor level, card-not-present transactions are ‘riskier’ and thus incur higher processor markups. Some processors may also charge for anti-fraud tools, like AVS.

The Pricing Model Your Processor Uses

The pricing model your processor uses affects your costs on the processor level. Some pricing models are easier to manipulate, leaving you overpaying without even realizing it. Some pricing models are a good deal for certain types of businesses (such as those with small average tickets) but would be very expensive for other businesses.

The model you want depends in part on your average ticket and your monthly volume.

Read more in our guide to credit card processing pricing models.

The Markup Over Wholesale Cost

A processor’s markup over wholesale (interchange) cost is also a processor-level factor. The markup is the only component of processing costs that your provider controls. If you don’t get a competitive, low markup, your total costs will be higher than they otherwise would be.

When looking for the lowest total cost, your goal is to negotiate the lowest markup over wholesale. That is, the lowest amount you’ll be charged on top of the non-negotiable costs of interchange.

How to Choose a Merchant Service Provider

Choosing a merchant service provider is a big decision. Picking the wrong company can leave you stuck in a 3-year (or longer!) contract and overpaying to take credit cards. When researching the right provider, it’s important to know what to look for and what to avoid.

Follow these steps to choose the right merchant services provider:

- Familiarize yourself with how credit card processing works.

CardFellow’s blog is full of helpful information that explains everything from rates and fees to pricing models. If you’re not sure where to begin, start with our comprehensive credit card processing guide. - Determine the right pricing model.

Is your average ticket $10 or less, or do you only accept a few thousand dollars per month in credit cards? If so, you should check out payment facilitators like Square. If not, competitive interchange plus pricing will be your best bet. - Compare markups.

Since interchange (wholesale) costs are the same from one processor to another, you can disregard it when looking for most competitive processing. The most competitive processor is the one that offers you the lowest markup over wholesale.

Need more help? CardFellow makes it easy to find the best credit card processing company for your business. We can help you take into account all the variables that affect cost, and then show you real quotes from multiple processors.

It’s free, no obligation, and private. (No sales calls!)

Give it a try by filling out our 2-minute business profile.

Need high risk merchant services, for adult entertainment, firearms, CBD, tech support, travel, or other high risk businesses? Use our high risk merchant account services form instead.