Some credit card processing fees are negotiable, and some aren’t. If you’re looking to lower credit card processing fee, put the spreadsheet aside for a moment and read this article before you call another processor to ask the fateful question, “What’s your rate?”

Before you can negotiate credit card processing fees, you have to know which fees are flexible. Credit card processing is like any other industry in that there are fixed costs and markups. Fixed costs are those that a processor can’t change, and markups are open to discussion.

Understanding the components of credit card processing cost is the first step toward negotiating competitive fees. The second step, as we will explain in a moment, is to negotiate pricing before negotiating fees. It may sound like the same thing, but there is an important difference.

Components of Credit Card Processing Cost

The three components of credit card processing cost are interchange fees, assessments and markups. Together, interchange and assessments make up the fixed costs, also sometimes called wholesale or base costs.

Interchange Fees (Not Negotiable)

The bulk of cost is interchange fees. Interchange fees remain the same no matter which credit card processor you choose and no processor can offer you lower interchange rates than another. These fees are charged by the banks that issue credit cards, and only the stakeholders of Visa, Mastercard and Discover (card-issuing banks) can update interchange.

Some processors conceal interchange costs through tiered or flat-rate pricing models, but don’t be fooled: interchange is always the basis of processing costs.

Assessments (Not Negotiable)

Visa, Mastercard and Discover charge various assessment fees when businesses accept one of their credit or debit cards. Like interchange, a business will pay the exact same assessment charges regardless of which credit card processor it uses. All processors pay the exact same assessment fees to Visa, MasterCard and Discover.

Markups (Negotiable)

For credit card processing savings, markup above interchange and assessments is the key. It’s the only area of credit card processing expense that you can negotiate. The processing markup includes the processor’s rates, credit card transaction fees, monthly fees, and any fees associated with software, gateways or processing equipment. That is, any fees that the processor can control.

The markup is where you want to focus your negotiating power because it’s the only area of expense you can change.

Distribution of Processing Cost

The goal when negotiating credit card processing fees is to get the markup portion of expense as low as possible in relation to fixed components of cost (interchange and assessments). A markup of 12% – 20% of the total cost of your processing is considered very competitive. For example, if your processing fees for the month are $100, your markup is competitive if $12 – $20 out of that $100 go to markup.

The graph below represents the distribution of credit card processing expense for a business that has competitive pricing. A cost distribution such as this is what businesses can expect to see with the instant quotes received through CardFellow.

As you can see, interchange fees that go to card-issuing banks account for the majority of charges, followed by the processor’s markup, and then assessments that go to the card brands (Visa, MasterCard and Discover).

Your goal is to negotiate processing fees so the distribution of cost looks similar to this graph.

The following graph represents the cost distribution of a business that does not have competitive credit card processing pricing. As you can see, the processing markup accounts for the majority of expense. Since markup is a negotiable area of cost, there’s a lot of room to cut costs. This business is paying too much in markup, since the negotiable component is at 52% of the total cost of processing.

This graph represents the typical cost distribution of a business before it uses CardFellow to lower its credit processing fees. Unlike the competitively priced business in the first graph, this business has a processing solution where negotiable markup is higher than non-negotiable interchange. The markup is nowhere near the 12% – 20% of the total that would indicate competitive pricing.

Using CardFellow to cut the markup will reduce the overall processing costs, resulting in lower overall processing fees.

Tips for Lowering Credit Card Processing Fees

Now that you know what’s negotiable and what’s fixed, you’ll have a better plan for lowering your processing fees. With that in mind, let’s take a look at how to approach negotiations with a processor. You’ll want to start off by negotiating the right pricing model before you even discuss rates and fees. From there, you’ll be able to talk markup numbers.

Negotiate Pricing First

Never start negotiations with a processor by focusing on rates and fees.

The first step to lower processing costs is to negotiate a favorable pricing model. There are several different pricing models when it comes to credit card processing, and the wrong one can set you up for expensive processing costs. Without the right pricing model, the rates and fees you negotiate can be manipulated and not result in the low costs you’d like.

Interchange Plus

Interchange plus or (interchange pass through) is the most competitive form of pricing, and it’s the one you want to secure. With an interchange pass through model, your processor will charge interchange and assessments and list them on your monthly statement. The processor will then add a small, separate markup, allowing you to more easily see what you’re paying over wholesale (interchange + assessments) costs.

Subscription or membership pricing is a form of interchange plus with another name. If you’re new to pricing models, be sure to check out the article linked above for a detailed explanation of the different types of pricing.

Tiered

Avoid “tiered” or “bundled” pricing models, which lump all of the costs together, making it difficult to see what you’re paying and difficult to get truly competitive pricing. Processors that use “qualified” and “non-qualified” rates are using a tiered pricing model in most cases. I say “most” because in recent years, Visa has started using a non-qualified description for some of its downgrades.

With tiered pricing, processors “bundle” together interchange and their markup, making it difficult to see what you’re paying over cost and to separate the processor’s markup. Additionally, the processors control which transactions are charged according to the different “tiers” and can can change it at any time. A card that is charged a low “qualified” rate one day may be charged a more expensive “non-qualified” rate the next time.

Trying to secure lower credit card processing fees while using a bundled pricing model is like playing whack-a-mole. As soon as you’ve negotiated a change in one place, a new fee or tier change pops up. Save yourself the time and frustration and avoid tiered pricing from the start.

If you’re already on tiered pricing, you can save on processing fees by switching to a competitive interchange plus processor.

Related Article: Stay Away from Tiered Merchant Accounts.

Negotiate the Rate Second

Once you’ve secured a pass-through pricing model, focus on negotiating rates and fees. In general, businesses with large average transaction sizes will want a smaller percentage markup even if it comes with a larger per-transaction fee. Businesses with small average transaction sizes will want a smaller per-transaction fee even if it includes a larger percentage markup. You can take the negotiating out of it by using CardFellow to secure the most competitive markup for your specific business type and transaction sizes.

Effective Rate

Even though markup is the only component that’s negotiable, keep in mind that the most important rate is the effective rate. The effective rate is a single number that represents the amount of processing volume paid in fees.

For example, a business that pays $20 in fees in a month where it processed $1,000 in credit card sales has an effective rate of 2.00%. Focusing on the effective rate ensure that you are negotiating for total cost, not an individual rate or fee.

It’s important to look at the effective rate because it will give you a clearer picture of your total costs. If you only focus on one component of cost, or one portion of the rates, you won’t have an accurate understanding of what you’ll actually pay in any given month.

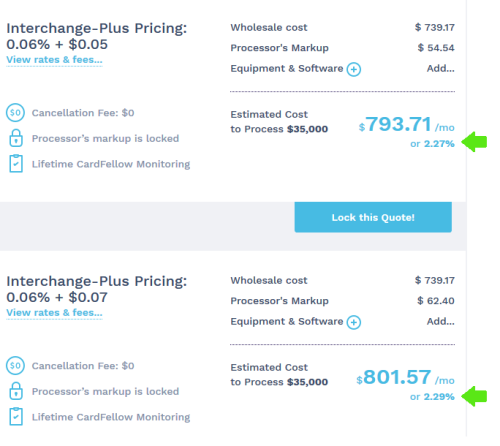

The effective rate of each quote that you receive through CardFellow is posted in the quote summary panel. This ensures that you can quickly and easily compare various offers. The screenshot below shows the quote panel in a CardFellow account. As you can see, we list not only the monthly cost in dollars, but the effective rate. For the example business below, the effective rate in one quote is 2.27%. Another company’s quote leads to an effective rate of 2.29%.

A detailed breakdown of the components of cost is also shown in the detail panel for each quote, but if you just want to glance quickly at the total cost differences between quotes you’ve received, the effective rate calculation will allow you to do that.

Did You Know?

You can request quotes from any processing company you’d like through your CardFellow account. While those quotes aren’t eligible for CardFellow protections (including a lifetime rate lock and no cancellation fee) it will allow you to more easily compare the overall costs, as quotes will be in the same format for a side by side, apples-to-apples comparison. Sign in to your CardFellow account or create one for free to use the quote comparison tools.