Visa’s Fixed Acquirer Network Fee (FANF), previously called the Network Participation Fee (NPF), is a monthly fee that affects all businesses to a varying degree.

Visa charges the Fixed Acquirer Network Fee, often abbreviated as FANF, for credit card acceptance. The fee went into effect in 2012, but has undergone several changes since then.

Unlike some other assessment fees, the FANF is not a set cost. It varies based on factors including processing method, sales volume, and number of business locations. In this article, we’ll cover when it applies and provide a table so you can quickly determine your cost.

- Fixed Acquirer Network Fee (FANF)

- FANF Costs

- Changes Over Time

- Identifying the FANF on Statements

- Lowering Costs

Fixed Acquirer Network Fee (FANF)

Effective April 1, 2012, Visa began charging a Fixed Acquirer Network Fee (FANF), which Visa previously called the Network Participation Fee (NPF). This monthly fee affects all business that take Visa cards. The only question is how much of an effect it has.

For “card present” businesses like retailers, the amount of the Fixed Acquirer Network Fee will be based primarily on the number of locations a business has. For “card not present” businesses like e-commerce websites, the FANF will be based on gross Visa processing volume.

Processors calculate FANF monthly, but will charge you quarterly for the previous calendar period. For example, the collection for the first quarter of 2012 will be in July 2012. As an assessment fee, the FANF is non-negotiable and remitted to Visa.

Fee Variables

The Fixed Acquirer Network Fee is a bit complicated because the amount of the fee varies depending on the following variables:

- Merchant Category Code (MCC)

The merchant category code used to classify a business plays a role in the amount of the FANF charged each month. However, the impact of the MCC is minimal, amounting to a difference of $0.90 – $1.10 for most businesses. (Those with less than 50 locations.) - Acceptance Method

The main factor in determining the amount of the FANF is whether a business processes the majority of its transactions in a card present or card not present environment. For businesses that have both, card-present and card-not-present FANF will both apply. - Card Present Businesses (Excluding Fast Food Restaurants / MCC 5814)

The amount of the Fixed Acquirer Network Fee for card present businesses will be based number of locations. Businesses with one location will be charged $2 – $2.90 a month, up to $85 a month for businesses with 4,000 or more locations. - Card-Not-Present Businesses (As well as Fast Food Restaurants / MCC 5814)

For card-not-present businesses, the amount of the FANF will be based on gross Visa processing volume. Card-not-present businesses will see a greater impact from the FANF than card-present businesses due to the fee being determined by volume.

For example, card-not-present business processing between $8,000 and $39,999 will be hit with a Fixed Acquirer Network Fee of $15 a month opposed to just $2 for a card present business with similar volume and one location.

Remember, if business accepts cards in both card-present and card-not-present methods, FANF fees apply to each method.

Exceptions

Visa will waive the FANF for charitable organizations classified under merchant category code 8398. Exactly how the fee will be waived isn’t quite clear, but indications are that Visa will charge the FANF and then provide a rebate at a later date.

Additionally, businesses with less than $200 of monthly volume will not be charged the fee.

FANF Costs

As noted above, there are two different ‘types’ of fixed acquirer network fees: ones for card present (swiped) transactions and ones for card not present (online or keyed) transactions.

Card Present FANF Rates

If you take “card-present” (swiped) payments, your FANF cost will depend on the number of locations you have and whether you’re considered a “high volume” industry.

The fee applies to each location, and goes up as the number of locations goes up. High volume businesses are determined by merchant category code (MCC) which is assigned to you when you open a merchant account.

Visa considers the following MCCs to be high volume for the purposes of the FANF:

- Airlines (3000-3299, 4511)

- Auto Rentals (3300 – 3499, 7512)

- Car and Truck Dealers (5511)

- Cruise Lines (4411)

- Department Stores (5311)

- Discount Stores (5310)

- Drugstores (5912)

- Electronics Stores (5732)

- Family Clothing stores (5651)

- Furniture Stores (5712)

- Grocery Stores and Supermarkets (5411)

- Lodging (3500-3999, 7011)

- Movie Theaters (7832)

- Service Stations / Automated Fuel Dispensers (5541, 5542)

- Stationary Stores (5943)

- Timeshares (7012)

- Tire Stores (5532)

- Warehouse Stores (5200, 5300)

- Wire Transfers / Money Orders (4829)

The following table shows the FANF costs for card-present businesses:

| Number of Locations | FANF Per Location | High Volume FANF Per Location* |

|---|---|---|

| 1-3 | $2.00 | $2.90 |

| 4-10 | $2.90 | $4.00 |

| 11-50 | $4.00 | $5.00 |

| 51-100 | $6.00 | $8.00 |

| 101-150 | $8.00 | $12.00 |

| 151-200 | $10.00 | $18.00 |

| 201-250 | $14.00 | $25.00 |

| 251-500 | $24.00 | $35.00 |

| 501-1,000 | $32.00 | $45.00 |

| 1,001 – 1,500 | $40.00 | $55.00 |

| 1,501 – 2,000 | $50.00 | $65.00 |

| 2,001 – 4,000 | $60.00 | $75.00 |

| 4,001 or more | $65.00 | $85.00 |

*Only applies to MCCs listed above.

If you have monthly sales volume under $200, FANF will not apply.

Businesses with monthly volume of $200 – $1,250 will pay a FANF of 0.15% of the total volume instead of a fixed dollar amount from the table.

Card Not Present FANF Rates

If you’re accepting “card-not-present” transactions (either online where a customer enters their card details themselves, or where you or staff key in the card details instead of swiping) you’ll pay card not present FANF rates.

Card-not-present FANF is determined by your monthly volume at the rates listed in this table:

| Monthly Volume | Monthly Fee |

|---|---|

| $1,250 – $3,999 | $7.00 |

| $4,000 – $7,999 | $9.00 |

| $8,000 – $39,999 | $15.00 |

| $40,000 – $199,999 | $45.00 |

| $200,000 – $799,999 | $160.00 |

| $800,000 – $1,999,999 | $450.00 |

| $2,000,000 – $3,999,999 | $1,000.00 |

| $4,000,000 – $7,999,999 | $2,000.00 |

| $8,000,000 – $19,999,999 | $4,000.00 |

| $20,000,000 – $39,999,999 | $8,000.00 |

| $40,000,000 – $79,999,999 | $16,000.00 |

| $80,000,000 – $399,999,999 | $45,000.00 |

| $400,000,000 or more | $70,000.00 |

As with card-present rates, if you have monthly sales volume under $200, the FANF will not apply.

If your volume is $200 – $1,249, you’ll pay 0.15% of the total volume instead of a set dollar amount.

What if my business has some card-present and some card-not-present?

In the event that some of your transactions are card present and some are card not present on the same merchant account, the card-present fees will still apply by location. The card-not-present fees will still apply by volume, but only the card-not-present transactions will be used to determine that volume.

For example, imagine you have a single location business that has 90% card-present transactions and 10% card-not present transactions. Your total sales volume is $100,000 in one month. You will be charged the card-not-present FANF rate for $10,000 of volume. (10% of $100,000.) You could expect to pay $15 in card not present FANF costs.

That would apply in addition to the $2 FANF rate for a single location. Therefore, you would pay $17 in total for this fee.

Changes Over Time

In April 2015, Visa announced several updates to the fixed acquirer network fee that makes it even less “fixed” than before. The main highlights of the changes are:

- The FANF will not apply to Taxpayer ID numbers in months when sales are less than $200.

- The FANF charge will be calculated at 0.15% of gross sales in months when sales volume is $200-$1,249.99.

In May of 2012, the antitrust division of the U.S. Justice Department has taken notice of Visa’s new FANF. Read more about the Justice Department probe here.

Identifying the FANF on Statements

Businesses that are charged on an interchange plus or tiered pricing model may be able to locate the FANF along with other Visa fees on a processing statement. (Note, businesses that utilize a “flat rate” processing company will not see individual assessment fees listed on their statements.)

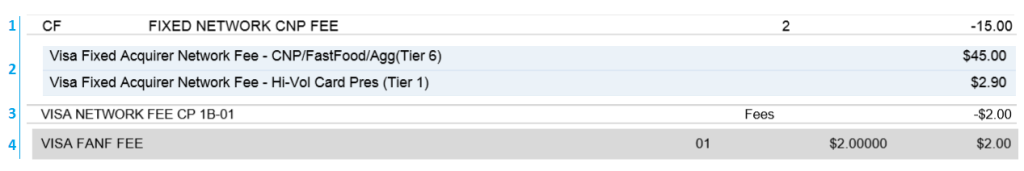

In the examples below, you can see the different names that a processor uses to refer to the fee.

In the first example, it’s called the Fixed Network CNP Fee, referring to FANF for card not present (CNP) businesses.

The second statement shows both card present and card not present fees (listed as the full name Visa Fixed Acquirer Network Fee), indicating that this business accepts cards in both methods.

The third statement lists the Visa Network Fee and notes it’s card-present, while the fourth simply lists Visa FANF Fee. However, from the amount ($2.00) we can assume that it was charged to a card-present business with one location.

In many cases, processors will simply pass the FANF cost to you without adding a markup. However, it’s important to remember that processors could add a markup if they chose. If you’re a CardFellow client, we require processors to pass assessments to you at cost, and we conduct statement audits to ensure you’re billed correctly.

Lowering Costs

As an assessment fee, you can’t negotiate the FANF. Processors will need to charge at least the amount that Visa sets so that they don’t lose money. If you’re looking to save money on your processing fees, you’ll need to focus on the processor’s markup.

In order to do that, you’ll need to know the fees that the processor charges in excess of the fees set by Visa/Mastercard and the banks that issue credit cards to consumers.

Fortunately, there are tools you can use to make the comparison process easier. CardFellow offers a free, no-obligation pricing tool. You’ll be able to see a full cost breakdown from multiple processors in our marketplace. You can also invite a quote from any processor you’d like and see how it stacks up. Our software puts quotes in the same format for you, allowing an apples-to-apples comparison.

Additionally, if you have questions or need further assistance when comparing pricing, you can contact the independent experts at CardFellow to get real answers from unbiased experts. Try it now!

With the state of the economy today, this just adds to the burden small business owners have to bear. We do a lot of pro bono work which involves our veterans, who receive counseling free. The interest rate on all credit cards is extremely high and I would think the card companies would be satisfied with all that income. Evidently not. Most businesses are struggling just to keep their heads above water. Just recently, Best Buy, a very large company is closing 50 stores! I rest my case.

Just another example of Greed in my opinion. As a small business owner just trying to stay ahead of all the monthly business costs that go with owning a small internet storefront business, having a credit card company say they want to charge my business more money for accepting their credit cards to pay for products purchased on my site seems inflationary and anti-American. Visa should be ashamed of this request for adding on new charges. It’s just plain GREED!

I work for a credit card processing company. Unfortunately, most retail and food service business owners do not understand the fact that we (the processor) don’t have anything to do with this fixed fee charged by Visa. I do agree with the comment made by positive horizon family center, card associations have set the rates for acquirers and banks to charge and on top of that they are charging assessment, acquirer’s processing fee which amounts to billions of dollars that all businesses have to pay just so they can make sales. This is not well known to the general public that every time that the consumer uses a credit card, the merchant has to absorb up to 5% as cost of that transaction. This will be very cumbersome, especially for small retailers.

Wish all of us would go back to using cash and let credit cards become a distant memory.

As if it’s not aggravating enough to be charged extra fees every month because of mid-qualifying cards and now Visa slaps us with another fee. When I called my provider to inquire as to why I was being charged extra fees for mid-qualifying cards, the only explanation I got was that I must not be obtaining and entering all of the necessary information pertaining to the transaction. However, I always swiped the card & keyed in all of the information I was prompted to supply. In a second call, another person explained that most of my charges were from accepting Rewards Cards. They said that Visa pays the card holder’s “rewards” and then recovers those expenses by passing their costs on to the retailer. What am I supposed to do when the majority of my customers present Rewards or Business Cards at the POS? It is becoming less and less profitable to accept credit cards as a form of payment. However if I were to stop accepting cards, I would lose a lot of sales. Visa knows this and they have us over a barrel. A big barrel full of greed.

Hi Roberta,

While there’s nothing you can do to get around paying Visa’s FANF, you can completely avoid mid and non-qualified surcharges.

You should really sign up to receive processing quotes here at CardFellow. We only allow processors to offer pass-through pricing, which eliminates surcharging.

You should also check out CardFellow’s Credit Card Processing [Exposed]. It’s a credit card processing guide that shows you the secrets to low processing fees.

I realize that all these fees add up. As a processor we too are frustrated by the fees accessed. However, the only reason the Visa FANF fee was introduced was due to the Durbin Act. Look it up! This is where your current gov’t decided to get involved in private business. This act forced Visa/MC to decrease fees charged for certain card types. It would be like the gov’t coming into your business and telling you that you cannot charge a certain amount for your product. You wouldn’t like this either. Unfortunately due to this act Visa/MC lost 9 billion dollars for their investors. Well obviously they were not going to sit back and take that kind of hit as their investors would not allow that to happen. Thus your new VISA Fanf fee. So before you go getting upset with VISA/MC, which is a business and is in the business of making money you should first consider why this was put in place. It was because the gov’t thought they were going to help you. If the gov’t came in and made you change your prices for someone else how would you react? You would have to find ways to get the lost income. That means raising prices somewhere else. Do I agree with the increase? No, but I understand. Gov’t needs to stay out of the private business world, period!

Great explanation! Thanks!

JML