CardFellow is an advocate and expert consultant that acts on behalf of our clients, and we really don’t like it when a processor tries to mislead one of our valued clients with deceptive information. That’s exactly what recently happened with a company called Riverside Payments.

You know the drill: Credit card processing sales people bombard you with calls and emails promising to save you tons of money. You resist as long as possible, but eventually you succumb to the pressure and hand over a statement from your current processor.

A day or two later, a pushy salesperson shows you a quote that compares your current processor’s pricing to the rates and fees they’re offering, and, of course, says switching will save you hundreds of dollars on processing costs.

Salespeople rarely review your current processor’s statement and come back to say that you that you already have competitive pricing because most aren’t interested in your current pricing, or in offering what is actually more competitive pricing. They’re interested in making a sale, and they’ll tell you whatever is necessary to make that sale – even if it’s complete nonsense.

This happens to CardFellow clients all the time. We secure the absolute most competitive pricing and terms for our clients. It doesn’t get any better. And yet, salespeople still claim that hundreds of dollars can be saved. So it’s always interesting when one of our clients sends us an offer they received from a prospective processor.

The latest example was sent to us by a client that was approached by a sales representative from Riverside Payments. The representative from Riverside presented a quote and cost comparison that is completely inaccurate at best and deceptive at worst.

I should note that our client gave permission for us to share details of the comparison and quote.

Our Client’s Current Pricing

Before I outline the information that Riverside Payments presented, and the glaring issues with it, I’ll provide an overview of the pricing our client secured through CardFellow.

Our client chose a certified quote through our marketplace back in 2012. Pricing hasn’t changed since, and we know that because we audit all of our clients’ pricing every six month to ensure it remains locked for life.

The client in question chose a quote through CardFellow with pass-through pricing of 0.05% on volume, a transaction fee of $0.05, and a monthly fee of $19.95. We’ve since had the monthly fee removed, but we’ll leave it in for the purposes of this article so that the pricing we reference is the same pricing Riverside Payments used for its comparison.

Any honest payment professional knows that this is as competitive as pricing gets and wouldn’t advise a business to switch. However, that’s not the case with Riverside Payments.

Riverside Payments’ Quote Inaccuracies

I’ve posted the complete quote and comparison from Riverside Payments here, and I’ll reference it in the snippets below as I talk about specific points.

The problems with Riverside’s quote don’t actually begin with its proposed pricing, but instead, with its apparent inability to accurately read a statement from its own processor.

Riverside Payments is an ISO of First Data, which means it essentially resells processing services offered by First Data. Our client is currently processing directly with First Data via a corporate/house account. This would lead one to reasonably assume that Riverside Payments would be able to accurately read a First Data statement, but that’s not the case here.

The points below outline the issues with the Riverside Payments quote as they pertain to simply reading our client’s current statement correctly for the purposes of comparing pricing.

Wrong sales volume.

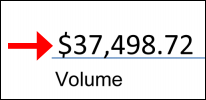

As you can see from the snippet below, Riverside posted our client’s monthly sales as $37,498.72.

But that’s actually the total sales volume less the fees charged for the previous processing period.

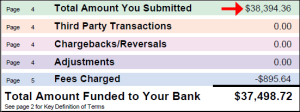

The snippet below is taken from our client’s statement, which is the same statement Riverside used for its quote. As you can see, the correct sales volume for the current month is $38,394.36.

The wrong total fees are used for comparison.

Getting the sales volume wrong is bad enough, but Riverside Payments also used the wrong total fees in its calculations. This is crucial because it impacts the entire comparison.

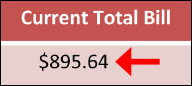

The snippet below shows that Riverside claims our client’s fees for the month compared are $895.64. This is not correct. Fees are actually only $773.66.

First Data’s statements often report charges in two sections. One section, called “Fees Charged,” shows fees that are being charged in the current month for the prior month’s volume, and another section called “Pending Financial Charges and Fees” shows fees that will be charged in the following month for the current month’s volume.

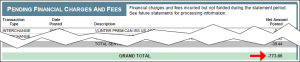

The snippet below is taken from our client’s statement. As you can see, the correct total fee for the current month is $773.66, not $895.64.

At this point, Riverside is using the wrong (too high) monthly fees as a starting point for its comparison. It doesn’t stop there.

Wrong effective rate.

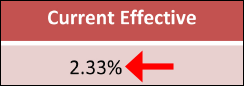

Since Riverside Payments is using the incorrect sales volume and fees, its calculation of the effective rate is also incorrect. As you can see from the snippet below, Riverside is claiming our client’s current effective rate is 2.33%.

The correct effective rate is actually only 2.01% when the correct sales volume ($38,394.36) and charges ($773.66) are used for calculation.

That takes care of correcting Riverside’s incorrect information. But there’s more.

Riverside Payments’ Pricing Problems

The next issue with Riverside Payments’ quote is the details (or lack of) regarding pricing.

Vague, bundled pricing.

Our client is currently being charged based on the most transparent form of pricing, called true pass-through. It’s transparent because all components of cost including, interchange fees, assessments, and the processor’s markup are disclosed separately and in detail. This is the ideal pricing model, and it’s the only one we allow processors to use when offering our clients quotes.

In contrast, Riverside Payments is proposing a pricing model called bundled pricing (also referred to as tiered pricing). Bundled pricing is among the most opaque and potentially expensive pricing models available. I’ll use its quote to provide examples below of just how vague its bundled pricing proposal is.

What happens to all of those interchange categories?

Riverside’s quote only disclosed five different rates, but there are a few hundred different interchange categories. The bundled pricing that it uses routes all of these various interchange categories to the five rates it quoted, but nowhere in its quote does it disclose how interchange is routed.

For example…

Riverside quoted 2.30% plus a $0.09 transaction fee for what it calls “Corp/Business,” but the interchange rate and fee for a card-not-present corporate card is 2.65% plus a $0.10 transaction fee. Since interchange can be thought of as the “wholesale” cost, it is the absolute lowest a processor could charge and not lose money. Does this mean that Riverside is going to lose money each time our client transacts this type of card? I highly doubt this is the case, but there’s no other information in this quote to support otherwise.

A similar example can be made for the rate that Riverside calls “Rewards” in its quote. Riverside is quoting 1.85% plus a $0.09 transaction fee, but the interchange rate and fee for a Visa card-not-present reward card is 1.95% plus a $0.10 transaction fee. Does this mean that Riverside is going to lose money on all of these transactions, too? Get real.

The problem here is two-fold. First, Riverside isn’t disclosing all of the rate tiers that it’s using to bundle interchange. Second, Riverside isn’t disclosing the interchange qualification matrix that it’s using to route interchange to its bundled rates. The result is a lack of transparency and a big red flag.

What happened to American Express?

Our client takes American Express in addition to Visa, MasterCard, and Discover. However, Riverside Payments’ quote makes absolutely no mention of American Express pricing. Will pricing be based on Optblue? What are the rates and fees for American Express?

A monthly fee of $200!

As you can see below, Riverside Payments quotes a monthly fee of $200 for what it calls “Monthly Service / Equipment Package.”

However, there is absolutely no detail about what our client will receive for $200. Our client already owns a PCI level-1 compliant EMV-capable credit card terminal, so there is no need to pay so much money for additional equipment. Is Riverside Payments engaging in the unscrupulous tactic of leasing credit card machines?

To summarize the above points, the problem with Riverside Payments’ quote is that is not actually a quote at all. It doesn’t specifically disclose the rate and fee that would apply to various transactions; it makes no mention of American Express fees, and it references outrageous monthly charges without providing a single supporting detail on what the charge actually covers.

Finally, let’s get to the point of Riverside’s comparison by analyzing the amount of money it’s claiming to save our client.

Not all credit card processing fees are negotiable.

Credit card processing is expensive. Ensuring your business is paying competitive fees is important, but the fact of the matter is that not all credit card processing fees are negotiable. Some processors leverage the fact that most people aren’t experts on credit card processing fees. These processors prey on the frustration that people experience with the cost of processing by offering quotes that propose savings that are simply unobtainable and completely inaccurate. That’s exactly what Riverside Payments has done in this case.

Luckily, our client was wise enough to send Riverside’s quote to CardFellow for analysis, and we do know a thing or two about credit card processing fees.

Riverside Payments would lose money based on the savings promised

As I noted in my last point, not all processing fees are negotiable. Only the fees beyond the cost of interchange and assessments will change among processors. At CardFellow, we refer to this component of cost at the processor’s markup.

The markup is where the processor makes its money. The markup is the only component of cost that changes from one processor to the next, and it’s essentially what a business is shopping for when comparing processing quotes.

Any savings promised by a prospective processor must come out of the markup earned by the current processor. For example, if a business is paying its current processor a markup of $200, and another processor promised to save the business $50, the markup for the new processor would be $150. The business would save $50 and the business’s new processor would make less money than the old processor.

As you can see below, Riverside Payments claims it will save our client $179/month based on the month it analyzed.

To see if this claim is reasonable, let’s calculate the total markup of our client’s current processor. As I noted earlier, any savings proposed by Riverside Payments will have to come from the markup of the current processor. This means that the markup earned by our client’s current processor must be at least $179 to make Riverside’s claim even remotely possible.

Supporting Evidence

I’ve gone through our client’s current statement for the month in question. Then I listed all of the processor markups.

| MASTERCARD AUTH FEE

VISA AUTH FEE DISCOVER AUTH FEE TRANSARMOR SOLUTION DISCOVER SALES DISCOUNT MASTERCARD SALES DISCOUNT VISA SALES DISCOUNT MASTERCARD DEBIT SALES DISC VISA DEBIT SALES DISCOUNT |

87 TRANSACTIONS AT .050000

541 TRANSACTIONS AT .050000 25 TRANSACTIONS AT .050000 – .000500 DISC RATE TIMES $1,353.88 .000500 DISC RATE TIMES $3,682.35 .000500 DISC RATE TIMES $15,594.24 .000500 DISC RATE TIMES $1,371.94 .000500 DISC RATE TIMES $15,049.82 |

4.35

27.05 1.25 19.95 0.68 1.84 7.80 0.69 7.52 |

The total of the current’s processor’s gross markup is $71.13. You read that right. CardFellow secured this client pricing that’s so competitive that the gross markup is $71.13 to process $38,394.36 in volume.

This means that Riverside Payments is proposing to lose $107.87 this month to process this business’s transactions.

Processors cannot lose money on transactions and remain viable as a business.

The bottom line is that this quote is not based in reality. It’s inaccurate, borderline unethical, and certainly not in the best interest of our client. Riverside Payments was looking to make a sale, not provide a more competitive processing solution. Next time it should approach a business that doesn’t have the backing of CardFellow’s expert support.