Processor Directory > CardConnect

CardConnect Review

- History and Clients

- Obtaining a CardConnect Merchant Account

- CardConnect Statements

- CardFellow’s Opinion

- What Services does CardConnect Offer?

- Fraud Prevention Tools

- What about reporting?

- Is CardConnect Secure?

- CardConnect Rates and Fees

- CardConnect Reviews

CardConnect is a classic example of a processing situation where what you’ll get comes down to what you know. We’ve seen statements showing everything from competitive pricing to overcharging in sneaky ways. Later in this review, we’ll provide examples of those CardConnect processing statements to illustrate the good and the bad. But first, let’s go over the different channels through which you could obtain a merchant account with CardConnect and why those channels matter.

History and Clients

CardConnect is a payment processor founded in 2006 that currently serves over 50,000 businesses across the United States. It boasts a client list including JellyBelly, Adobe, Hoover, and General Electric. CardConnect is headquartered in King of Prussia, Pennsylvania, and is a registered independent sales organization (ISO) of Wells Fargo Bank and Deutsche Bank. In the summer of 2016, CardConnect went public.

Obtaining a CardConnect Merchant Account

CardConnect is owned by First Data, but that doesn’t mean you have to call up First Data to get an account. Yes, you can get CardConnect merchant accounts through First Data, but also through First Data resellers called ISOs, independent sales agents, or through CardConnect itself. That’s a lot of opportunity for different pricing, terms, and service. There’s no standardization when it comes to pricing, and CardConnect doesn’t require any specific pricing model. Different resellers and agents can set their own pricing and terms.

That means it’s up to you as the customer to seek out a transparent pricing model and a competitive markup. If you don’t know what you’re looking for, it’s easy to overpay.

The good news is that because there are many channels through which you can get an account with CardConnect, you actually have more room to negotiate. You can take advantage of CardFellow’s quote marketplace to find the best credit card processing company that works with CardConnect while securing the lowest possible pricing. You’ll also benefit from CardFellow protections, including no cancellation fee and rate guard to ensure your rates don’t increase.

Processing Cost Basics

Before diving into the statements, it helps to have a basic understanding of pricing models and the costs of credit card processing. We’ve covered it thoroughly in our article on credit card processing rates and fees, so I won’t go into it in-depth here, but as a quick refresher:

Interchange refers to the fees that go to the banks that issue credit cards to consumers. Interchange is the same for all processors and is non-negotiable. Your processor does not control interchange.

Assessments refers to the fees that go to the card brands themselves. Assessments are also the same for all processors and non-negotiable. Your processor does not control assessments.

Markup goes to the processor. This is the only component of processing cost that is negotiable and in your processors control. How your processor charges markup can set the stage for transparent and competitive pricing or for opaque, expensive pricing.

Pricing Model Basics

There are two primary pricing models processors use to charge you for credit card processing. One is pass-through (also sometimes called interchange plus) and the other is bundled (also sometimes called tiered.) For a detailed explanation of these two models (and their variations), check out our article on credit card processing pricing models.

As a quick overview:

Pass-through pricing refers to a model in which credit card processors will ‘pass’ the cost of interchange and assessments to you and charge their markup separately. This model is the most transparent, as you can see what you’re paying in non-negotiable wholesale costs (interchange and assessments) and what you’re paying as markup. While it’s not a silver bullet to low cost processing, it sets the stage for competitive pricing.

Bundled pricing, also called tiered pricing, refers to a model in which credit card processors ‘bundle’ or group the fees into different tiers. They often lump interchange together with their markup, listing assessments separately. In other cases, they lump all three components (interchange, assessments, and markup) together. With the fees bundled together, the processor then charges you a rate it sets based on its own internal criteria. Processors often use three “tiers” of rates, called “qualified,” “mid-qualified,” and “non-qualified,” but they can create more or fewer at their discretion. With this type of pricing, qualified rates are the lowest while non-qualified rates are the highest. Tiered pricing is opaque, as you cannot separate non-negotiable costs from negotiable markup.

CardConnect uses both pass-through and tiered pricing.

CardConnect Statements

Now for the evidence. As mentioned earlier, we’ve had plenty of opportunity to review CardConnect statements over the years. Sometimes, those statements show fair and competitive pricing. Sometimes they don’t.

The Good

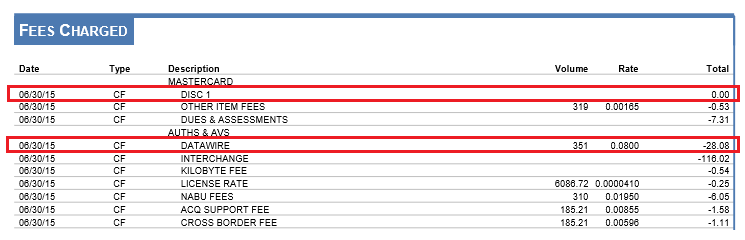

Like all processors, CardConnect has the ability to offer competitive, transparent pricing and we’ve seen situations where they do that. For example, in the snippet below, CardConnect priced the business using interchange plus and a competitive markup. It charged 0% and 8 cents per transaction for a business that has an average transaction around $15. For such a small average ticket, the low cents charge is more important, though, so don’t be lulled into thinking that 0% markups are automatically the way to pay the lease. In some cases, it makes sense to take a higher percentage fee in exchange for a lower cents fee. In this case, CardConnect offered a reasonable cents fee.

Here’s what it looks like on the statement.

“Disc 1” refers to CardConnect’s percentage markup. It charges this business 0% on volume. The “datawire” line is CardConnect’s per-transaction markup. It charges this business 8 cents per transaction, as you can see from the column labeled "Rate."

We can also see from this statement that the assessment fees listed (such as the NABU fee) are charged at cost, without padding. The processor doesn’t control those fees, so they can’t lower them below Mastercard’s set rate. They could add to them, however, charging you more than necessary. In this situation, CardConnect has not done so, showing that they’re transparently and fairly passing along the assessments.

CardFellow maintains a list of assessment fees if you want to check whether your processor pads those costs.

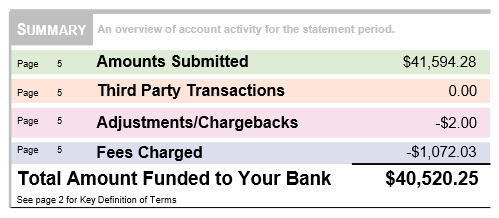

This CardConnect statement, with true pass-through pricing (no padding on interchange or assessments) and a competitive markup resulted in a reasonable effective rate of 2.58%.

We’ve also seen examples of CardConnect helping B2B businesses achieve lower rates due to its CardPointe system. We’ll address that further, with statement examples, in the section on CardPointe B2B later in this review.

The Bad

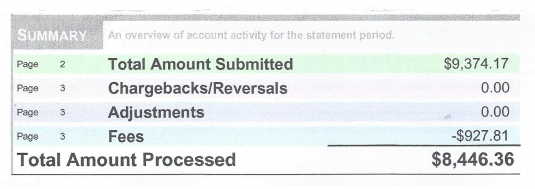

Unfortunately, CardConnect currently holds the record for the highest effective rate we’ve seen on a merchant account – 9.9%! For one month, this business paid almost 10% of its credit card sales in processing fees.

For this statement, we divided the total fees by the total card volume to calculate the effective rate. $927.81 / $9374.17 = 9.8975%.

High effective rates like this are often a result of “tiered” or “bundled” pricing, and that’s the case here. You can often spot bundled pricing by looking for “non-qualified” transactions, usually abbreviated as “nonqual” or “nqual.”

In the snippet above, you’ll see “Visa non-qual sales discount” and “Visa sales discount” along with a rate and a volume to which that rate applied. The second line of the two, “sales discount,” refers to transactions that CardConnect considered “qualified.” As you can see, the “qualified rate” is 6.7855%. That’s supposed to be the “good” rate! Additionally, CardConnect only considered $190.91 of this business’ total card sales to be “qualified.” The rest it claims are “non-qual.” CardConnect applied the non-qual rate of 9.2355% (!) to $8,937.96 of this business’ card sales. Since this business only processed $9,374.17 this month, that means most of its transactions were charged 9.2355%. Ouch.

The high “non-qualified” rates aren’t the only problem. This statement also shows “padded” assessment fees. That is, the processor inflated the fees that the card brands charge.

This section shows the Visa Access Fee at $0.0494 per transaction. But Visa’s network access fee is only $0.0195. It may not seem like a big difference since we’re talking about pennies, but if a processor pads all assessments, it can add up quick. This is especially true as businesses grow and process more credit card sales. Some assessments are percentage-based while others (like the access fee) are flat cents-based. That means that higher sales or an increased number of sales will both results in higher assessment fees. It’s important to ensure your processor charges assessments at cost.

For the record -- This business signed up for a free CardFellow account, chose a processor through our system, and saved over $750/month.

CardFellow's Opinion

CardConnect can be a low cost solution or an expensive one. Whether you get a good deal or not depends largely on where you obtain CardConnect and what you can negotiate for pricing and terms.

There’s never a good reason to opt for tiered or bundled pricing, and even small businesses are eligible for pass-through. When evaluating processors, be sure you’re looking at those offering transparent pass-through pricing and a competitive markup. If you need assistance, we can help. Check out how CardFellow works.

Setting aside cost, there are other factors that make CardConnect a good option for some businesses. What CardConnect has going for it is its CardPointe gateway technology.

CardPointe is the company’s payment framework – essentially, it’s the technology that allows you to accept cards. But CardPointe is unique in that it offers specialty features that aren’t readily available elsewhere, particularly for B2B credit card processing.

In the rest of this review, we’ll go over CardConnect’s services and equipment options.

What services does CardConnect offer?

CardConnect offers payment processing through a variety of possible methods: in-person, online, on the go, and over the phone.

A virtual terminal is available if you would prefer to accept payments using your existing computer. A mobile processing option is available for accepting payments on the go. CardConnect also offers a payment gateway for e-commerce transactions. If you offer goods and services on a recurring basis, CardConnect supports recurring billing to automate the invoice and payment process. Recurring billing can include a card updater to automatically maintain up-to-date customer card information to reduce declined recurring billing transactions. In addition to accepting payments, you can process voids, returns, and refunds.

CardConnect also offers fraud prevention tools to help businesses reduce the risk of processing fraudulent transactions, and online reporting options to effectively manage business from anywhere.

The company offers a comprehensive library explaining various features, but we’ll cover the most important features in-depth right here in this review.

Card Processing

With CardConnect, you can accept major credit cards, including MasterCard, Visa, American Express, Discover, and JCB. Additionally, customers can pay with signature-based debit. Card processing is available through all of CardConnect’s options, including the virtual terminal, payment gateway, and mobile processing service.

Of course, that’s true for most processing companies, so what makes CardConnect different? The CardPointe system.

CardPointe

In April of 2016 CardConnect rolled out its CardPointe platform. Existing CardConnect customers would have seen a notice about the CardPointe service on March and April statements. The notice informs existing customers that the statement fee will be increased by $10 and renamed “CardPointe Fee.”

CardPointe offers a central payment system that allows businesses to process transactions via mobile, countertop terminal, POS system, virtual terminal, gateway, and hosted payment pages, but the B2B options are particularly noteworthy.

Businesses that accept commercial or purchasing cards know the frustrations of paying more for those cards. However, what many businesses don’t know is that there are ways to keep those costs down. That’s where enhanced data comes in.

CardPointe and Enhanced Data for Commercial Transactions

Also referred to as Level 2 or Level 3 data, enhanced data refers to providing additional details about a transaction when you submit it for processing. Those details may include invoice numbers, shipping addresses, tax rates, or other information. If a business provides the required information, they can achieve lower interchange rates.

However, some businesses find it tedious to provide level 2 and level 3 data, or aren’t sure which fields they need to fill out. The CardPointe system offers autofill capabilities for providing enhanced data. That gives you the best of both worlds: you can take advantage of the lower costs that enhanced data can offer while automating the process of providing the extra information.

How much will you save by providing enhanced data?

Some businesses wonder if the savings are worth it. This is one situation where the answer is an easy, “Yes.” According to Visa’s interchange schedule, commercial transactions eligible for level 3 cost 1.90% plus 10 cents per transaction. Level 2 costs 2.50% + 10 cents per transaction. However, a commercial transaction for which you don’t provide level 2 or 3 data will run you 2.70% plus 10 cents per transaction. That’s a full 0.20% - 0.80% more.

If you were to accept a commercial card, didn’t provide level 2 or level 3 data, and also didn’t mean normal requirements, your transaction can “downgrade” to the most expensive category, where it will cost 2.95% plus 10 cents per transaction. Ouch.

With simple changes to accepting commercial cards and providing enhanced data, you could pay up to 1.05% less. Considering many commercial transactions are larger than consumer transaction, that percentage adds up quick.

However, in order to benefit from lower costs associated with enhanced data, you need to be on pass-through pricing. With pass-through pricing, any cost reduction at interchange is passed by the processor to your business. If you’re not on pass-through, your processor can simply keep the savings instead of passing it to you.

CardPointe Level 2 and Level 3 Savings

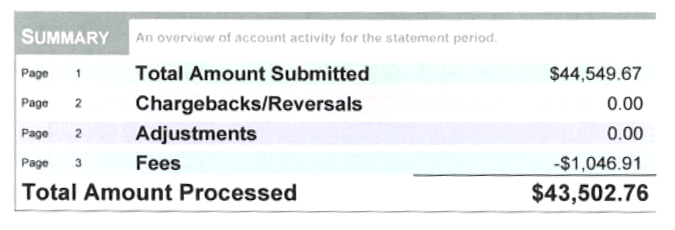

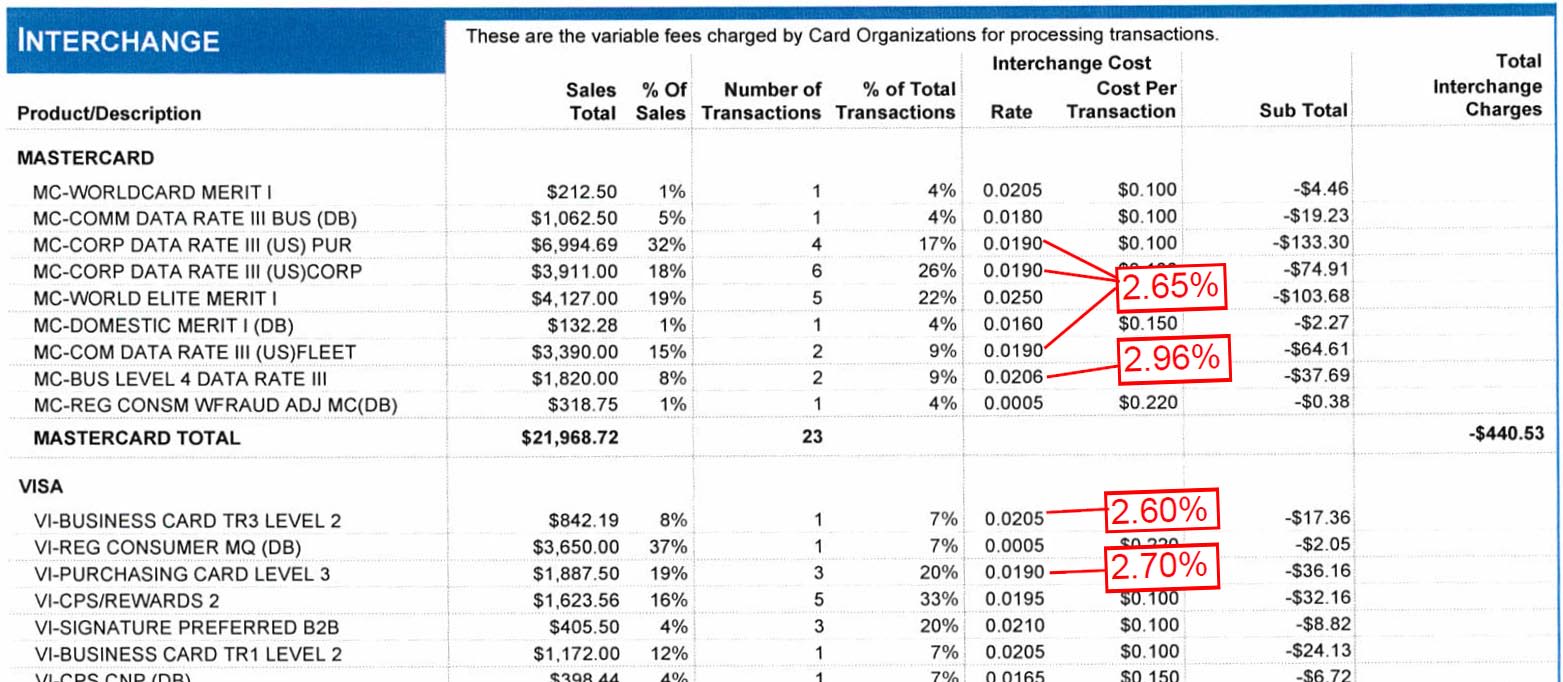

Okay, but how do the numbers look when applied to a real business? Let’s take a look at an example of enhanced data savings with CardPointe. This business accepts primarily commercial cards and does not swipe the cards.

Both commercial cards and card-not-present transactions typically result in higher costs. However, CardPointe and a competitive markup through a processor at CardFellow have kept this business’ effective rate a low 2.35%.

How did CardPointe help? To answer that, we need to take a look at the interchange charges. Remember, the processor (CardConnect) doesn’t control interchange – those costs are set by the banks that issue cards. However, there are many interchange categories that can apply to a transaction. When you provide level 2 or level 3 data, you can qualify for lower cost interchange categories.

Here’s where this business saved:

In the Mastercard section, the third line down is the interchange category called “MC-Corp Data Rate III.” This category only applies when a business provides enhanced data. It comes with a rate of 1.9%. For this business, it accounted for 32% of Mastercard sales, totaling $6,994.69.

If this business hadn’t provided enhanced data, it would instead have been charged 2.65% for those transactions - a difference of 0.75%. That means that this business would have paid $52 more for just that one set of transactions if it didn’t provide enhanced data. As you can see from the red notes on the statement, there are multiple categories where the business would have paid more.

What CardPointe does is streamline the process of passing level 2 and level 3 data. It knows which fields need to be filled, and autofills any data that you don’t provide.

While there are other gateways and solutions that are capable of passing level 2 and level 3 data, CardPointe’s is one of the most comprehensive and easiest to use. For that reason, we often recommend it to businesses as long as you’re also able to secure competitive interchange plus pricing.

For the record – this business selected CardConnect via a merchant service provider chosen through CardFellow. Our guidance is the main reason the business is saving all that dough with enhanced data.

If you take a lot of B2B transactions, it’s worth your time to understand level 2 and level 3 data and how it affects your costs. Check out our Guide to B2B Credit Card Processing and Enhanced Data.

Check Processing

If you need to accept checks, CardConnect offers electronic check conversion, allowing paper checks to be automatically deposited as an electronic transaction. Businesses can accept out of state and international checks in addition to local checks. Electronic deposits eliminate the need to go to the bank, saving time.

In-Person Processing

CardConnect offers in-person processing with either countertop terminals or a full POS system.

Traditional small businesses often prefer countertop terminals. CardConnect offers the CardPointe Terminal, an Ingenico countertop terminal featuring point-to-point encryption for security.

The CardPointe Terminal integrates directly with the dashboard, letting you view transactions in real-time as well as issuing refunds or creating customer profiles.

The terminal accepts magstripe cards, EMV chip cards, and NFC (contactless) payments.

POS System

CardConnect (and thus the CardPointe platform) was acquired by First Data and as a result, CardConnect is compatible with Clover POS systems. That’s good news for businesses that want to accept payments in person using a system with more features than a basic countertop terminal.

The Clover Station offers a customizable POS solution, allowing you to download apps to create your perfect system. The Android-based POS also supports optional accessories such as barcode scanners, cash drawers, receipt printers, and customer-facing displays.

Virtual Terminal

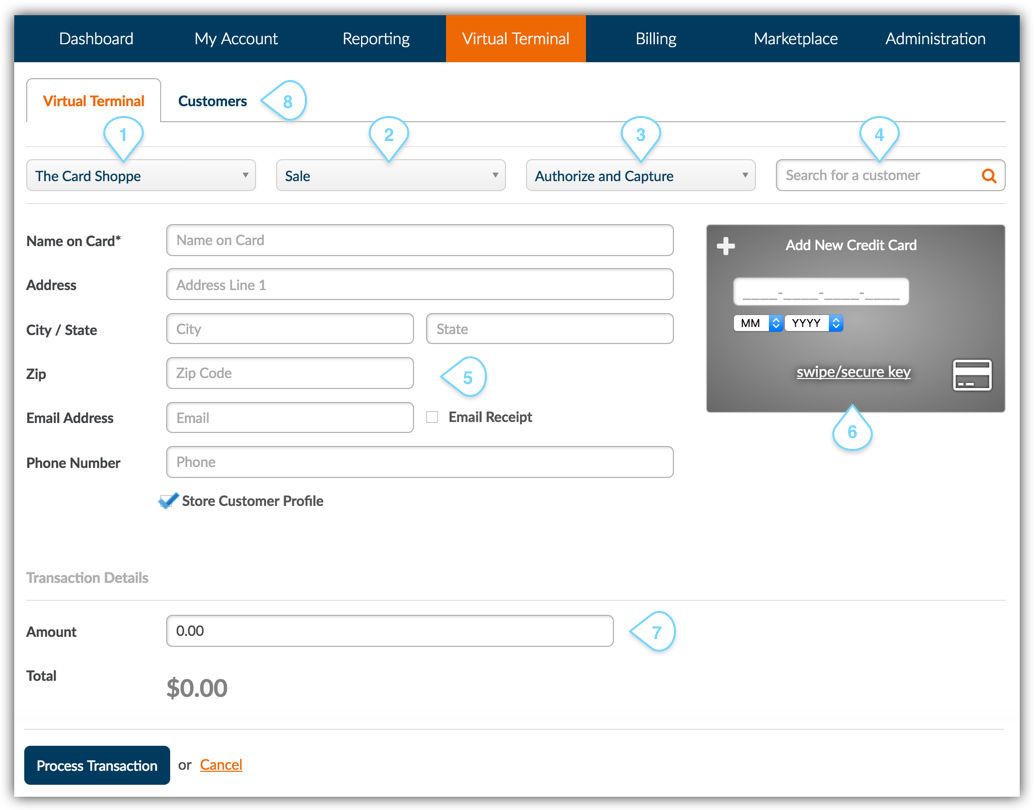

The CardConnect Virtual Terminal option allows you to accept cards and checks from any internet-capable computer. Take payments in person, over the phone, or by mail, and optionally add a USB card reader for convenient swiped transactions.

The virtual terminal can also process Level II and Level III data as discussed above, offering the ability to accept business purchasing cards at the lowest possible rates. Receipts for transactions can be customized and printed or emailed to customers for convenience.

As you can see from the screenshot above, the virtual terminal screen allows you to easily choose a customer (field 1) or search for a customer (field 4), select the type of transaction you wish to initiate (field 2), choose whether you want to authorize and capture the transaction or authorize only to capture later (field 3), provide customer details (field 5), add card information (field 6), and set the transaction amount (field 7). You’ll also be able to choose whether to “store” the customer’s profile after you’ve entered the relevant information.

Some businesses wonder about EMV chip card acceptance with virtual terminals. If you utilize a CardConnect Bolt terminal, you can securely accept chip cards by “dipping” them into the machine.

Mobile Payments

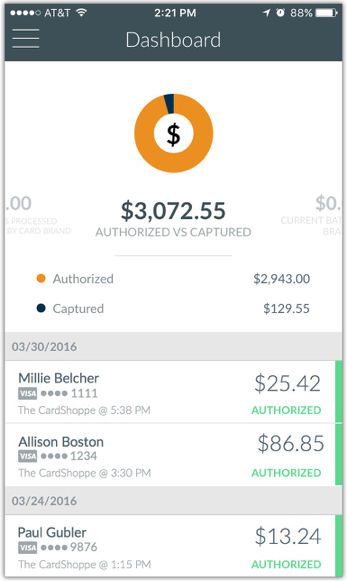

If you need to accept payments on the go, CardConnect Mobile offers the ability to process transactions almost anywhere. The mobile app works with both Android and Apple devices. The app includes a dashboard that shows transactions processed and provides access to the other functions, including payment entry and reporting.

As you can see in this screenshot, the CardPointe mobile app shows transaction history, with the customer’s name, card type, last 4 digits of the card, time of the transaction, amount, and status. This lets you quickly see important details about any transaction.

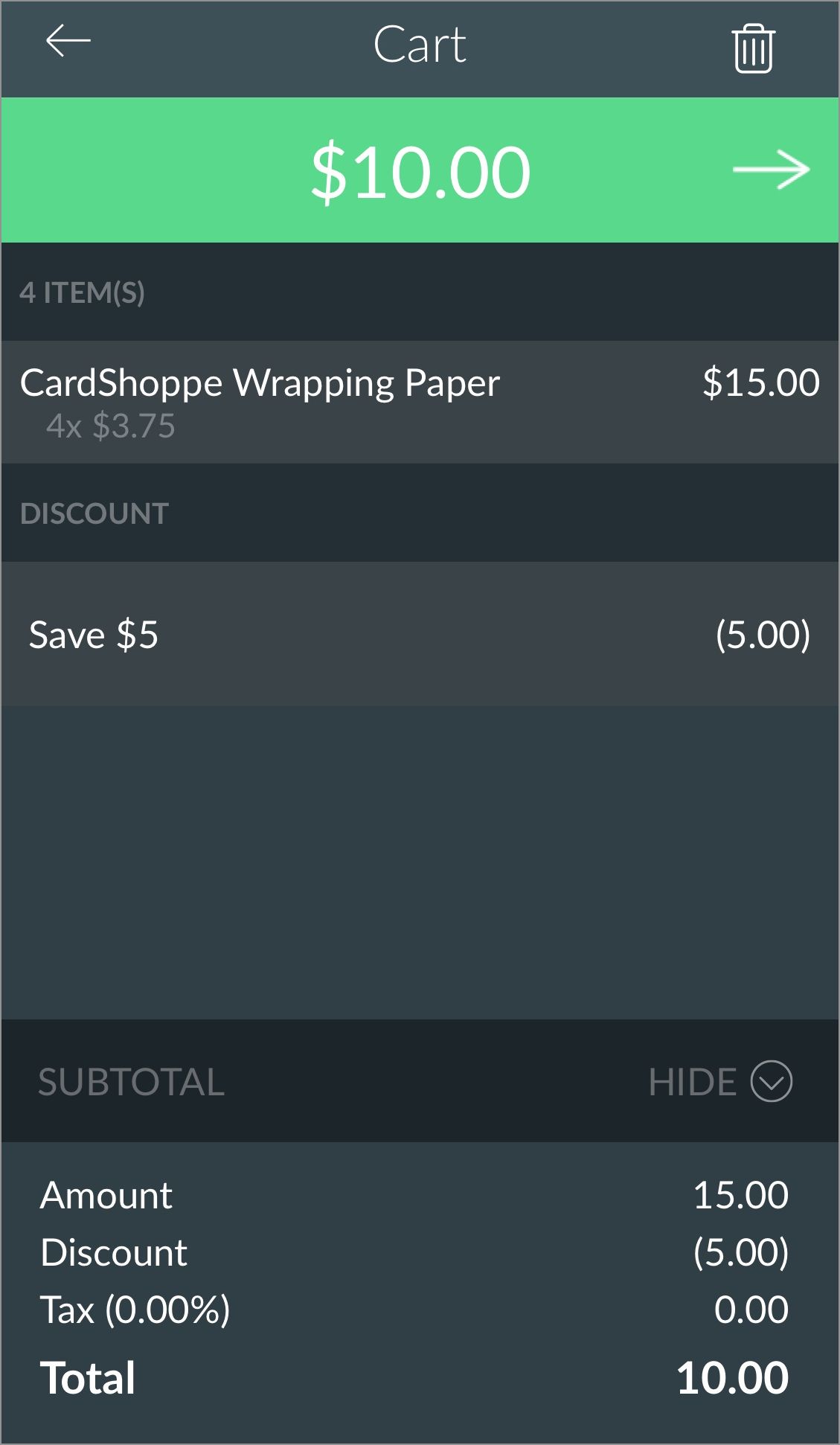

When you’re in the payments screen, you can search for products you’ve previously entered, browse by categories you’ve set up, or manually key in prices. You can also apply pre-set discounts or create new discounts for specific customers.

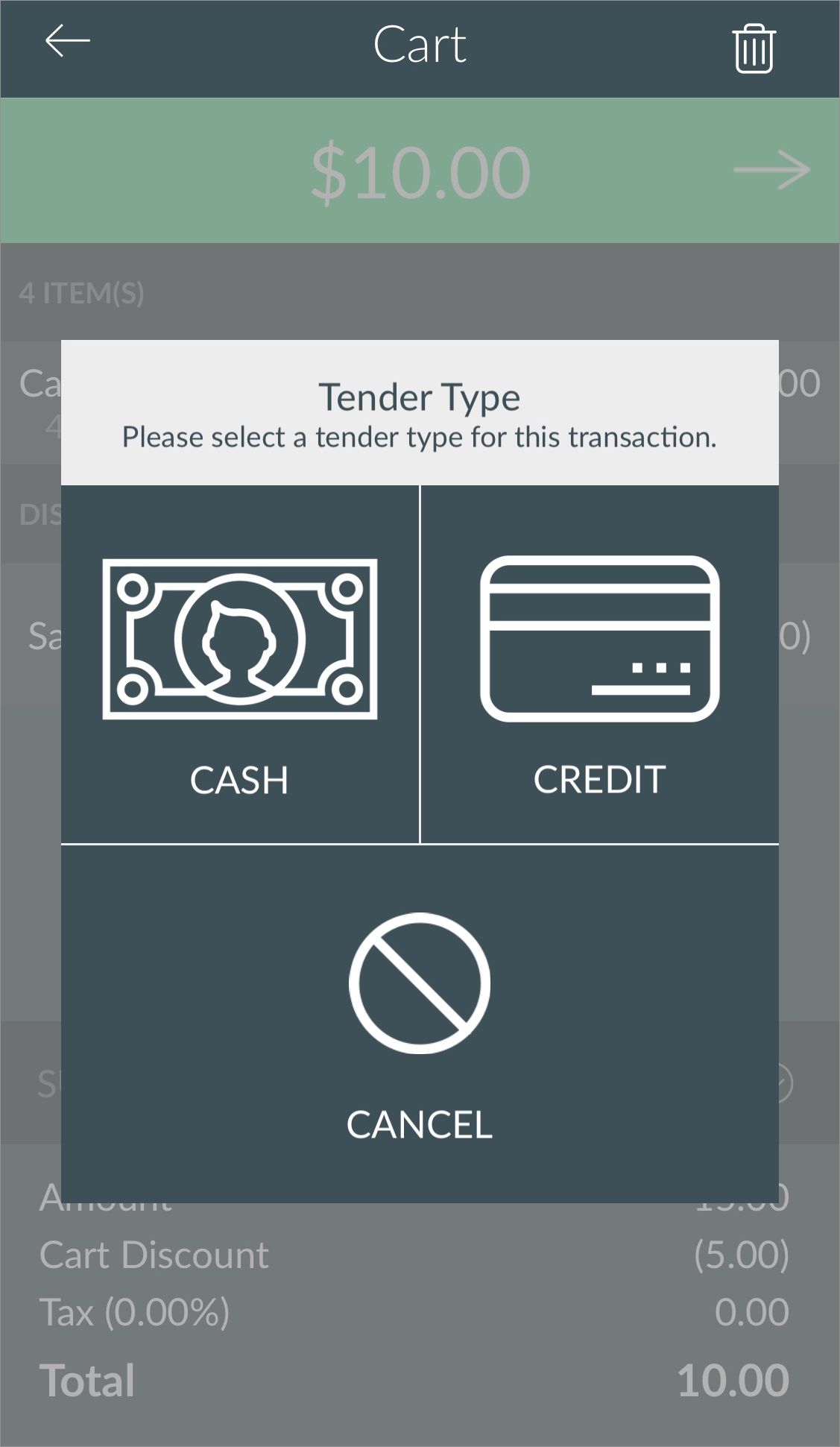

Once you’re ready to accept the payment, you’ll be able to review the items in the customer’s order. It will also list any discounts that you’ve applied so you can review the total for accuracy before accepting payment.

In the example screenshot above, the customer’s order came to $15.00, but they received a $5.00 discount, bringing the amount owed to $10.00.

From there, you’ll be able to head to the checkout screen, where you’ll be asked how the customer will pay.

If you accept credit cards, you can connect a card swiper via standard headphone jack. Many businesses prefer this type of card acceptance, as it’s more secure, faster, and lower cost than manually keying in a customer’s card details. In the event of a lost network connection while processing a mobile transaction, you can still accept payments, and upload the transaction information when a connection becomes available.

In 2018, the major card brands eliminated the requirement to collect signatures, but some businesses still prefer to have customers sign for purchases. If you prefer to collect signatures at the time of a card purchase, you can capture those signatures digitally.

Once the customer has made their payment, you can email a customized receipt to your customers. CardConnect Mobile is ideal if you are frequently away from a storefront.

Payment Gateway

CardConnect offers integration with the CardConnect Gateway if you want to accept payments through your existing business website. The gateway works with a variety of shopping carts and includes user-friendly APIs for quick integration. CardConnect supports multiple programming languages, including JavaScript, PHP, and more.

The CardConnect gateway is compatible with WooCommerce and Magento, and offers the option for hosted payment pages (CardPointe HPP) if you prefer a simpler “plug and play” style online payment form.

CardPointe HPP

The HPP option allows you to securely accept payments online through an online payment page or customized “buy” button and comes standard as part of the gateway solution. You can add fields, customize the page, and send receipts to customers by email upon successful checkout. HPP is popular with small businesses that don’t have developers on staff or prefer quick implementation. Since hosted payment pages aren’t stored on your server, you won’t receive sensitive cardholder details. CardPointe will handle the transaction for you.

Fraud Prevention Tools

CardConnect offers fraud prevention tools to help you minimize the risk of fraudulent transactions and resulting costly chargebacks. Real-time analysis of transactions scans for fraud triggers and automatically declines suspicious transactions while processing non-suspicious payments seamlessly.

Additionally, you can utilize the Address Verification System (AVS) which checks the address given by a customer with the billing address on file at the credit card company to ensure a match. CardConnect also supports 3D Secure, offering lower interchange fees and safer transactions. 3D secured is offered by the major credit cards, and is known as Verified by Visa, MasterCard SecureCode, and American Express SafeKey, depending on the credit card brand.

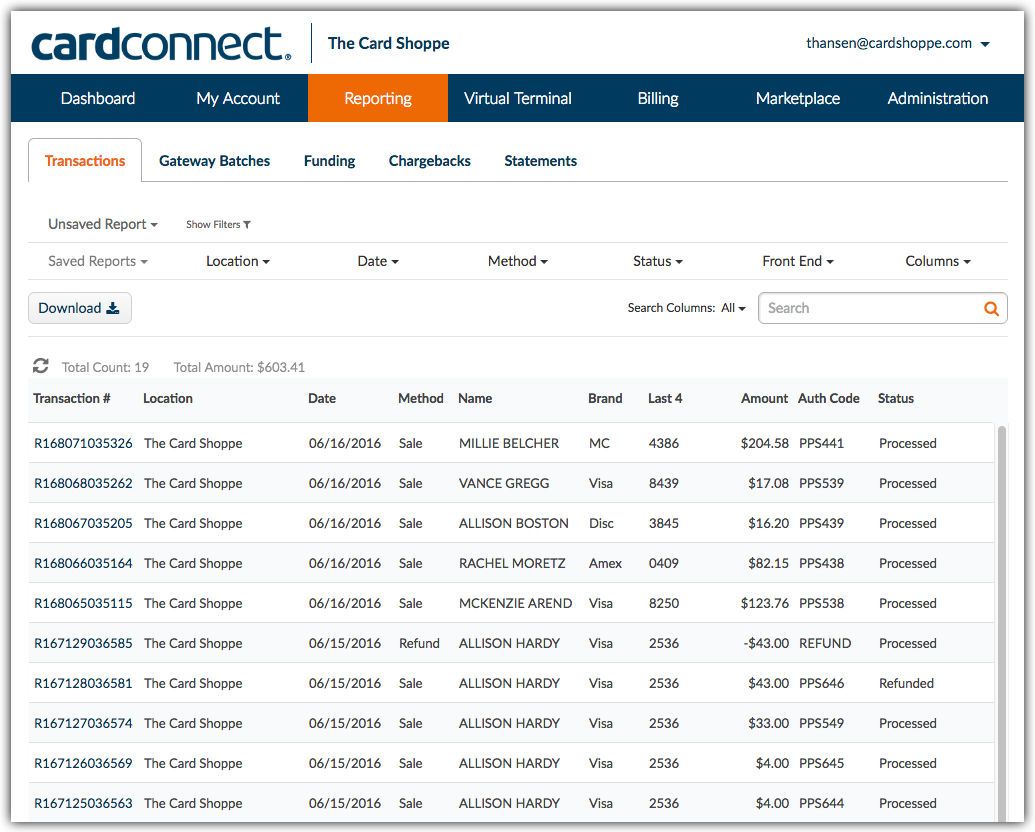

What about reporting?

The CardConnect reporting system provides access to a range of reports, including deposits, settlements, statements, and more. The report center is available online, allowing you (or other employees that you designate) the ability to view and analyze information from anywhere, at any time.

You can generate reports in CSV formats for review in Excel. Reports are available for transaction histories, chargebacks, and amounts funded to your bank account.

Is CardConnect secure?

CardConnect uses a combination of security tools to help ensure safety. The company combines point-to-point encryption, tokenization technology, and a PCI compliant card storage vault. Point-to-point encryption automatically encrypts data at the time of card swiping or entering, while sensitive data is instantly tokenized for additional safety.

In spring of 2017, CardConnect introduced an option to define AVS mismatch thresholds, helping businesses control transactions using Address Verification. Transactions under the defined amount will be approved even with an AVS mismatch, while those over the threshold will need approval. Note that entering "zero" as the mismatch threshold will decline ALL transactions with an address mismatch.

Read more about using Address Verification.

CardConnect Rates and Fees

As we mentioned earlier, pricing will vary depending on where you obtain your account. As such, CardConnect doesn’t publish rates or contract terms on their website. But we can help you get a fully-disclosed quote that you can review in private, with no pressure from sales calls.

You’ll need to be signed in to your CardFellow account to request a CardConnect quote. If you don’t have a CardFellow account yet, you can get one for free in less than 2 minutes. Sign up here.

Quotes through CardFellow are the most competitive you’ll find, and come with CardFellow’s protections, including no cancellation fee, rate guard to prevent your rates from going up, and ongoing independent statement monitoring.

If you need help comparing your CardConnect quote through CardFellow with your current pricing, give us a call and we’ll walk you through the numbers.

CardConnect Reviews

For a company that’s been around for about a decade, there isn’t as much as you might expect in the way of reviews and customer experiences available online. While it may be a good sign that there aren’t a lot of negative reviews, the flipside is that there also aren’t positive reviews.

As of early 2019, CardConnect is not accredited with the Better Business Bureau, but does have a profile. CardConnect has an A+ rating with the BBB and 17 complaints lodged in the past 3 years. Complaints allege the company charges termination fees after stating there was no contract or cancellation fee, has excessively high termination fees, high rates, and dishonest practices. There are no written reviews separate from the complaints.

There are no positive reviews to be found direct from CardConnect, either, as they don’t list any testimonials on their website.

Given the lack of reviews, it’s particularly important that businesses that have used CardConnect talk about their experiences. If that’s you, please take a minute to leave a CardConnect review.