You have probably been told that business credit cards are expensive to process. What you haven’t been told is that there are steps you can take to get lower pricing.

It doesn’t matter how big or small your business is – if you take business credit cards, you can qualify for better rates. B2B transactions don’t have to cost more.

Note: Unfortunately, in October 2017, Visa raised its rates for some commercial transactions and businesses won’t save as much by providing Level 2 or Level 3 data as they did before the change. However, if you take a lot of corporate cards, it can still be worthwhile.

By the end of this guide, you’ll be armed with the information necessary to qualify for lower costs by providing Level 2 or Level 3 data to save your business as much as 1.05% on commercial credit card transactions.

Before you begin, it may be helpful to read our credit card processing guide to familiarize yourself with the basics of processing, such as interchange and assessments.

Contents

Business Cards vs. Corporate Cards vs. Purchasing Cards

Businesses issue cards to employees to use for business expenses, most often travel, dining, and entertainment costs, as well as supplies. The primary difference lies in who is ultimately on the hook for the purchases made with that card. With a business card, the cardholder is usually liable (or jointly liable with the business) for the money. (The technical term is “personal guarantor.”) With a corporate card, the corporation is usually liable and individuals aren’t – a personal guarantor is not required.

Businesses issue cards to employees to use for business expenses, most often travel, dining, and entertainment costs, as well as supplies. The primary difference lies in who is ultimately on the hook for the purchases made with that card. With a business card, the cardholder is usually liable (or jointly liable with the business) for the money. (The technical term is “personal guarantor.”) With a corporate card, the corporation is usually liable and individuals aren’t – a personal guarantor is not required.

Purchasing cards (also called P-cards) essentially take the place of a purchase order, streamlining the process for authorized employees to buy approved goods or services for a business. Employers can impose restrictions on P-cards, such as capping spending or restricting purchases at businesses with a certain merchant category code (MCC).

Business cards, corporate cards, and purchasing cards can all be used in person (also called card-present) or online, over the phone, and by mail such as to pay an invoice (also called card-not-present.) However, level 2 and level 3 data primarily help with card-not-present transactions. While there are solutions available for card-present transactions (such as those offered by processors in the CardFellow marketplace), businesses that processes card-not-present commercial transactions will see the greatest benefit from enhanced data.

Card Brand Participation

Visa, Mastercard, and American Express have programs for Level 2 enhanced data, while only Visa and Mastercard offer Level 3. Discover does not participate in any enhanced data programs.

Level 2 requires more information than basic (level 1) transactions, but less information than level 3.

In order to process Level 2 transactions with American Express, you need to contact them for approval. Level 2 and Level 3 data for Visa and Mastercard are available through interchange without having to notify the card brands.

American Express Enhanced Authorization

Confusingly, American Express has a service called enhanced authorization that does not apply to B2B payments. Despite the use of “enhanced” in the name and the fact that it involves providing additional data to American Express, your Amex rates don’t change when using Amex Enhanced Authorization.

Instead, Enhanced Authorization refers to providing information (such as IP address) to help reduce the risk of fraud. While it may be a beneficial service, especially for ecommerce businesses, it does not apply to lower rates for commercial payments.

However, American Express does participate in a level 2 enhanced data program for commercial transactions. I’ll cover the required data for Amex enhanced data later in this article.

Enhanced Data Explained

The term data level (used by Visa) and data rate (used by Mastercard) both refer to the amount of information a business provides with a transaction. Since they mean the same thing, I’ll just use the term data level from here on.

The more information a business provides with a transaction, the greater the data level becomes. A transaction passed with the least amount of data is level 1, and a transaction passed with the greatest amount of data is level 3. The lower the number, the less data supplied with the transaction.

For example, a transaction that qualifies at interchange for data level 1 was processed with less information than a transaction that qualifies at data level 3.

The greater the data level of a transaction, the lower the interchange cost associated with the transaction. In other words, the more data a business passes with a commercial transaction, the lower the fee it pays to process the transaction. Of course, that assumes the business has a competitive pass-through pricing model, but more on that later.

Enhanced Data Requirements and Eligibility

Commercial cards are eligible for level 2 and 3 rates, but may be charged at level 1 rates if you don’t provide all the required data. Consumer cards are only eligible for data level 1.

Specific requirements are subject to change. Currently, the fields required for enhanced data are as follows:

| Visa Level III minimum fields: | Visa Level III optional fields: |

|

|

| MasterCard Level II fields: | MasterCard Level III fields: |

|

|

In addition to these fields, there are specific interchange qualification criteria that may also apply. For example, there may be requirements related to settlement time, MCC, and more.

American Express Level 2 Requirements

As noted earlier, American Express only participates in level 2 enhanced data for commercial transactions. In order to qualify, you’ll need to provide the following.

| American Express minimum fields: |

|

Requirements subject to change at Amex’s discretion.

Sending Level 2 or Level 3 Data with a Transaction

When sending level 2 or level 3 data with a transaction, it’s important to provide complete info in order to qualify for the best pricing. If you’re thinking that the lists above look like a lot of details to provide, keep in mind that some processing companies can help set you up in a way that streamlines the process. For example, some virtual terminals can auto-fill information, which makes the process of providing enhanced data a lot faster. This also cuts down on training time, since your staff won’t need to be shown how input data, and can reduce manual (employee) error.

Since enhanced data is sent at the time of the transaction, you’ll need to use equipment (usually a gateway) that supports level 2 or 3 data. Fortunately, many popular gateways are capable of supporting enhanced data and are compatible with a number of processors. Options like Authorize.net can support level 2 data, while its parent company CyberSource can support levels 2 and 3. However, some of the aggregator models like Stripe don’t currently support enhanced data.

You can use the CardFellow directory of credit card processing gateways to determine if your existing solution allows for level 2 and 3 transactions.

The Basics of Interchange

We’ve covered interchange thoroughly in this article and our processing guide, but it’s a crucial component to understanding level 2 and level 3 transactions and to seeing the savings available, so let’s go over it briefly. Interchange is the largest part of processing costs. It’s the component that is determined by and goes to the banks that issue credit cards.  Think of interchange as the “wholesale” cost of processing. Achieving level 2 or level 3 interchange means lowering the wholesale cost, which can result in a lower overall processing cost as long as you use a processor on a true pass-through pricing model. (Also sometimes called interchange plus pricing.)

Think of interchange as the “wholesale” cost of processing. Achieving level 2 or level 3 interchange means lowering the wholesale cost, which can result in a lower overall processing cost as long as you use a processor on a true pass-through pricing model. (Also sometimes called interchange plus pricing.)

Interchange costs are not controlled by processors, and any promise by a processor to “lower your rate” will not actually affect the cost associated with interchange. Interchange categories have rules that determine when transactions are eligible for the category. Every transaction is routed to an interchange category based on the criteria of the transaction. Criteria includes but isn’t limited to card input method (swiped, online, keyed), transaction size, card type (rewards, commercial, etc.), card brand, and more. Your goal is to help your transactions qualify for the lowest cost interchange category possible every time you take a card.

Pass-Through and Tiered Pricing

A pass-through pricing model means that your credit card processing company will charge you the actual interchange (wholesale) cost and apply a separate markup. This allows you to easily see how close you’re paying to wholesale, and to enjoy the savings when you’re able to lower your interchange (wholesale) costs. If your credit card processor uses a tiered pricing model, the processor will benefit from your efforts to lower interchange costs, not you.

Processors in the CardFellow marketplace are contractually obligated to use pass-through pricing, resulting in the highest level of transparency and potential for lowest costs. If you use choose a processor through CardFellow and successfully lower your interchange costs through level 2 and level 3 data, you’ll reap the benefits in terms of lower overall costs.

Targets, Downgrades, and Enhanced Data

Every transaction you process has a “target” interchange category, which is the one it will qualify for if the minimum requirements are met. If your transaction doesn’t meet requirements, it will “downgrade” to a more expensive category.

The opposite of downgrade interchange categories for commercial cards is enhanced interchange categories, also known as level 2 and level 3. Enhanced data interchange categories have the most requirements. Your transactions will qualify for enhanced data categories if you meet the requirements.

For a commercial card, you’ll be paying more than you have to if your transactions don’t qualify for level 2 and 3 rates, or if you downgrade by failing to meet the minimum requirements, such as using address verification or settling the transaction in the specified timeframe.

You can spot downgrades on your billing statement by looking for anything labeled “standard,” “std,” or “EIRF.” Check out our article on interchange downgrades for more information.

When you choose a processor through CardFellow, we check for downgrades. Even better, we’ll help you correct any problems through our free statement audit service. We’ll also help you achieve enhanced data interchange categories.

Benefits of Level 2 and 3 B2B Payments

For the business taking the card, processing transactions by including level 2 and level 3 data will result in lower costs than level 1 data, meaning a lower overall cost of processing for your business.

For the business using the card, level 2 and level 3 data provide greater details on the transactions conducted by employees, allowing for more effective budget/spending management and reporting. Additional benefits from the card brands may also apply, such as rental car insurance, emergency cash advances, roadside assistance, corporate trip planning, global medical assistance, lost passport/luggage reimbursement, and more. These benefits will vary by card company and may have additional requirements.

Can I just refuse to accept commercial cards?

No. Your agreement with the card brands generally includes a provision requiring that you accept all types of cards that are valid for payment. In other words, if you accept Visa cards, you agree to accept all Visa cards.

For example, Visa’s Core Rules state:

“A US Merchant that wishes to accept Visa Cards must accept any valid Visa Card in its category of acceptance that a Cardholder properly presents for payment. This means that the Merchant must permit the Cardholder to choose whether to pay for a transaction with that Visa Card or with some other means of payment accepted by the Merchant.”

Mastercard’s Rules state:

“Merchants that accept Mastercard Cards may choose to accept Debit Mastercard Cards only, Other Mastercard Cards only, or both Debit Mastercard Cards and Other MasterCcrd Cards” and “Merchants that choose to accept Mastercard Cards must honor all Mastercard Cards without discrimination when properly presented for payment.”

These policies mean that if you accept commercial cards, it’s worth taking the time to understand and set up procedures for sending enhanced data with your business card transactions.

Am I required to provide enhanced data?

No, but if you take a lot of business or purchasing cards, it’s in your best interest. When you accept a commercial card, it remains a commercial card whether or not you send the enhanced data with the transaction. However, without enhanced data, the transaction will not qualify for the best possible pricing.

If you only take commercial cards now and then, you may be able to set up credit card surcharges for those transactions to help defray the costs, but surcharging is often disliked by customers and should be considered carefully. If you take commercial cards regularly, qualifying for enhanced data is likely to be a better long-term solution.

Level 2 and 3 Rates

Okay, I’ve mentioned several times that it can be less expensive to accept commercial cards if they correctly qualify for the preferred interchange categories, but how much less expensive? Let’s take a look at what the costs would be with examples.

The information below is taken from the Visa interchange table for corporate and purchasing cards, referred to as commercial in Visa’s interchange categories.

| Interchange Category | Interchange Rate |

| Commercial Level III | 1.90% + $0.10 |

| Commercial Level II | 2.50% + $0.10 |

| Commercial Card Present | 2.50% + $0.10 |

| Commercial Card Not Present | 2.70% + $0.10 |

| Non-Qualified (formerly Commercial Standard) | 2.95% + $0.10 |

As you can see, the rate applied to a transaction that qualifies for Commercial Level 3 is 1.90% + $0.10. The rate for a Commercial Level 2 transaction is 2.50% + $0.10.

On the other hand, the Commercial Card Not Present category will cost you 2.70% + $0.10. That means that if you accept a commercial credit card and don’t provide level 2 or 3 data, you’ll pay .20% – .80% more.

The Non-Qualified category is the lowest downgrade category, with the most expensive rate of 2.95% + $0.10. If you accept a commercial credit card, don’t provide level 2 or 3 data, and also fail to pass minimum requirements, your transactions will downgrade to this category, leaving you to pay a full 1.05% more than you could have paid with the Level 3 category.

Let’s look at a few examples.

Example

Say you accept a Visa purchasing card for a $500 card-not-present transaction. Here’s what you’d pay, if you…

Provide information to qualify for level 3: $9.60 (500 x 0.019 + 0.1)

Provide information to qualify for level 2: $12.60 (500 x 0.025 + 0.1)

Don’t provide any enhanced data: $13.60 (500 x 0.027 + 0.1)

Don’t provide enhanced data and downgrade: $14.85 (500 x 0.0295 + 0.1)

That’s a $5.25 difference between the interchange category with the lowest cost and the one with the highest. MasterCard’s interchange rates are similar, with the Data Rate III category incurring a 1.80% + $0.10 cost, which jumps to 2.95% + $0.10 for a “standard” (downgraded) commercial credit transaction.

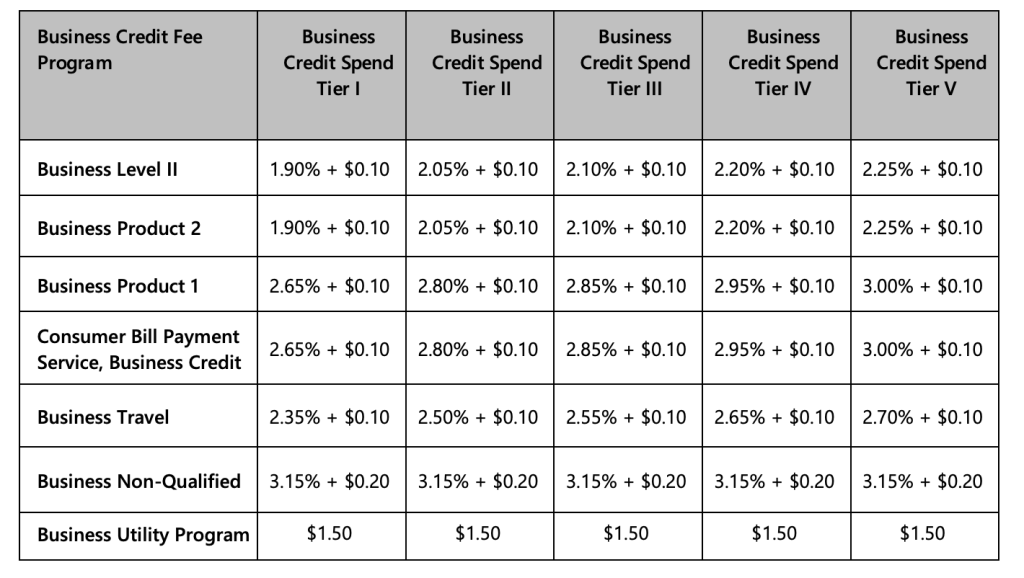

Business credit cards also have a gap, though it partly depends on the “spend tiers” involved. Where Visa has previously utilized one category (such as “Business Level II”) it now has multiple, depending on the “tier” of spending. (Note: Visa does not currently define the tiers publicly.)

The business credit interchange fees are as shown in the screenshot, below:

In this case, the difference from the lowest priced category to the highest comes in at 1.25%. That can add up quickly. There’s no point in giving away an extra 1% on all your business card transactions if you can avoid it by providing enhanced data to qualify for better pricing.

Choosing the Right B2B Credit Card Processor

It’s hard to compare credit card processors to find the right one even for businesses that don’t have to consider enhanced data. With specific needs like accepting B2B payments, it can seem even more daunting. To make matters worse, there’s no incentive for a processor to help you qualify for level 2 or 3 interchange rates. Remember, you can think of interchange as the “wholesale” cost of credit card processing. Banks collect interchange. Since processors don’t make money directly from interchange, their profits aren’t affected by whether you get lower costs at “wholesale.” If there’s no money in it for them, there’s no incentive to ensure that they help you save.

That’s where CardFellow comes in. In addition to connecting you with processors in our marketplace that can support enhanced data, we offer a free interchange optimization service. That means you’ll have an expert looking at your statements to ensure you’re paying as little as possible at wholesale.

We’ll work with you every step of the way. First, we help you choose a processor that can help you qualify for level 2 or level 3. Then we make sure your costs reflect it.

Unlike shopping for a processor when you’re primarily accepting consumer credit cards, you don’t want to focus as heavily on the markup when you’re looking for a B2B processor. Instead, you’ll want to focus on the total cost. In some cases, a processor might charge you a slightly higher markup but help you drastically reduce your wholesale rates, resulting in a lower cost overall. Ready to get lower your costs for accepting commercial cards? Sign up at CardFellow and then give us a call for help fitting together the pieces of the puzzle.

Resources

CardFellow Quote Comparison Tool Understanding Credit Card Processing

Download a Copy

This guide is available in PDF form to download. Click here to download your copy.