Processor Directory > Fiserv

Fiserv Review

Big companies attract lots of reviews, and this one is no exception. Are the Fiserv complaints what you should believe, or should you listen to the reviews that praise the company? The truth is, you could get a great deal with Fiserv merchant services, or a not so great deal. It depends on how you go about signing up for processing. The company offers credit card processing services directly and through resellers, commonly known as ISOs.

Because of that, there's no standard pricing. The ISO has control over the rates and fees you'll pay, and it can vary wildly.

Let's take a look at exactly what the company can do and what customers think of Fiserv's merchant services.

- News

- What services does Fiserv offer?

- Specialty Credit Card Processing

- Clover Capital

- Perka Loyalty Card App

- Veteran Program

- Processing Equipment

- Security and Fraud Protection

- Fiserv Rates and Fees

- Fiserv Reviews

- First Data Reviews

News

In spring of 2017, First Data acquired Acculynk, makers of the PaySecure solution that enables online PIN debit entry. The use of PINs for online transactions has been possible for several years, but has not caught on and isn't offered by most online businesses. Supporters hope that First Data's acquisition will increase usage of online PIN debit transactions, which can be lower cost for businesses.

In the summer of 2019, First Data was acquired by Fiserv. The name change from First Data to Fiserv was not immediate, but now the company's website almost exclusively refers to the processing company as "Fiserv." You may still see "First Data" used on other third party sites, especially review sites.

What services does Fiserv offer?

As one of the largest processors in the world, Fiserv offers all the payment services you need, including credit card and check acceptance, terminals and point-of-sale solutions, ecommerce, fraud protection, mobile solutions, and robust reporting.

The company offers merchant accounts directly and through resellers, called independent sales organizations (ISOs).

The company's website can be a little overwhelming with so many options and buzzwords, but at the heart of it, Fiserv is still a payment processor. Let's demystify their offerings by looking at the various categories of services.

Credit Card Processing

You'll see a lot of references to “omnichannel” processing. It simply refers to having several different options for customers to make their payments. With Fiserv, you can quickly and securely accept credit and debit cards online, in person, or by phone. First Data offers card acceptance online, in store, or on-the-go. However you need to take cards, you can do so on the Fiserv platform.

In addition to physical credit and debit cards, you can accept “mobile wallet” payments, such as Apple Pay, Android Pay, Venmo, Paypal, and more.

The option for next day funding means you'll see funds in your bank account quickly, reducing the time between when you process a transaction and when you receive the money.

Fiserv's merchant services boasts transaction approvals in under 2 seconds, and allows you to accept most major credit and debit cards, including Visa, MasterCard, Discover, Diners' Club, and EBT. The company also has seamless integration with point-of-sale systems and the option to offer cash back to debit card users.

Check Acceptance

For those businesses that still need or want to accept checks, Fiserv offers TeleCheck electronic check acceptance service to convert paper checks into electronic checks. Conversion to echecks helps reduce fraud and bounced checks. You can also choose options like TeleCheck Checks by Phone to allow customers to make payments from their checking accounts over the phone, or TeleCheck RemotePay to allow you to accept recurring payments from a customer's checking account.

B2B Payments

Not all processors take on business to business (B2B) payments, but Fiserv offers that service. The company states it can integrate with ERP systems for ease of ordering, and offers both accounts receivable and accounts payable modules to easily keep track of cashflow. Fiserv is compatible with ERP systems from Oracle, SAP, and Microsoft Dynamics.

International Payment Acceptance

Businesses with international customers will be happy to know that Fiserv offers Dynamic Currency Conversion (DCC) to allow you to accept and process transactions from international customers in their preferred currency while receiving the funds in your home currency.. DCC features daily updates of foreign currency exchange rates. Fiserv supports more than 130 currencies.

Read more about how to take international payments.

E-Commerce

Fiserv provides scalable e-commerce solutions for processing transactions online. The company boasts security features including end-to-end encryption and tokenization to keep transactions safe. When you use compatible equipment and services, you may be able to reduce your PCI compliance scope, helping ensure you don't get hit with PCI non-compliance fees. Fiserv states that utilizing their multi-layered security solution results in PCI compliance scope of just three requirements: protecting any paper cardholder data that your business collects or stores, restricting physical access to cardholder data received by your business, and maintaining a policy for information security.

Mobile Solutions

Looking to take payments on the go? For accepting payments with a smartphone or tablet, Fiserv offers SourceConnect and uCommerce as well as the Clover Go to allow you to use an NFC mobile device. Seamlessly integrate mobile payment apps or use the PayEdge cloud-based mobile solution.

The company also offers wireless terminals for on-the-go acceptance of payments. If you'd like to use your smartphone or tablet, Fiserv offers MobilePay, Pogo, or Verifone's PAYware Mobile solution to process transactions.

QR Code Payments

The Covid-19 pandemic has caused more consumers to seek out contactless payment options to avoid handling cash or handing over a card. Fiserv gives you the option of accepting QR code payments. A customer can pull up the QR code for their card right on their phone, which your cashier or server can scan at checkout without having to touch it.

Gift Cards

Many businesses like the option of offering gift cards. Fiserv offers options for both digital or physical gift cards that you can sell and redeem at any of your locations. If you opt for digital gift cards, you can automatically replenish the "inventory" so that it never appears out of stock to an interested customer.

Buy Now, Pay Later

With the increasing popularity of "buy now, pay later" purchasing options, some businesses want to offer that option to their customers. After all, "buy now, pay later" options can help customers with larger transactions, such as fitness equipment, home furnishings, and other items with price tags that could otherwise discourage a purchase.

Fiserv supports buy now, pay later in two different ways: QuadPay and Installment Loans. As you may have guessed from the name, QuadPay lets customers split a purchase into four equal (and interest-free!) payments over the course of 6 weeks. Transactions are limited to $1,500 and payments are deducted from the customer's linked card

With Installment Loans, you can enable installment plans so customers can pay for their purchase monthly for up to 60 months, depending on the transaction size. Installment Loans are available on purchases ranging from $300 - $15,000.

In either case, you get paid upfront, so there's no risk of losing out if your customer falls behind on their payments.

Specialty Credit Card Processing

In addition to offering payment services for retailers, restaurants, and service businesses, Fiserv offers credit card processing for specific niches.

Franchises

Franchise owners looking to streamline operations can take advantage of Fiserv's options specifically geared to multi-location businesses. This option combines Fiserv's enterprise level processing with its franchise support model to help ensure that customers have a seamless, consistent experience no matter which of your locations they patronize.

Stadiums

Sport and event stadiums face unique challenges for accepting credit card transactions. Acceptance must be fast and both the equipment and the processor's network must be able to handle many transactions all at once. With Clover Sport from Fiserv, stadiums get fast, reliable transactions to help speed up lines. As with other services, there are multiple options (omnichannel payments) available. Customers can pay a cashier with a traditional POS system or a portable line-buster solution, or you can opt for mobile ordering or self-serve kiosk orders.

Payout Businesses

Businesses that "pay out" money to customers face their own unique challenges. Considered high risk by some processors, these businesses aren't always able to easily secure credit card processing. Payout businesses range from medical services like HSAs and insurance companies handling reimbursements to sports betting sites paying out cash winnings. You can choose from single or mass payouts depending on your needs. You can even white-label a payee portal for easy tracking and viewing of payments.

Fiserv helps minimize the risk of fraud and other issues that payout businesses face by offering card industry blacklist filter services and other screenings to help ensure your transactions are safe.

Clover Capital

Fiserv continues to offer the merchant cash advance program, Clover Capital, that was previously offered under the First Data name. It’s intended for those that need access to funds for business purposes. As with most cash advances, Clover Capital does not require collateral or a personal guarantee. Additionally, there's no fixed payment amount, as you'll repay the advance through a percentage of your daily credit card sales.

The one-page application requests basic information about your business and financial situation. Businesses that have been around for at least 6 months and process a minimum of $1000/month in Visa and Mastercard transactions are eligible to apply for Clover Capital. You'll also need to provide copies of your previous 6 months' processing statements and previous 2 months' bank statements.

The application review takes an average of 3-5 business days and funds for approved applications are typically deposited within 2 days of approval and signing paperwork.

Funds can be used for almost any legitimate business expense, including expansion, purchasing inventory, marketing campaigns, purchasing or upgrading equipment, hiring staff, and more.

Veteran Program

First Data was a supporter of veterans by offering a "Veterans' Program" that provides veteran-owned or affiliated businesses with discounted pricing on processing and lower cost equipment. Fiserv shares this commitment to the military through its Fiserv Salutes military engagement strategy, in addition to serving as a founding member of the Coalition for Veteran-Owned Businesses. The company commits to hiring veterans, and also provides discounts on some equipment and services. At the time of this review, Fiserv offers veterans and their spouses half off a Clover device and a waiver of the first 3 months of software fees.

Credit Card Processing Equipment

Fiserv offers a variety of machines for taking credit cards, including the popular Clover family of processing equipment. It also offers the proprietary FD series. Terminals boast fraud protection and security features to help keep your customers and your business safe. Most equipment can connect to the internet wirelessly.

In the past, First Data has regularly leased equipment, a practice we don't recommend here at CardFellow. Leases went through the equipment arm, First Data Global Leasing, and typically involve expensive contracts separate from your processing contract. It’s not clear from Fiserv’s website if the company has continued the leasing practice. In any event, we strongly recommend avoiding equipment leases.

Clover

While Fiserv supports other equipment, it particularly pushes the Clover line, which includes full POS systems (the Clover Station and Clover Station 2018), small footprint or portable systems like the Mini, Flex, and Mobile, and a smartphone app/reader called the Clover Go. You can view details and read reviews of any of the Clover machines in our product directory: Clover systems: Clover systems.

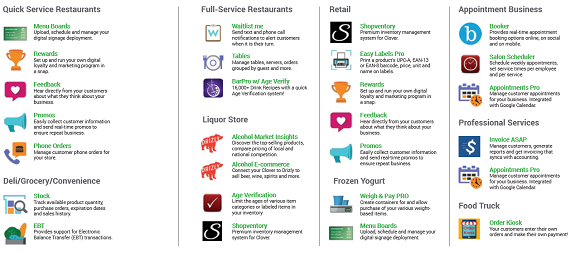

One feature that sticks out about Clover systems is the Clover app market, which allows you to customize your Clover Station with specific apps that you choose. The app market breaks apps down categories ranging from general business to specific industries, as seen in the image below.

However, it's important to note that Clover stations cannot be reprogrammed. If you purchase a Clover POS system, you can only use it with the company from whom you purchase it.

Since POS systems like the Clover aren't cheap, be sure you know what you're getting into before purchasing. It's important to secure competitive pricing and the right processor before purchasing your system. Additionally, you'll need to purchase a Clover software plan in order to use all of the features of the Clover systems. Software plans come at an additional monthly charge, which is separate from the fees to take cards and any merchant account monthly fees.

You can also read or leave Clover reviews here.

Clover vs. Square

Many businesses correctly note that there are a lot of similarities between Clover equipment and Square equipment. (Especially as Square continues to debut new machines like the Terminal, a competitor to the Clover Flex.)

A primary difference between Clover and Square is processor compatibility. Square only works with Square for credit card processing. You can't use the equipment with other processors. By contrast, Clover works with any processor that runs on First Data's platform, giving you more choices when deciding on a processing company.

That also means that you have more opportunity to negotiate better pricing. (More competition = lower costs for you.)

Read more about the differences between Clover and Square.

Security and Fraud Protection

Fiserv offers the TransArmor Data Protection service started by First Data, for an additional fee. But when I say "offers," I really mean "requires" since First Data adds the TransArmor solution to all its clients' accounts. (Note that CardFellow clients are exempt from this requirement. You can choose to use the TransArmor security package, but you are not required to like other businesses.) TransArmor features encryption and tokenization to protect businesses and their customers.

Aside from TransArmor, the company provides a limited warranty against compromises. Additionally, the company offers EMV enablement to allow you to implement chip-based payments through point-of-sale terminals or with a mobile device.

Fiserv helps you achieve PCI compliance and complete yearly assessments to ensure that you are always meeting compliance requirements. The company can help you identify possible vulnerabilities in your systems, and suggest solutions to prevent breaches. Fraud detection services help you avoid costly fraudulent transactions by identifying patterns and fraud trends using machine learning.

Fiserv Rates and Fees

Like all processors, Fiserv can set rates and fees differently from one business to the next. The company has the ability to offer pricing on several different models, including interchange plus and flat rate.

Keep in mind that your pricing will vary depending on whether you go directly to Fiserv or to a reseller in addition to what pricing model the processor uses.

At the time of this update, Fiserv does not publish pricing on its website. You should expect fees for accepting credit cards, for security / fraud protection, and for equipment, at a minimum.

Interchange Plus

However, if you prefer not to use flat rate pricing or it isn't the best fit for your business, you may still be eligible for interchange plus pricing. To get a fully-disclosed quote with extremely competitive pricing, you can request through this profile. Signing up for interchange plus pricing can often drastically lower your credit card processing fees.

Fiserv Reviews

Note: For historical record, we're leaving our information about First Data's reviews here. However, we'll add sections specifically for Fiserv reviews and attempt to separate the two whenever possible.

Fiserv at the Better Business Bureau

On the Better Business Bureau's website, Fiserv has its own profile separate from First Data's. However, Fiserv does not solely handle credit card processing, but also provides other banking and financial services. At the time of this update, the company has an A+ rating, though it is not currently accredited with the Better Business Bureau.

The company has had close to 150 complaints in the past 3 years, and currently averages a 1-star rating (out of 5 stars.) It's worth noting that the BBB has a reputation among consumers as a place to go to complain and have a business wrong addressed. This may skew the reviews to those seeking out a place to complain vs. those seeking to make a review in general.

Several of the negative reviews refer to BillPay or other consumer services rather than credit card processing. The only review that mentions merchant services states that the company held funds but still withdrew fees from the customer's account. Fiserv replies to all reviews.

The complaints closed in the last few years span a range of issues, again not all related to credit card processing. The issues that do apply to processing claim that the company holds funds from legitimate transactions, continues to charge for equipment that has been returned, and provides poor customer service.

Historical Purposes - First Data Reviews

It's one of the largest credit card processors in the world, and therefore people have a lot of opinions on the First Data Corporation. Any company this size is going to attract some negative reviews, and First Data merchant services is no exception. The company has had over 1,000 complaints lodged with the BBB in the past 3 years – a hefty number. While it's true that as a giant processor, First Data has an accordingly large client base, other big processors don't come anywhere near First Data's number of complaints in their own BBB profiles.

Yelp and Ripoff Report also have some info worth reviewing.

First Data Complaints and Reviews with the Better Business Bureau

First Data Merchant Services is not currently accredited with the Better Business Bureau. However, the company has a profile page at the BBB site, and currently shows an A+ rating on a scale of A+ to F.

As of autumn 2016, there are a bit over 1,000 complaints on the BBB site. By contrast, other large processors have under 100 complaints.

First Data complaints allege a variety of issues, including failure to properly disclose contract information, failure to honor refund promises, failure to correct billing errors, unauthorized work performed outside the scope of the contract, unauthorized debits, and customer service problems.

The BBB notes that many complaints were resolved with the assistance of the BBB. The BBB found that while other complaints were not resolved to the customer's satisfaction, First Data made a good faith effort to resolve the complaint.

In addition, there are 6 reviews available with the BBB: 5 negative and 1 positive, however the positive review is actually negative and just marked incorrectly. The 5 negative reviews reiterate the complaints, mentioning difficulty cancelling service, predatory equipment leases, high fees, complex contracts, and poor customer service. The positive review, as mentioned, seems to have been marked positive by accident, as it talks about expensive leases, unsupportive customer service, and high fees, ending with a suggestion to use a different credit card processing company.

First Data Reviews with Yelp and Ripoff Report

Yelp has several different listings for First Data Merchant Services in different locations. Each contains a number of reviews, mostly one star. Complaints range from serious (allegations of fraud by forging customer's signature on a contract) to the usual complaints about processing companies: high fees, terrible customer service, deceptive sales representatives, and difficulty cancelling accounts. Several of the reviews urge businesses to stay away from First Data, stating the company is unethical and deceptive.

400 reviews appear on Ripoff Report, again stating that First Data overcharges, takes funds unauthorized, has terrible customer service, and engages in deceptive practices. Some reviews also complain of expensive and non-cancellable credit card machine leases.

SATISFACTION

RATES & FEES

CUSTOMER SERVICE

4.5/5

Unlike general web reviews, verified reviews are posted by businesses that have chosen the processor's quote through CardFellow's marketplace, and CardFellow has confirmed with the processor that the business is using its service. Businesses can update verified reviews at any time to ensure the review accurately reflects the processor's performance over time.

From Patty, on May 28, 2014

SATISFACTION

RATES & FEES

CUSTOMER SERVICE

5/5

Our rep is always very patient and helpful when I call. I appreciate his willingness to help.

From Trish, on May 28, 2014

SATISFACTION

RATES & FEES

CUSTOMER SERVICE

5/5

Loved the simplicity. The account analysis and information provided by CardFellow was fantastic -- extremely helpful in what can be a very confusing processor comparison process!!! Definitely reduced the time needed and let me focus on actual store operations. I will definitely be recommending CardFellow to other shop owners. Knowing that CardFellow will regularly be reviewing to ensure adherence to contract is an added assurance that this was a great decision. Thank you! Oz was fabulous too!! He provided so much information on selection of equipment and the actual setup process with First Data. I can't say enough positive things about the entire experience.

From john, on May 26, 2014

SATISFACTION

RATES & FEES

CUSTOMER SERVICE

4/5

From Patti, on May 14, 2014

SATISFACTION

RATES & FEES

CUSTOMER SERVICE

4/5

From marya, on Apr 23, 2014

SATISFACTION

RATES & FEES

CUSTOMER SERVICE

5/5

From Jon, on Apr 08, 2014

SATISFACTION

RATES & FEES

CUSTOMER SERVICE

5/5

From Dan, on Mar 17, 2014

SATISFACTION

RATES & FEES

CUSTOMER SERVICE

5/5

From Alan, on Mar 13, 2014

SATISFACTION

RATES & FEES

CUSTOMER SERVICE

5/5

Been with Oz and First Data for five months and I am pleased with the great service and rates. Thanks to Ben at CardFellow also.

From JAMES, on Mar 07, 2014

SATISFACTION

RATES & FEES

CUSTOMER SERVICE

5/5

Very prompt, up front, professional.

From David Dutton, on Feb 26, 2014

SATISFACTION

RATES & FEES

CUSTOMER SERVICE

3.7/5

SATISFACTION

RATES & FEES

CUSTOMER SERVICE

1.1/5

Unlike verified reviews which are validated by CardFellow, web reviews can be submitted by anyone viewing this profile. While we validate these reviews as best we can, CardFellow does not verify that a reviewer is using or has used a processor's service.

Do you Know this processor? Write a review about it

Posted by eric on Aug 05, 2018

SATISFACTION

RATES & FEES

CUSTOMER SERVICE

1/5

Do not use First Data, ever. These people sucked us into a long 4 year contract. At the end of it, I closed my account. They would lease your machine to you for the entire term which cost thousands of dollars over the cost of similar machines. They would also charge you property tax on that machine, they are also one of the very few that charges PCI compliance fees to the tune of $149 a year. When I used their services I only had about $1,500 to $2,000 a month in charges, but all their fees amounted to 10% of that being taken out. Total scam. I was one of the lucky ones, if you try to end your lease early they will ruin your credit score.

Posted by Blake Newman on Jan 09, 2017

SATISFACTION

RATES & FEES

CUSTOMER SERVICE

1/5

All their customer people know how to say is I'm sorry, I apologize, I'm sorry. But, they can't solve any of your problems. Some of the sorriest people I've ever talked to. They suck you into a long-term contract and then when you try to break the contract, they play whack-o-mole with you. If you need a merchant account to accept credit cards for your business - DO NOT USE FIRST DATA. They are such crooks and make it expensive to stop doing business with them. If you call one minute before the contract expires, you get hit with a $500 early termination penalty. If you call one minute after the contract expires, you get automatically renewed and they hit you with another month's fee. Unbelievable. And, every time you call, plan on 45 minutes to wait on hold, be transferred, wait on hold, be transferred.

View Processor's Feedback